- Bitcoin may be affected by stablecoin market capitalization decline

- Despite BTC price falling on the chart, RSI suggests a possible reversal

Bitcoin (BTC) has recently recorded significant price fluctuations, causing various reactions in the cryptocurrency market. Given this volatility, stablecoins are worth paying attention to. This asset class plays an important role in crypto trading, providing liquidity and exposure to the market.

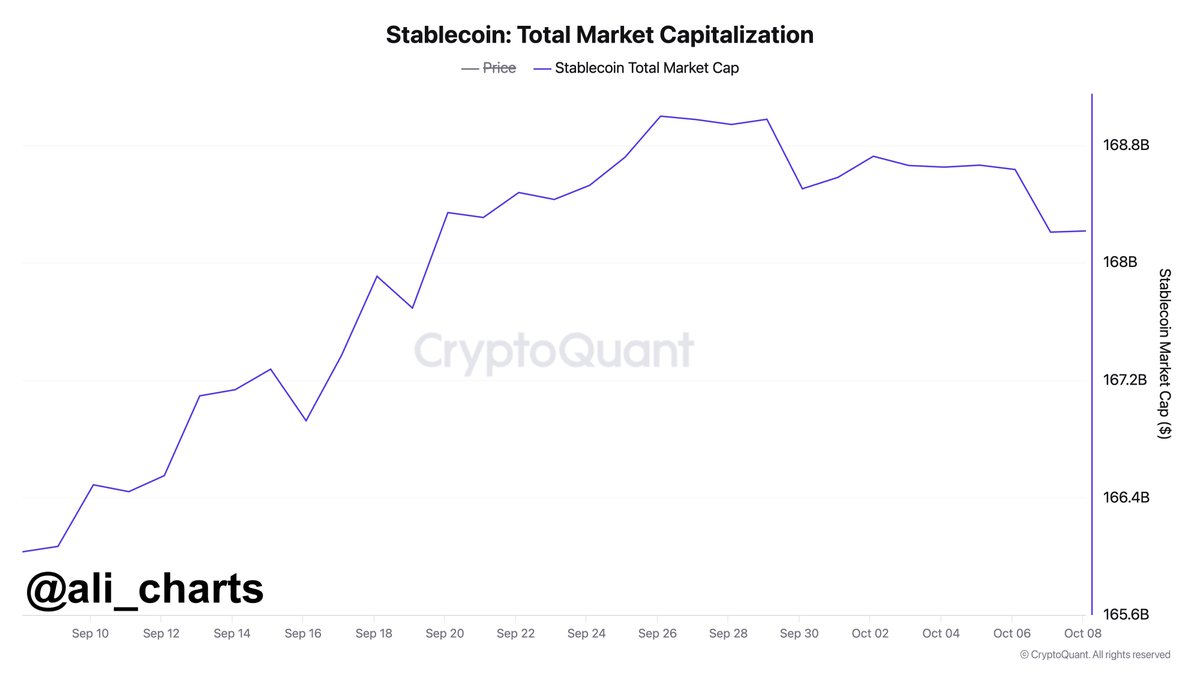

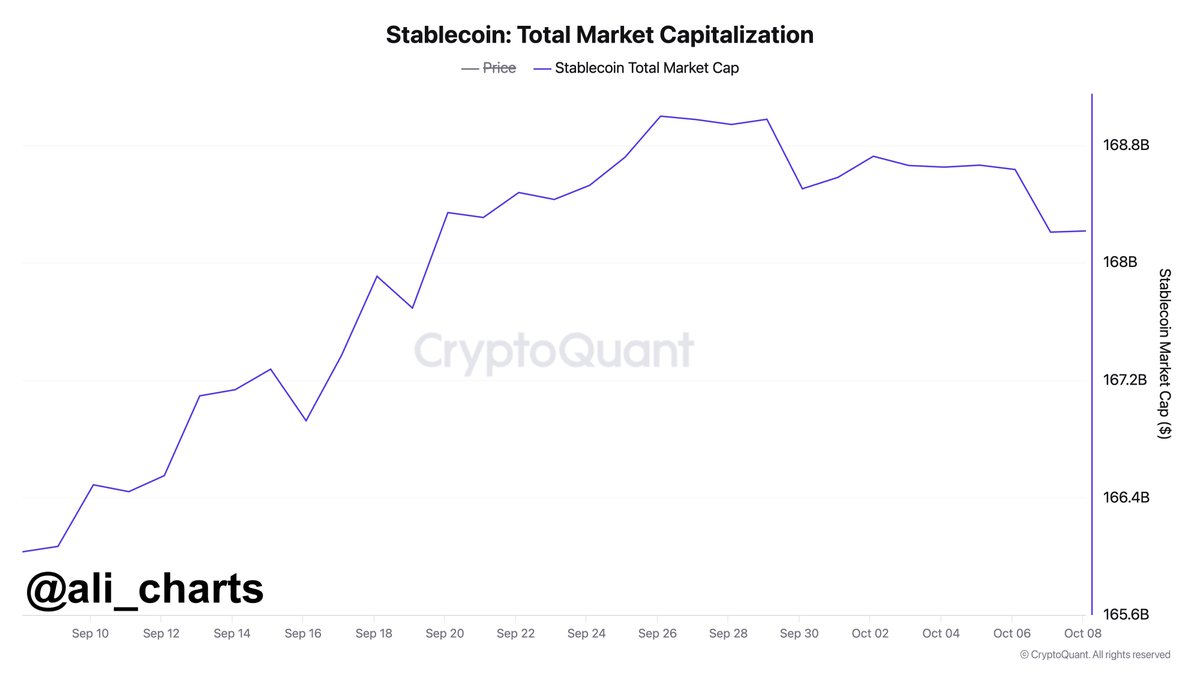

However, the recent $780 million drop in stablecoin market capitalization could be a sign of declining purchasing power. This decline could lead to a decline in demand for cryptocurrencies, leading to price stagnation or further decline.

Source: Ali/X

Bitcoin, the market-leading cryptocurrency, is expected to be significantly affected and could enter a prolonged period of accumulation or continue its downward trend.

Price drop during liquidation

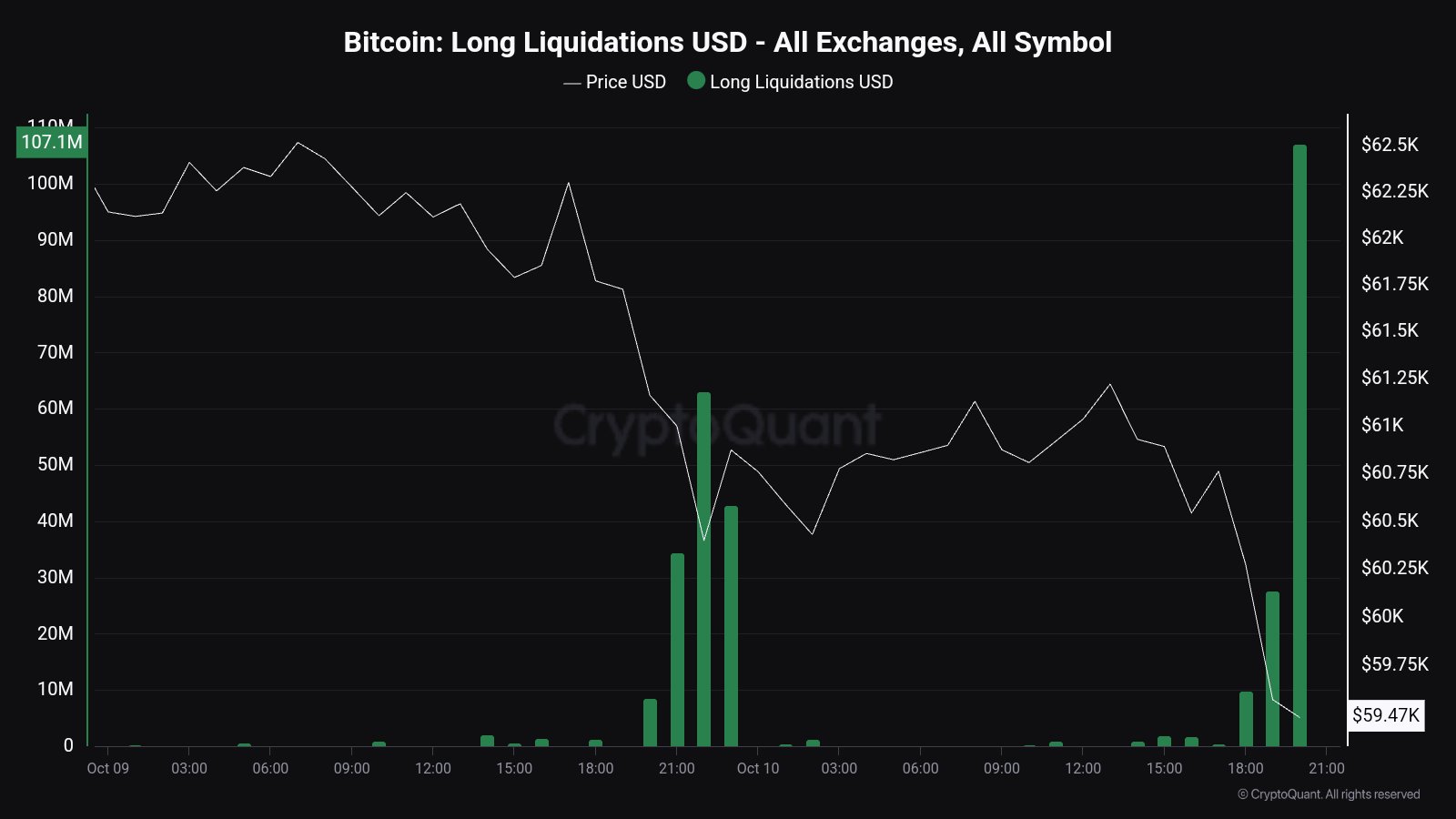

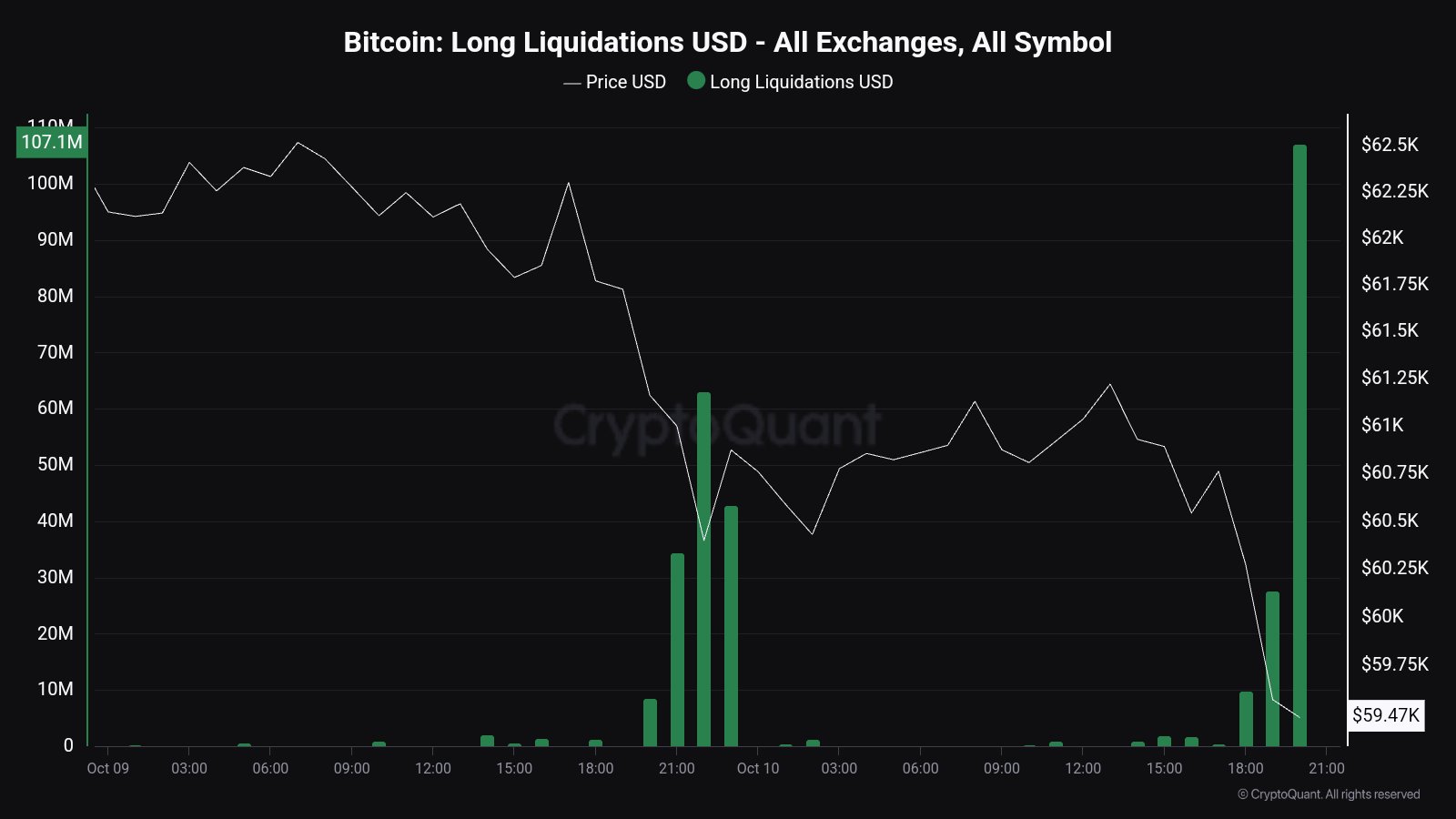

Analysis of the 2-hour BTC/USDT price movement shows that Bitcoin is already using liquidity in the range of $59,500 to $60,000, and even below $59,500. It became clear.

Although there is hope for a reversal, if it does not occur, BTC could fall further and test the sub-$55,000 level.

While this correction may not have been widely expected, the decline in stablecoin market capitalization suggests that weak demand could cause Bitcoin to fall before reversing.

Source: TradingView

With BTC falling below important support levels including the 100-day moving average (DMA), there is a pretty good chance that BTC will fall to $55,000.

This indicator acted as both support and resistance during the last few months when BTC was range-bound. A break below that is a sign of bearish momentum.

Furthermore, Bitcoin also fell below the 200 Exponential Moving Average (EMA), further confirming that downward pressure may continue. During this decline, $107 million worth of BTC longs were liquidated once the price fell below $59.5k.

Source: CryptoQuant

BTC RSI breaks above the trend line

Despite these bearish signals, there may still be a glimmer of hope for BTC to recover by the end of the year.

Bitcoin’s Relative Strength Index (RSI) has broken out of a 200-day downtrend. At press time, it appeared to be retesting this breakout level.

If BTC sustains above this trend line, it could signal a reversal and provide some reassurance to traders and investors expecting a long-term uptrend in Bitcoin.

Source: TradingView

Staying ahead of these market movements is important, especially as the price of Bitcoin remains at a critical point.

While further declines are possible, there is also the possibility of a reversal, making this an important time for traders and investors to keep a close eye on BTC.