- ETC faces bearish risks amid short-term bubble signals.

- ETC continues to fight against Bitcoin.

ethereum classic [ETC] Unlike Ethereum, it maintains its original blockchain history since the DAO hack [ETH]a new version of the network has been created.

At the time of writing, the price was $18, which was far behind Ethereum's $2,300 price.

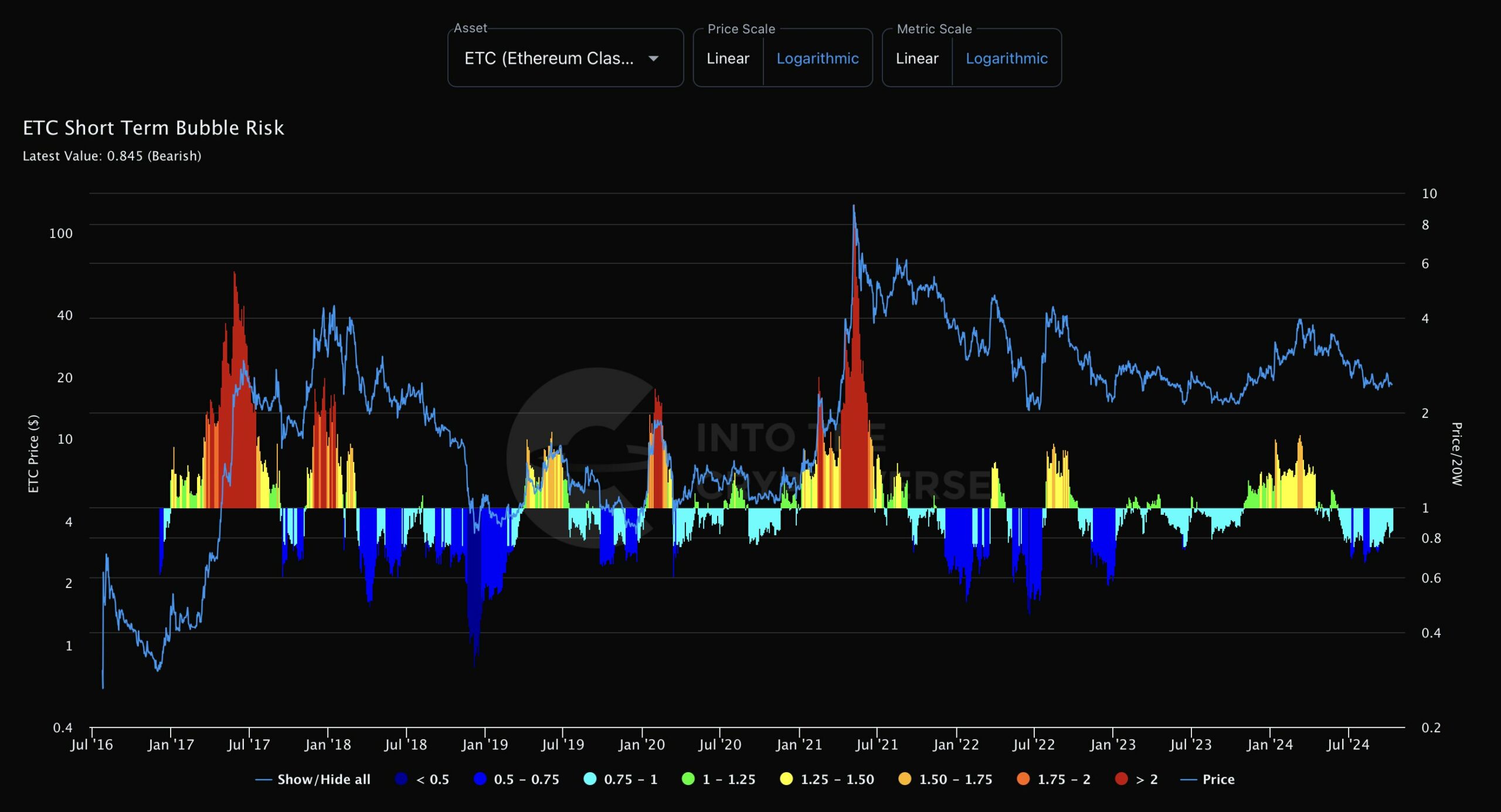

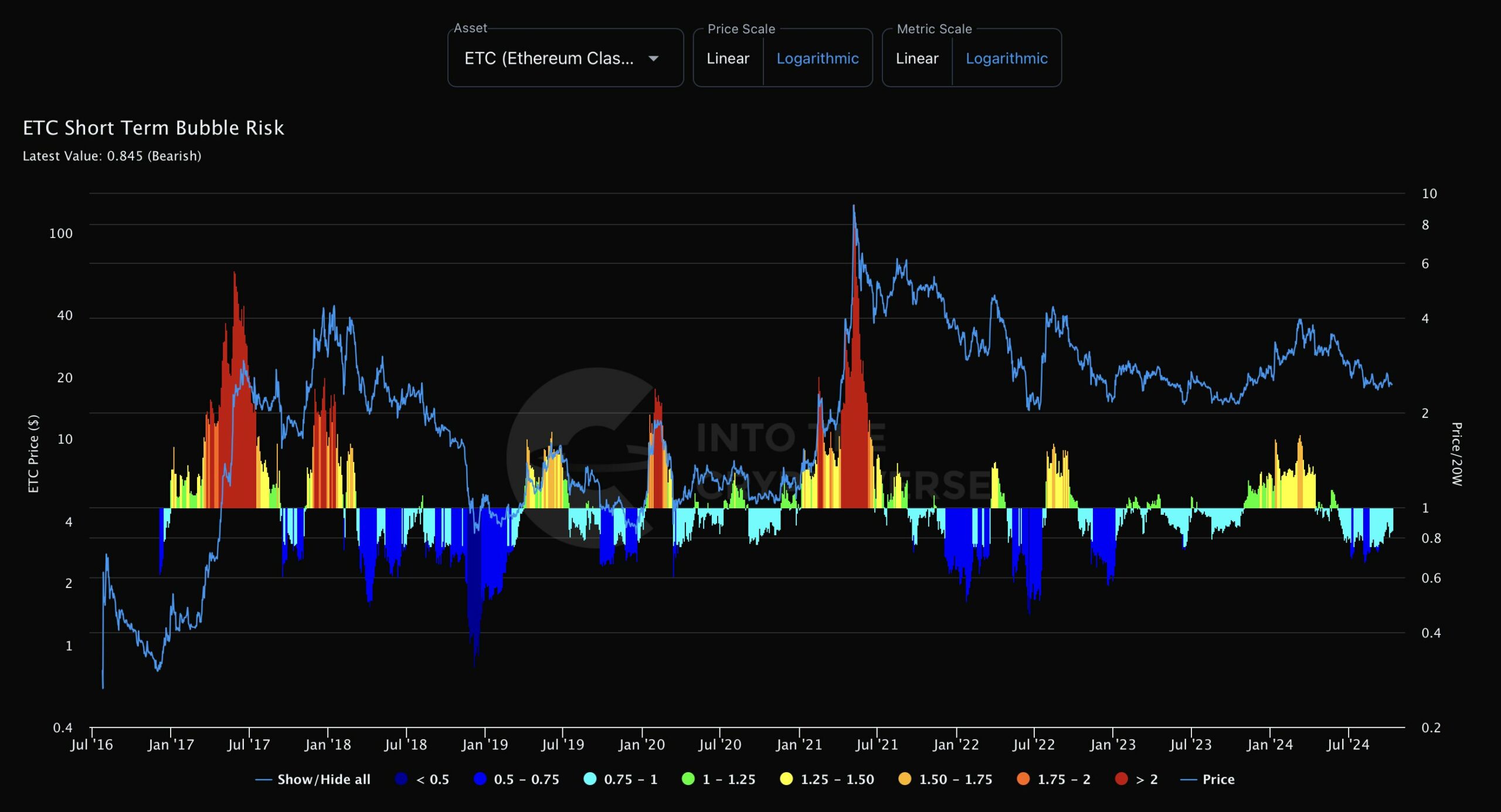

Recent analysis reveals that ETC's short-term bubble risk has turned bearish, indicating a likely continuation of the downtrend.

This negative outlook is supported by several indicators that point to further decline. Since peaking at $186 in April 2021, ETC has been in a consistent downward trend.

Source: IntoTheCryptoverse

ETC’s valuation against Bitcoin [BTC]Cryptocurrency, the major virtual currency, is also declining. This trend mirrors Ethereum's performance and highlights BTC's dominance in the overall market.

Cryptocurrency markets generally tend to make gains in the final quarter of the year, but ETC's weak valuation suggests it may not follow this pattern.

Historically, Bitcoin's strength often influences other cryptocurrencies, but ETC appears vulnerable to continued decline despite the usual optimism in the fourth quarter .

Source: IntoTheCryptoverse

ETC is below the weekly MA, but the trend line has broken

Further signs of ETC's weakness are evident in its moving averages. At the time of writing, the stock was trading below all simple moving averages (SMAs), including the 8-day SMA, which indicates a bearish trend.

This downward movement highlighted the increased risk for traders holding Ethereum Classic or considering entering the market for potential gains in the fourth quarter.

For futures traders, shorting ETC can be a viable option, especially since trading below the moving average usually indicates bearish trend direction.

Source: IntoTheCryptoverse

However, there is still a ray of hope for Ethereum Classic. Technical analysis of the ETC/USDT pair shows that it recently broke out of the downtrend line that had been suppressing the price since May 2024.

A break in a trend line often signals a potential market reversal, and a move in ETC above $18 signals a potential bottom formation. If the price sustains above this level, it could rise to $25, representing a profit of over 40%.

Source: TradingView

Conversely, if ETC fails to hold the current support and falls below the key $18 level, the decline could continue. Falling below this critical level is likely to lead to further price deterioration.

Read Ethereum Classic [ETC] Price prediction for 2024-2025

Ethereum Classic faces considerable bearish risks, but there is still potential for a near-term upside if broader market conditions improve.

As always, the future of Ethereum Classic will largely depend on market trends and the performance of other major cryptocurrencies.