- Bitwise CIO Matt Hougan said the company still expects Bitcoin prices to exceed $80,000 in the fourth quarter.

- Bitcoin’s chances of reaching its $80,000 goal depend on the upcoming US elections and the lack of market surprises.

- Bitfinex may be the sole recipient of 119,754 BTC recovered from past thefts.

According to Bitwise Chief Investment Officer Matt Hogan, if there are no surprises in the market and the upcoming election does not impact investor sentiment, Bitcoin (BTC) will reach 80,000 yen by the end of the year. It is said that it could reach US$. Meanwhile, the US government considers Bitfinex to be the sole victim and potential recipient of the 119,754 BTC seized from hackers.

Bitwise estimates Bitcoin price could reach $80,000 by year-end

Hogan said in a note to investors on Wednesday that the company still maintains a positive outlook for Bitcoin to rise to $80,000. However, Hogan pointed out that three key factors must come into play for the top cryptocurrencies to reach their stated price targets.

- Politicians are not manipulating market sentiment as the US election approaches.

- More stimulus from China and another 50 basis point interest rate cut from the Federal Reserve.

- Lack of market surprise.

In recent weeks, there has been mixed support from the crypto community for the upcoming election. Meanwhile, several crypto leaders believe that Republican candidate Donald Trump's victory could stir up bullish momentum in Bitcoin and crypto markets, while Democratic candidate Kamala Harris' victory could lead to a bearish trend. It suggests that there is.

Bernstein analysts largely support this idea, estimating that a Trump victory could push Bitcoin above the $80,000 price level. Conversely, we predict that a Harris victory will cause Bitcoin to fall to around $40,000.

But Hogan said the important thing is not about elections, but about politicians getting away from manipulating the market.

“To prosper, [B]IT coins don't need politicians. We just need to get them out of the way,” Hogan said in the post.

He also pointed out that the Fed could cut rates by another 50bps by the end of the year, and China's fiscal stimulus could push Bitcoin prices higher.

Finally, the market needs to experience little to no surprises in the fourth quarter for Bitcoin to maintain its uptrend. Potential surprises Hogan highlighted include hacks, lawsuits, and locked tokens or dormant wallets entering the market.

But judging by previous quarters and recent events, market surprises may be hard to avoid.

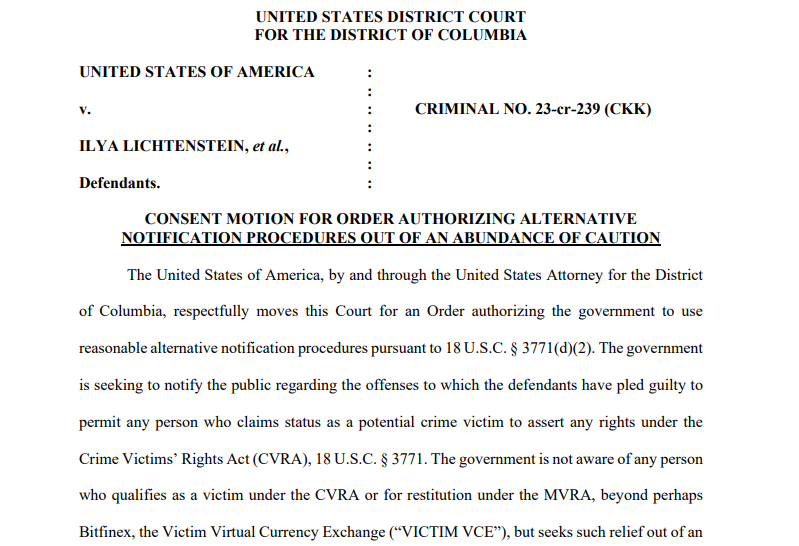

A possible black swan suggests that cryptocurrency exchange Bitfinex may have been the sole victim and recipient of the recovery of 119,754 bits of Bitcoin stolen by hackers in 2016. This is the latest U.S. government filing suggesting that.

“The government does not know who is considered a victim under the CVRA.” [Crime Victims’ Rights Act] or compensation under the MVRA. [Mandatory Victim Restitution Act]It probably exceeds Bitfinex…,” the U.S. Attorney for the District of Columbia said in a Tuesday filing.

Bitfinex Victim Rights Notice

Bitfinex was hacked in August 2016, resulting in a loss of 119,754 BTC, which was worth $71 million at the time. Based on Wednesday's price, the token is worth about $7.4 billion.

After the breach, Bitfinex distributed the losses to all users, issued BFX tokens to compensate for the losses, and over time succeeded in recovering approximately 80% of the stolen funds.

In 2023, both Lichtenstein and Morgan were charged with laundering some of the stolen Bitcoin. The filing states that both men admitted to the charges.