- The Ethereum Foundation liquidated 2,500 ETH, totaling approximately $6.06 million, amid market volatility.

- ETH faced significant support at $2,300. Failure to maintain this level could lead to a significant decline.

In a significant move, the Ethereum Foundation recently transferred 2,500 Ethereum [ETH]worth approximately $6.06 million on the Bitstamp exchange.

Details of the Ethereum Foundation’s recent move

These trades were executed at 8:14 a.m. and 8:19 a.m. UTC on October 8 and are part of a broader liquidation trend as foundations navigate volatile market conditions.

In addition to this development, a prominent whale from the 2017 ICO era also became active, transferring 5,000 ETH (approximately $12.22 million) on the same day.

The whale has reportedly leaked more than $113 million in ETH since September, further increasing selling pressure on the market.

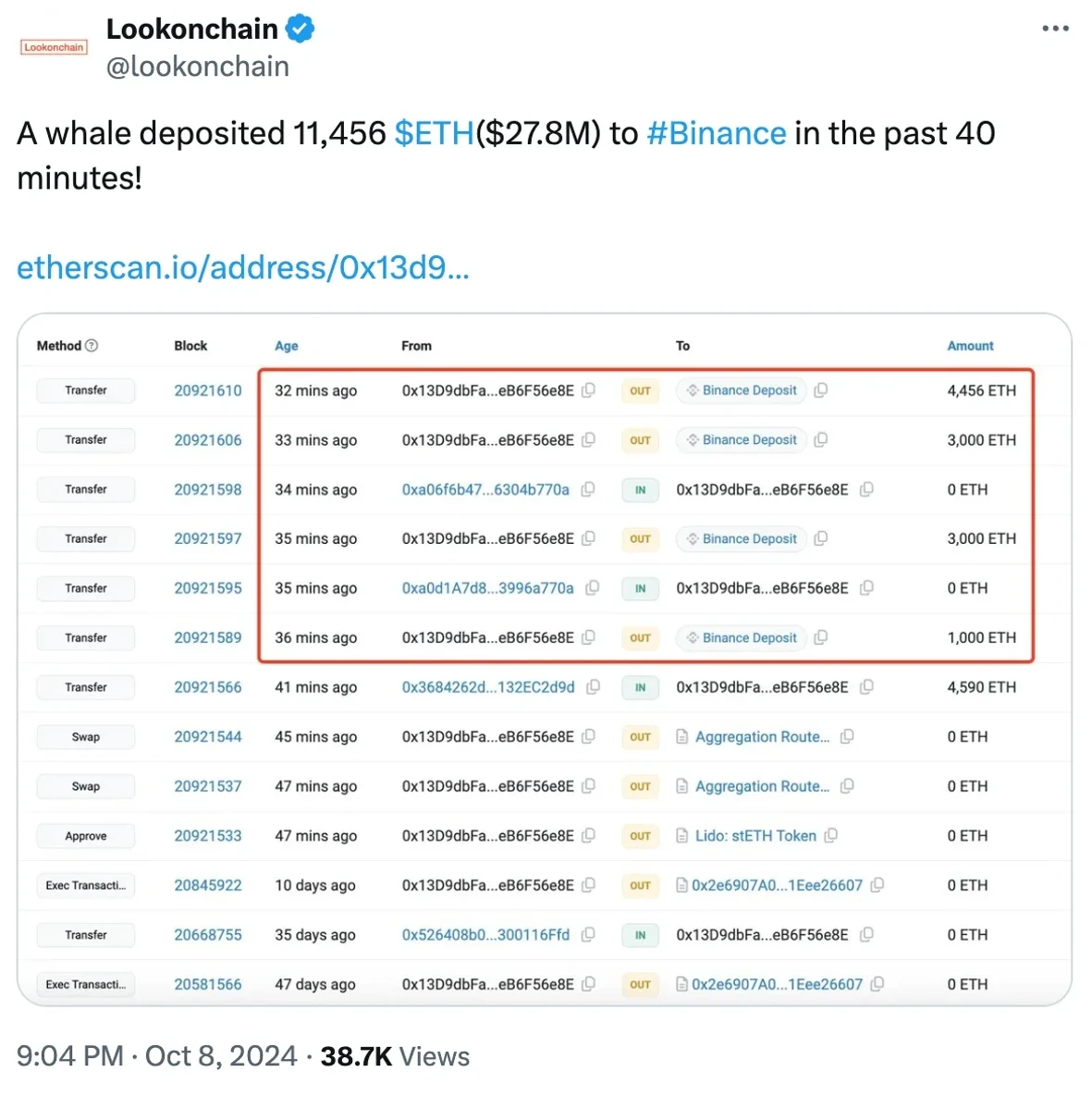

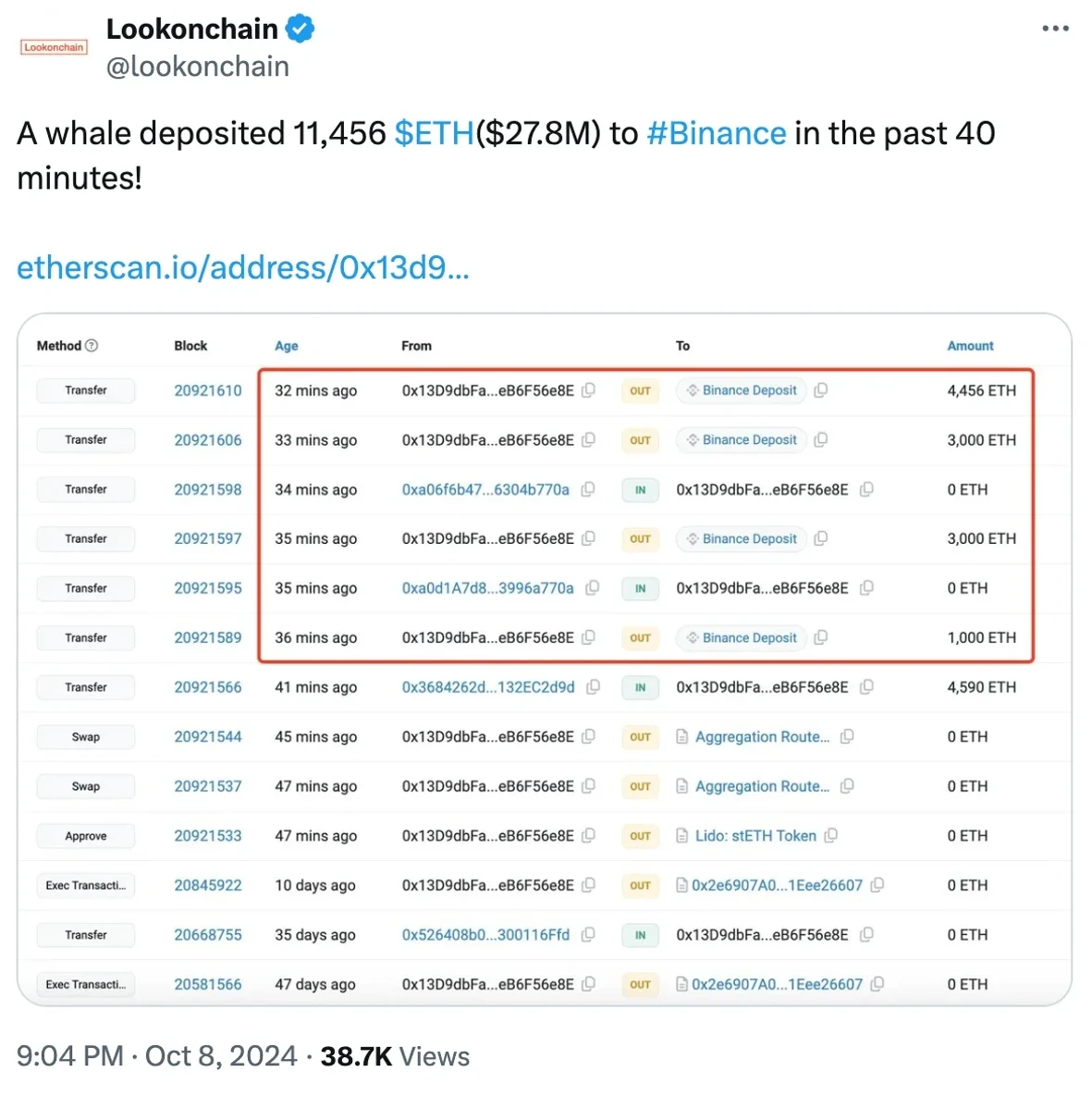

Recent insights from Lookonchain reveal that the Ethereum Foundation is actively managing its ETH holdings in response to bearish market conditions.

Source: Lookonchain/X

In a calculated move, the foundation transferred 2,500 ETH to Bitstamp and executed the transaction in two equal segments of approximately $3.03 million each.

The strategy appears to be aimed at converting a portion of digital assets into cash or stablecoins, and highlights that: A proactive approach to asset management amidst ongoing market challenges.

Community reaction

In response to this situation, various crypto communities have stepped in, as user X (ex-Twitter) stated:

“What the hell is going on at ETH?”

Adding to the fray was another X user sweep who pointed out:

“What does the whale know about what is being cooked?”

A recent analysis by Ali Martinez highlighted that Ethereum is at a critical juncture, with the $2,300 mark identified as a key support level.

Martinez noted that approximately 2.77 million addresses were captured.

If bullish momentum prevails and the price remains above this threshold, a significant upward trajectory is possible, perhaps tripling its value.

However, if the price drops below $2,300, it could cause a significant drop of around 30% and send ETH down to $1,600.

Source: Ali Martinez/X

Impact on ETH price

In the face of the growing bearish mood surrounding ETH, CoinMarketCap’s latest update reveals that Ethereum is trading at $2,433.51 at the time of writing, reflecting a modest 0.16% gain in 24 hours. It became.

Despite this slight increase, the Relative Strength Index (RSI) remains below the neutral level of 45. This suggests that bearish pressure remains a factor in the market.

However, the widening of the Bollinger Bands signals increased volatility, suggesting that bullish momentum may soon outweigh the bearish influence.

Source: Trading View