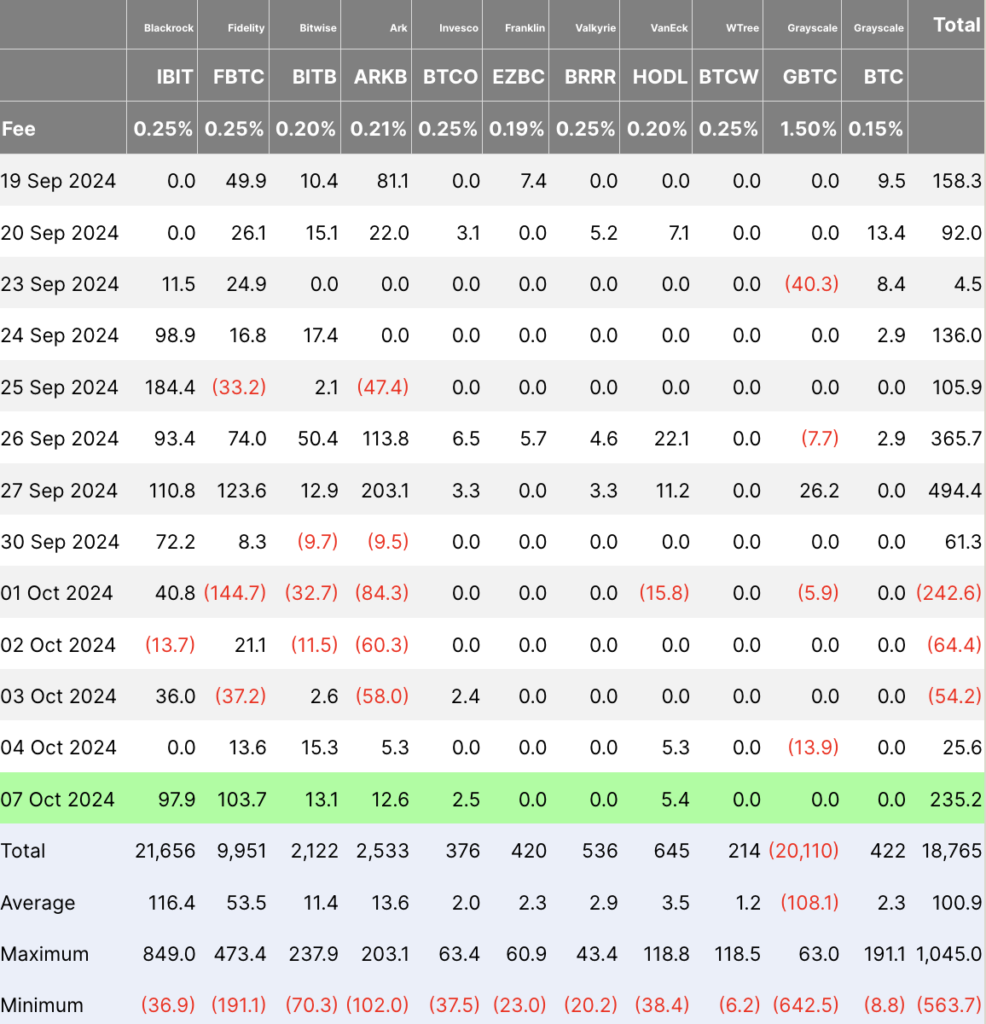

On October 4, the Bitcoin ETF recorded modest net inflows of $25.6 million. Fidelity's FBTC ETF saw inflows of $13.6 million, while Bitwise's BITB ETF saw inflows of $15.3 million. Ark's ARKB ETF brought in $5.3 million, as did VanEck's HODL ETF. However, these gains were partially offset by Grayscale's GBTC, which saw outflows of $13.9 million. Other ETFs, including BlackRock, Invesco, Franklin, Valkyrie, and WisdomTree, were flat.

Through October 7th, the Bitcoin ETF saw significant inflows of $235.2 million, indicating a sharp increase in institutional investor activity. Fidelity's FBTC ETF recorded inflows of $103.7 million, followed by BlackRock's IBIT ETF with $97.9 million. Bitwise's BITB ETF and Ark's ARKB ETF recorded inflows of $13.1 million and $12.6 million, respectively. Invesco's BTCO ETF added $2.5 million and Van Eck's HODL added $5.4 million. No outflows were reported for all major ETFs on this day.

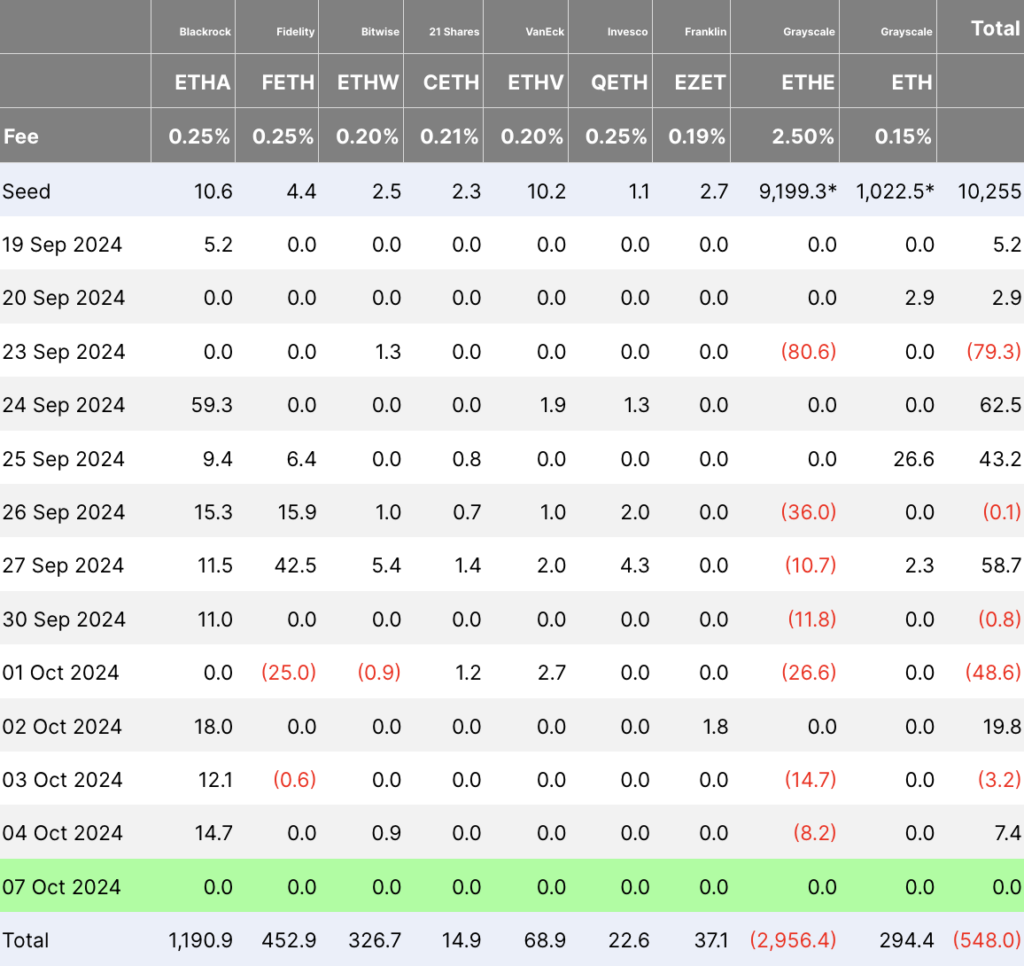

For the Ethereum ETF, net inflows on October 4 totaled $7.4 million. BlackRock's ETHA ETF topped the list with $14.7 million, while Grayscale's ETHE experienced outflows of $8.2 million. Bitwise's ETHW ETF recorded a small inflow of $900,000, while other ETFs did not see any noticeable movement.

On October 7th, the Ethereum ETF saw no significant inflows or outflows, with all products reporting flat inflows.

Significant inflows into Bitcoin ETFs on October 7th signaled renewed confidence in the market, especially after quiet trading on October 4th. The Ethereum ETF turned positive on October 4th due to BlackRock inflows, but there was no further movement on October 7th, suggesting this. Institutional interest in Ethereum will be temporarily suspended.