8:55 ▪

4

Minimum read time up to ▪

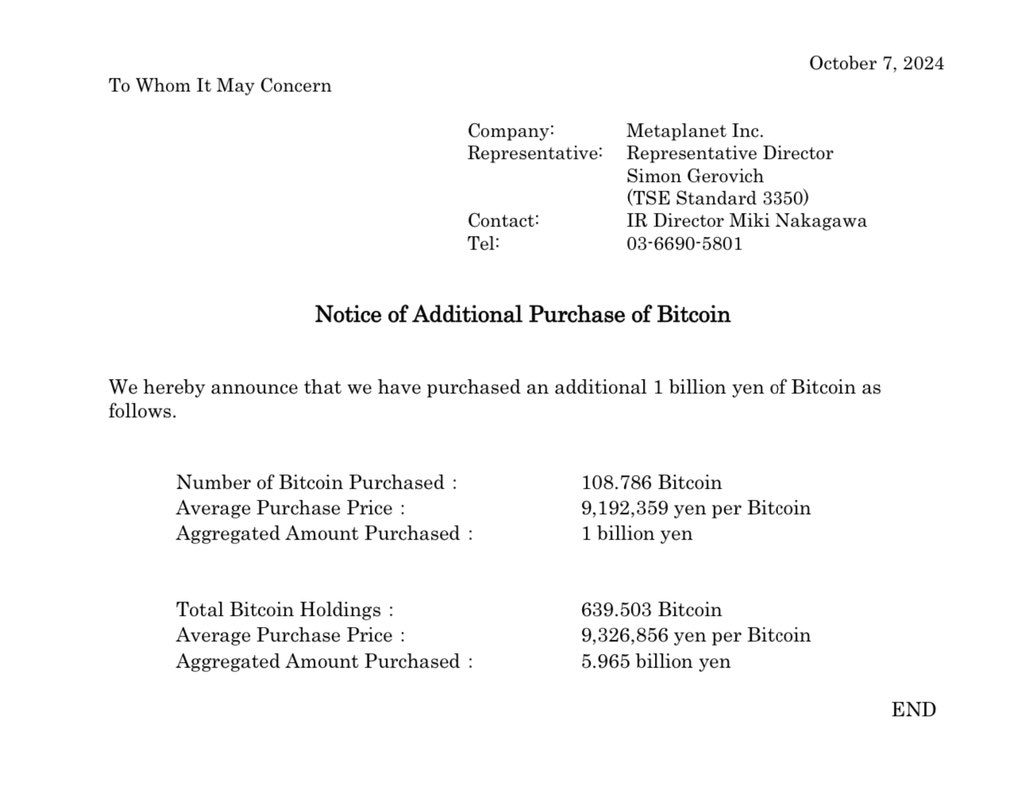

Bitcoin continues to attract large companies, and Metaplanet is no exception. The Japanese investment firm, which has been making more strategic acquisitions, just announced the purchase of 108.78 Bitcoins for a total of 1 billion yen (approximately 6.1 million euros). This investment makes Metaplanet one of the world's most influential companies in the Bitcoin ecosystem and strengthens its position as a stalwart in the crypto world. But what's behind this latest acquisition? Between strategic vision and a race for dominance, Metaplanet seems determined to make history in the Bitcoin space.

Self-assertive accumulation strategy

Since May of last year, Metaplanet has been accepting Bitcoin cards. From the beginning, the company said it wanted to build a “strategic stockpile” that would take advantage of price fluctuations to gradually increase its holdings.

Currently, Metaplanet manages 639.5 Bitcoins, giving it an important position among the most enthusiastic Japanese companies in the digital asset field.

Why is there so much interest in Bitcoin? Metaplanet seems to believe in its potential as a store of value and a means of asset diversification.

In fact, the company has relentlessly strengthened its position, maintaining a delicate balance of buying and selling to optimize profits.

Last week, for example, the company sold 23 Bitcoins for a capital gain of approximately 1.3 million euros. This flexible and thoughtful approach signals a long-term vision on the part of Metaplanet, which wants to take advantage of price fluctuations while ensuring market presence.

This strategy is working. With an average purchase price of JPY 9,192,359 (EUR 56,588) per Bitcoin, Metaplanet continues to acquire BTC at strategic times, especially during price declines.

This position demonstrates thorough market analysis and renewed confidence in Bitcoin's ability to play an increasingly central role in the global financial system.

Long-term vision and betting on Bitcoin

For Metaplanet, Bitcoin is more than just a speculative asset. It's a bet on the future of finance. By accumulating BTC, the company is preparing for a scenario where Bitcoin becomes a safe haven during economic fluctuations.

The decentralized and limited status of cryptocurrencies makes them particularly attractive diversification tools in a world where fiat currencies are increasingly subject to aggressive monetary policy.

In addition to that, Metaplanet has registered its name among the world's leading Bitcoin holders. While still far behind giants like MicroStrategy and Marathon Digital Holdings, which hold 252,220 Bitcoin and 26,842 Bitcoin respectively, the Japanese company is now a significant player on the international stage.

Its growing influence could inspire other Japanese companies to follow suit and strengthen Japan's position as a strategic hub for cryptocurrency development in Asia.

This week's acquisition also allows Metaplanet to strengthen its position in Japan and the crypto world.

The company is gradually approaching the position of dominating the ranking of the largest Bitcoin holders.

This approach goes beyond just investing and may foreshadow a trend among other Japanese companies, especially those seeking alternatives to traditional investments. Such a move could be the beginning of a broader movement towards institutional adoption of Bitcoin.

The impact of Metaplanet's strategy extends beyond its own reserves. The company's support for Bitcoin could have market-wide implications and send a strong signal to other institutional investors. Meanwhile, the Fear & Greed index is in fear.

Get the most out of your Cointribune experience with the Read to Earn program! Earn points every time you read an article and get access to exclusive benefits. Sign up now and get rewards.

The appeal of Bitcoin in 2017, creating important documents. This essay aims to revitalize Avance, which is the forefront of transactions and the center of virtual currency. En tant que redacteur, il aspire à fournir en permanence un travail de haute qualité qui reflète l'état du secteur dans son ensemble.

Disclaimer

The views, ideas and opinions expressed in this article are solely those of the author and should not be construed as investment advice. Please do your own research before making any investment decisions.