Market situation

The cryptocurrency market fell over the weekend. Market capitalization fell 3% in seven days to $2.21 trillion. However, it is notable that positive sentiment has returned from Thursday, when buyers were attracted to $60,000 Bitcoin. The crypto fear and greed index is right in the middle and has moved out of the fear zone.

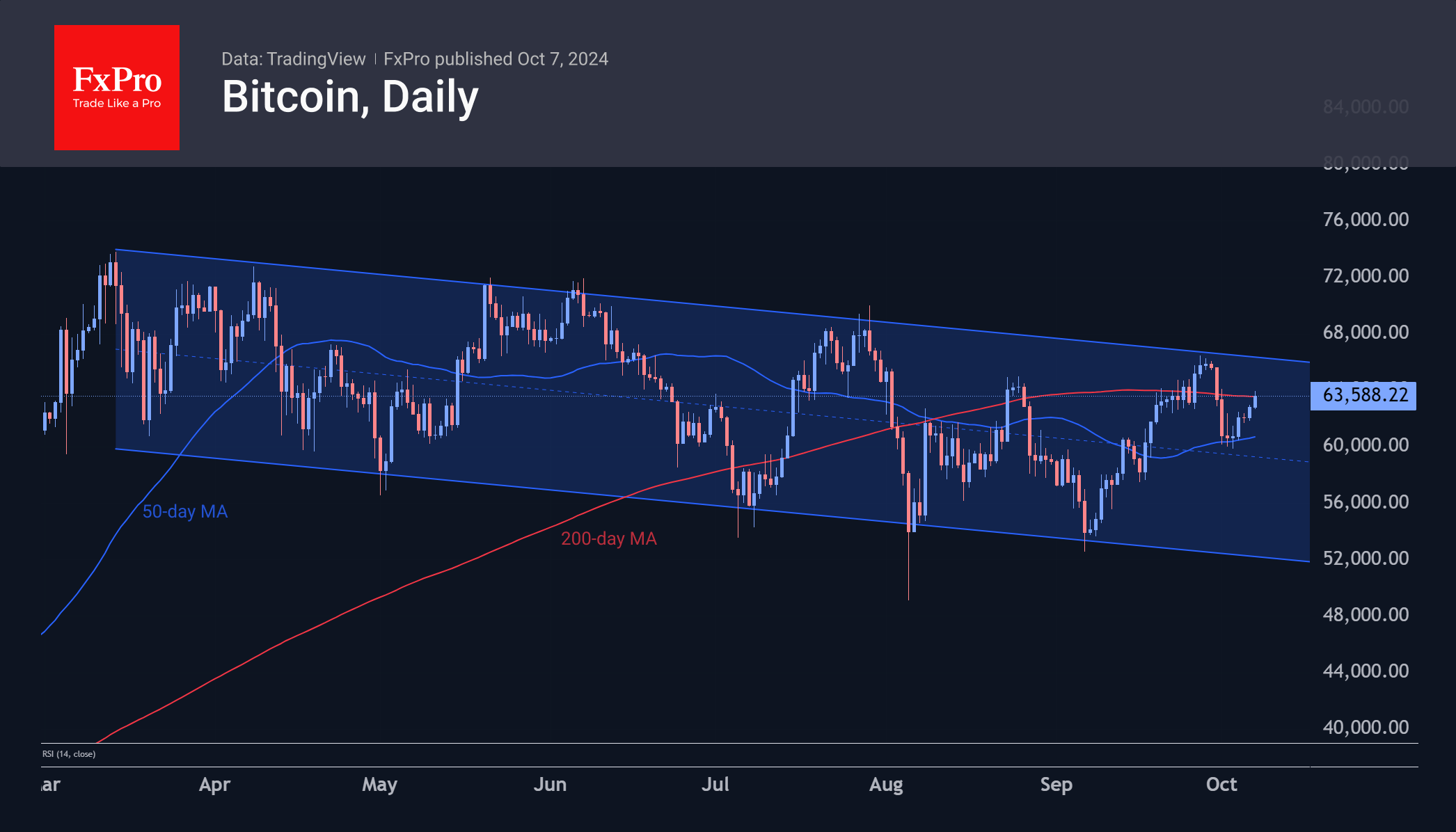

Last week, Bitcoin successfully rebounded from the area where the 50-day moving average intersects the $60,000 round level. The cryptocurrency rose 1.5% to $63,500 from the start of the day on Monday, with the price returning to test the 200-day moving average. The above consolidation acts as a bullish signal, indicating that the corrective rally is over and buyers are taking over.

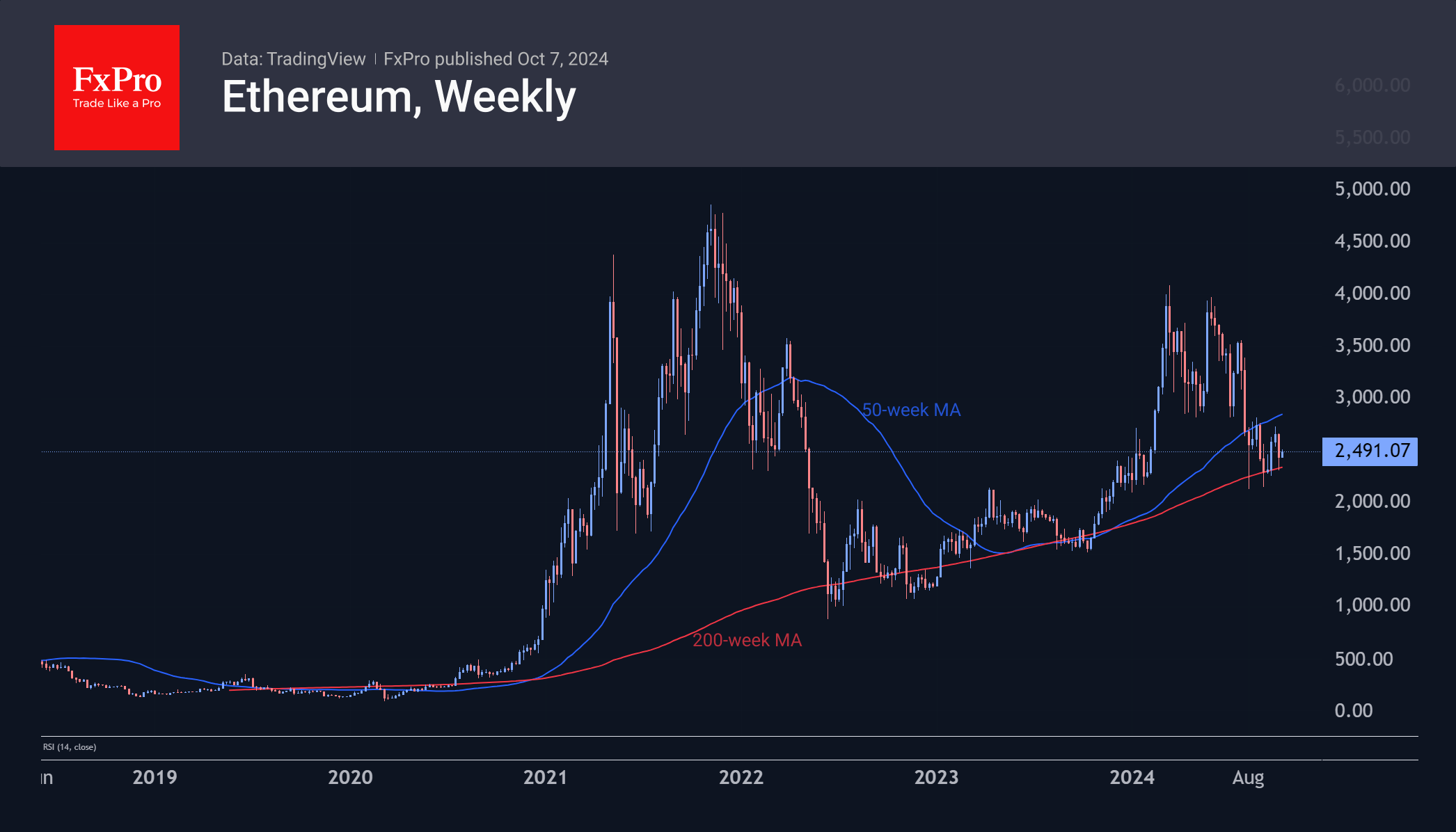

Ethereum is in a weak position, falling below its 50-day average and approaching $2,500. Last week, the second-largest cryptocurrency found support at its 200-week moving average, as it has done many times since mid-2012. While this is a good sign of accumulation by long-term buyers, it is sure to disappoint short- and medium-term speculators.

news background

Ethereum’s inflation rate has risen to a two-year high of 0.74% annually, casting doubt on the cryptocurrency’s deflationary outlook and its hard money status. This is the conclusion Binance has reached. The shift in network activity to L2 has reduced the number of transactions on the underlying asset and reduced the coin burn rate.

According to SoSoValue, outflows from U.S. Spot Bitcoin ETFs last week totaled $301.5 million after three weeks of inflows. Cumulative inflows since the BTC-ETF was approved in January fell to $18.5 billion. The Ethereum ETF recorded net outflows of $30.7 million last week, increasing to $553.7 million since product approval.

Binance continues to surrender its market leading position. According to CCData calculations, Binance's share of total trading volume in the CEX spot and derivatives markets fell to 36.6%, the worst since September 2020.

On October 9th, a new documentary will reveal the true identity of Bitcoin founder Satoshi Nakamoto, who is hiding behind a pseudonym. Politico acknowledged that revealing Satoshi's identity could shock financial markets and influence the U.S. presidential election.