From November 15, 2024, the UAE will exempt virtual currency transactions and conversions from value added tax (VAT) applicable to both individuals and businesses.

While other countries remain cautious about enacting clear crypto regulations, the UAE is taking an open and proactive approach.

How have crypto regulations changed in the UAE?

Prior to the tax exemption policy, the UAE imposed a 5% VAT on cryptocurrency transactions, similar to other commercial transactions. However, the decentralized and anonymous nature of cryptocurrencies has posed challenges to taxing them.

Previous tax regulations created barriers for companies and individuals to enter the cryptocurrency market. The new tax exemption policy aims to foster growth in the sector and attract investment.

The UAE's Federal Tax Authority (FTA) issued revised VAT regulations on October 2, stating that crypto-related transactions, including remittances and conversions, will be exempted from VAT in the UAE.

“The UAE (Dubai) just eliminated all taxes on cryptocurrency transactions. If the US wants to be competitive, it needs to follow,” said Borovik, a cryptocurrency trader.

Dubai is emerging as a global hub for cryptocurrencies and blockchain technology. Due to its progressive regulatory framework, the city has attracted many companies and projects in the cryptocurrency field.

Read more: Complete guide to filing crypto taxes in 2024

How do virtual asset companies benefit from VAT exemption?

Interestingly, the UAE has already applied VAT exemption for investment fund management, asset transfers and conversion of virtual assets since January 1, 2018. This means that since 2018, any person or business that has paid VAT on the purchase or sale of virtual currency may be eligible for a refund from fiat currency. government.

However, this retrospective process may include certain voluntary disclosures to the FTA. This means old transaction records will be scrutinized and some companies could face penalties if fraud is discovered.

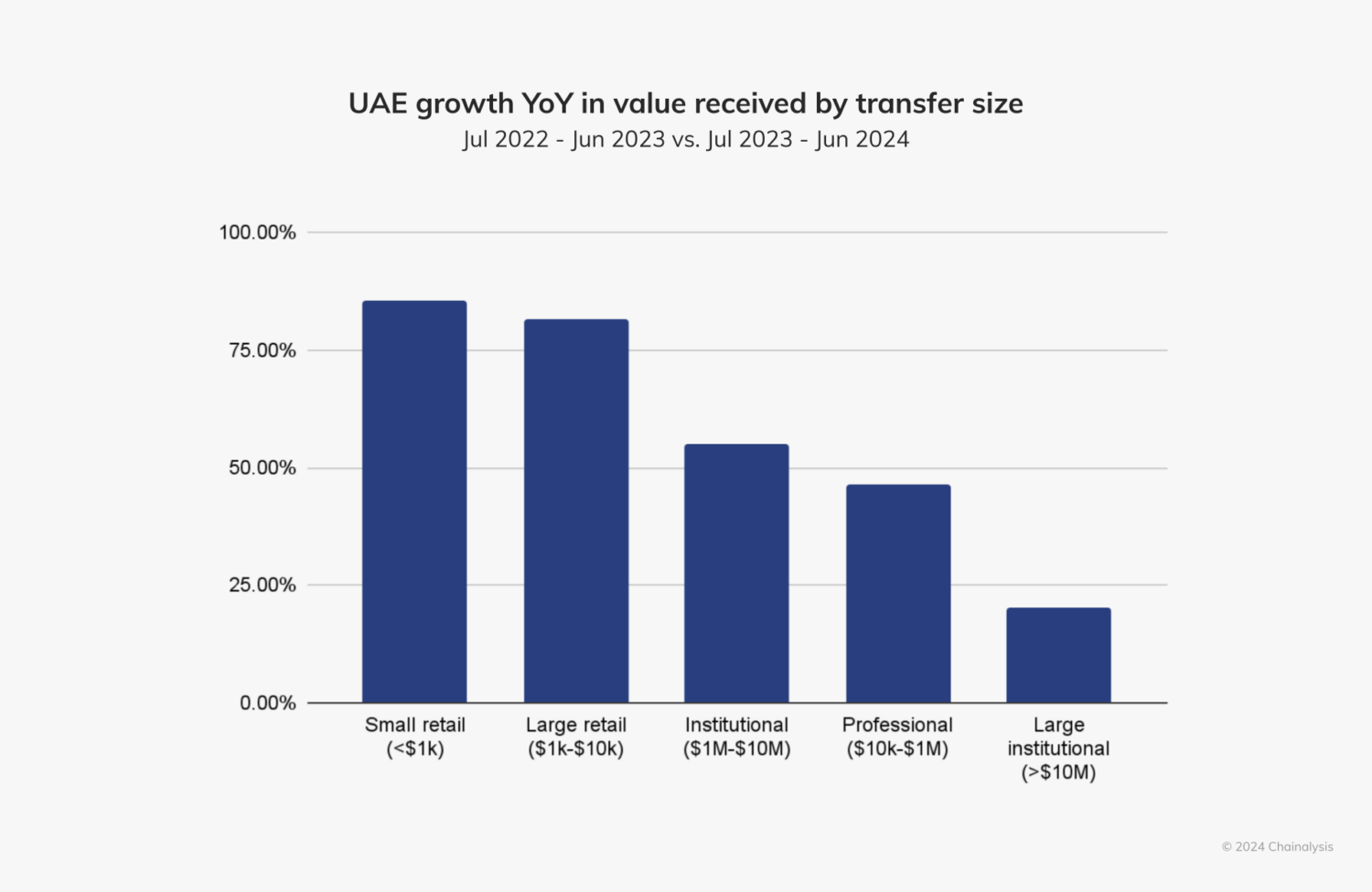

According to Chainalysis, from July 2023 to June 2024, the UAE received over $30 billion in cryptocurrencies, placing the country in the top 40 in the world for crypto inflows and third in MENA (Middle East and North Africa). It has become a large virtual currency economy. region.

The Chainalysis report also highlights that the UAE is developing a diverse and growing cryptocurrency ecosystem. The total value of DeFi services, including DEX, in the UAE increased by 74% year-on-year, from $2.3 billion to $3.4 billion. DEXs alone increased by 87% from an estimated $6 billion to $11.3 billion.

Read more: Top 11 listed companies investing in cryptocurrencies

With the new tax exemption policy, the UAE is poised to become a preferred destination for venture capitalists and blockchain businesses next year.

Disclaimer

In accordance with Trust Project guidelines, BeInCrypto is committed to fair and transparent reporting. This news article is intended to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to independently verify their facts and consult a professional. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.