Monero is showing early signs of recovery, rising 5% in the past 24 hours and emerging as one of the market's top performers.

At the time of writing, Monero (XMR) was trading at $146.63 with a market cap of $2.7 billion, providing some relief to investors after a rocky start to October. After starting the month at $153.8, XMR experienced a sharp decline, dropping to $142.96 on October 2nd, before rising further to a low of $136.43 the next day.

The plunge coincided with the announcement by leading cryptocurrency exchange Kraken that it would delist Monero in the European Economic Area to comply with local regulations, which is likely to take effect in December. This is probably in anticipation of the Crypto Asset Market Law.

Kraken's delisting accelerates downward trend

Kraken's decision to delist Monero in the EEA shocked the market and raised concerns about regulatory scrutiny surrounding privacy coins. Monero's privacy-focused technology that obfuscates transaction details has long attracted the attention of regulators, and the looming MiCA framework appears to be tightening the noose even further.

However, what raised eyebrows was the timing of Monero's price drop. There are suspicions that selling of XMR began before Kraken's delisting announcement, leading to speculation that insiders acted on non-public information. This is especially questionable since Monero bucked the trend with a sharp decline even as the broader crypto market was rising at the time.

Despite the regulatory hurdles Monero faces, privacy coin supporters remain optimistic. Many argue that Monero's use case, which revolves around anonymous trading, will ensure its relevance regardless of exchange delisting.

According to one Monero supporter known as “Klaus,” “Whether this price holds or falls below $1, we believe whales will use this technology to collect wealth.”

That said, the token has yet to fully recover from its October lows, and trading volumes remain low. XMR’s daily trading volume decreased by 24.5% and hovered around $67.8 million, showing signs of waning interest from traders.

Key Resistance Levels for XMR Tests

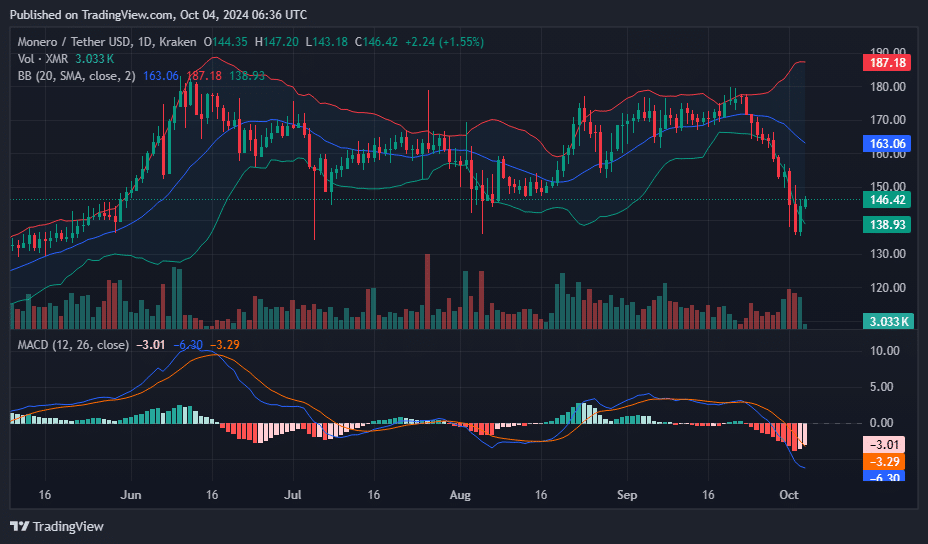

From a technical perspective, Monero has recovered from $134, a key support level that has been held since early July. This pullback has pushed XMR above the lower Bollinger Band and the next important hurdle lies at the midpoint of the Bollinger Band at $163. Monero needs to clear this level with strong momentum to confirm a sustained bullish reversal.

Above $163, the psychological resistance level at $180 looms as a formidable barrier, as the price refused to move higher in both June and September. Breaking through these levels will be key for Monero to re-establish a stronger bullish trajectory.

Technical indicators also paint a cautiously optimistic picture, as the moving average convergence divergence remains in bearish territory and the MACD line is still below the signal line. However, the two lines are converging, suggesting that momentum could change soon.

The histogram remains in the red, suggesting that the selling pressure is waning and the bulls may soon take control. Although volume levels have stabilized at the time of writing, they are still insufficient to signal a definitive bullish move. A significant increase in volume will be needed for Monero to gain the traction needed for a more robust recovery.