Bitcoin prices fell for the fourth day in a row as the crypto fear and greed index returned to the fear zone and geopolitical risks increased.

Bitcoin (BTC) has fallen to $60,200, its lowest since September 18 and 8% below last week's high.

The current weakness comes as investors embrace risk-off sentiment amid heightened geopolitical tensions after Israel vowed to retaliate for Tuesday's attack.

Risk assets such as the Dow Jones Index, S&P 500 Index and Nasdaq 100 Index have continued to decline recently, while bond yields have been rising. The dollar index also rose to $101.50, the highest since September 13th.

Bitcoin also fell as some whales continued to sell their holdings. One of the top sellers was Ceffu, which withdrew 3,372 coins worth $211.3 million. This account sells Bitcoin, Ethereum (ETH), Solana (SOL), and Avalanche (AVAX). According to Arkham, the company has assets worth more than $2 billion.

Another investor sold 265 Bitcoins last week for $17.5 million. He bought these coins two years ago for $6.2 million and made a profit of $11.5 million.

According to Santiment, the current reversal is due to growing sentiment towards the coin on social media. Most of the time, when enthusiasm among social media users gets very high, Bitcoin tends to fall.

Meanwhile, the crypto fear and greed index has fallen from last week's high of 60 to the fear zone of 39.

On the positive side, October is often a strong month for Bitcoin, with an average return of 20.6%. This is followed by November, with an average return of over 46%.

The main triggers that could push interest rates higher are further rate cuts by the Federal Reserve and the end of the US election period.

Bitcoin price hits major resistance level

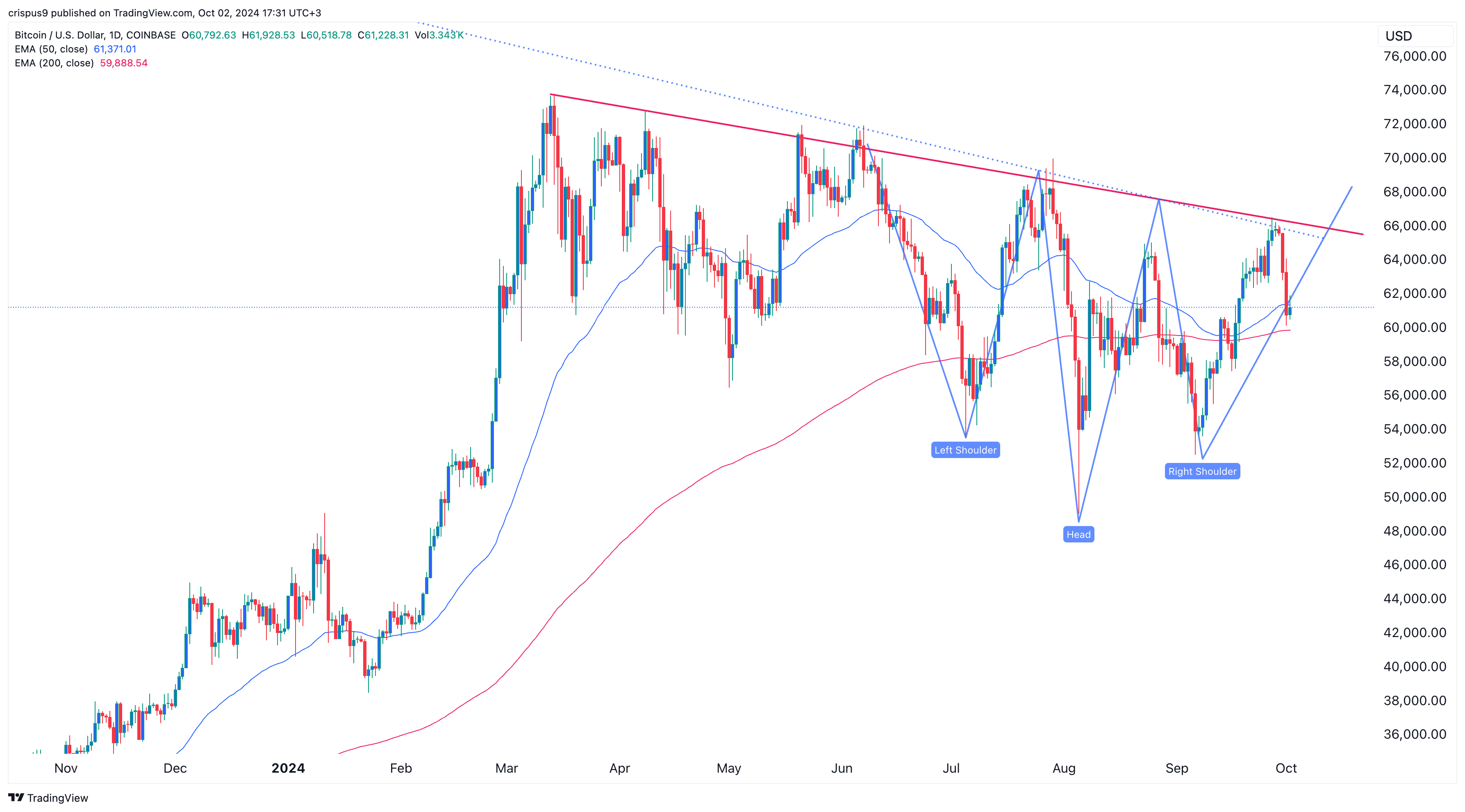

Technically, the coin also declined after reaching the key resistance level at $66,000. This is a price that would be the highest since March of this year and is worth noting. Renowned trader Peter Brandt said in a note that a reversal of resistance and a breakout above all-time highs would confirm a clear breakout.

On the positive side, it remains above the 50-day and 200-day moving averages, forming an inverted head-and-shoulders pattern. Therefore, a rebound is likely in the coming days.