Bitcoin plunged earlier in the week after Japan unexpectedly elected a new prime minister over the weekend.

Bitcoin (BTC) is poised for a major drop following a roughly 14% rally after the U.S. Federal Reserve cut interest rates by 50 basis points about two weeks ago. The election of Japan's new prime minister over the weekend appears to have triggered the move.

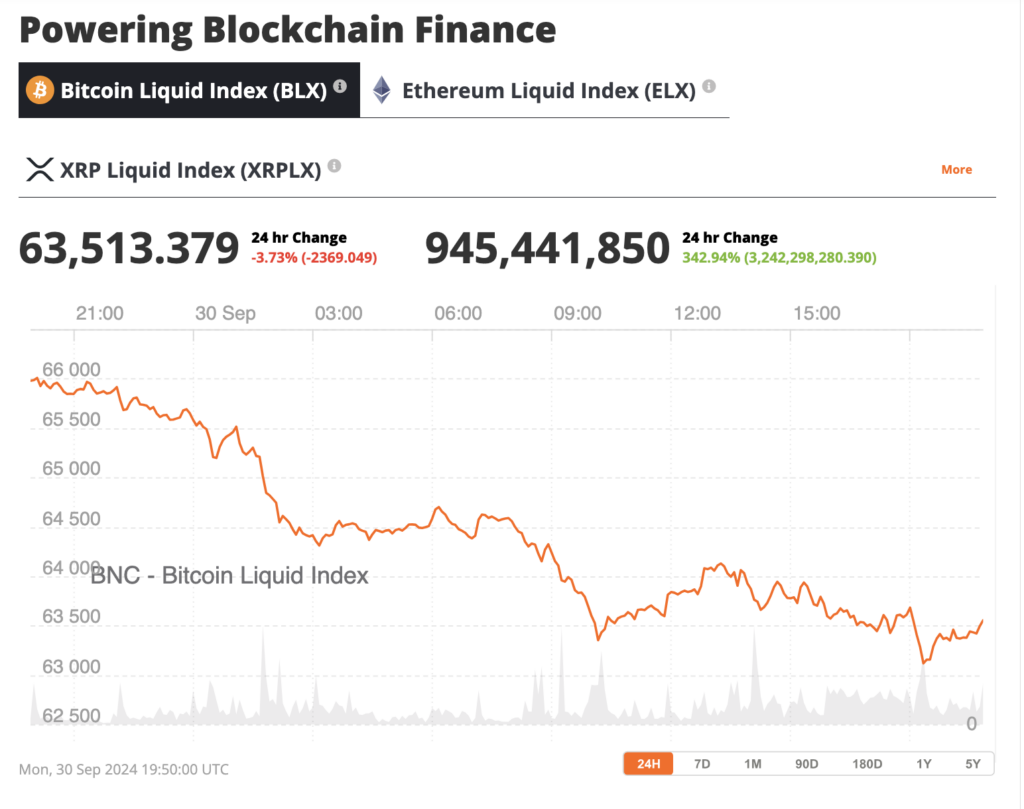

Source: BNC Bitcoin Liquid Index

In a surprising decision, Japan's ruling party has selected Shigeru Ishiba as the next prime minister. Mr. Ishiba is widely believed to support the Bank of Japan's (BOJ) goal of normalizing monetary policy, meaning raising interest rates. After being elected, Ishiba called for a snap general election to be held in late October.

This came after the Bank of Japan's modest rate hike in late July, causing a sharp unwinding of the yen carry trade and sparking a global financial panic, with Bitcoin dropping from around $70,000 to $50,000 within days. It plummeted to less than $1,000. The decline was so severe that the Bank of Japan had to intervene, using former officials, to reassure the market that there would be no further rate hikes in 2024.

Ishiba's election over the weekend triggered another sharp rise in the yen and a 5% drop in Japan's Nikkei Stock Average, with the sell-off extending to Bitcoin, which fell from about $66,000 to $63,300. At the time of writing, Bitcoin has fallen about 3% since late Friday, recovering slightly to $63,800. European stocks are down about 1%, but U.S. stock index futures are down only slightly.

Bitcoin takes a lull after a strong performance

Until this weekend, Bitcoin had enjoyed a strong rally since the Fed cut its benchmark interest rate by 50 basis points in mid-September. China's monetary and fiscal stimulus measures to stimulate the economy also contributed to the rise, with the Shanghai Composite Stock Index rising 8% on Monday after its best week in more than a decade.

However, late last week, several indicators of overbought conditions showed up, including a rise in the perpetual funding rate for Bitcoin futures.

This week marks the start of a new month with important economic reports and central bank commentary. Federal Reserve Chairman Jerome Powell is scheduled to speak on economic and monetary policy Monday at the annual meeting of the National Association for Business Economics. The United States is scheduled to release manufacturing and services sector statistics from the Institute for Supply Management (ISM) on Tuesday and Thursday, with the key event being Friday's September jobs report. These data points could have a major impact on the Fed's interest rate decisions at its next meeting in early November. According to CME FedWatch, the market is currently pricing in a two-thirds chance of a 25 basis point (bp) rate cut. What triggered Bitcoin's latest rally was the Fed's decision to cut interest rates by 50 basis points in September, instead of the expected 25 basis points. Changes in expectations for a November interest rate cut could once again impact Bitcoin's price path.

Retail participation in Bitcoin rally is low

One of the big questions surrounding Bitcoin's current rally is whether retail investors are involved. Retailer participation often indicates market excitement and greed and can be a leading indicator of market tops. Bitcoin (BTC) is about 15% below its all-time high, and it appears retail has yet to see mass adoption.

A key indicator of retailer participation is the ranking of the Coinbase (COIN) app in app store downloads. During the 2017 and 2021 bull markets, Coinbase ranked as the number one downloaded app near the top of the market. According to @CoinbaseAppRankBot, Bitcoin's most recent peak was in the top 5 in March. However, Coinbase currently sits at #438, near its lowest level this year, indicating a continued lack of interest from retailers.