If the Fed is cutting interest rates and China is ramping up stimulus, why is the stock market slowing?

- Stock markets continue to rise, but momentum is slowing despite supportive news.

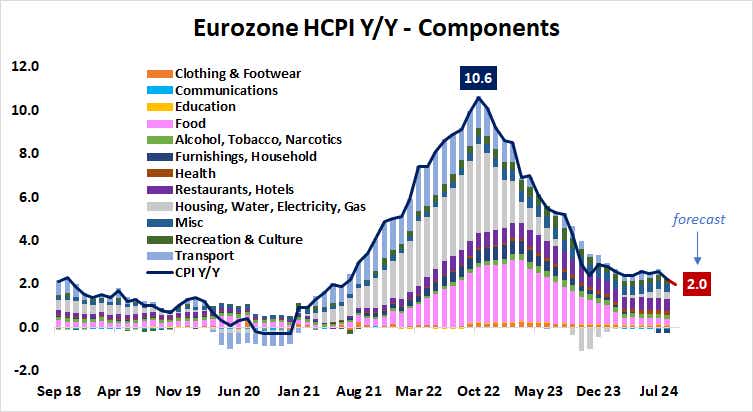

- The euro could fall if Eurozone CPI inflation data supports expectations of an ECB rate cut.

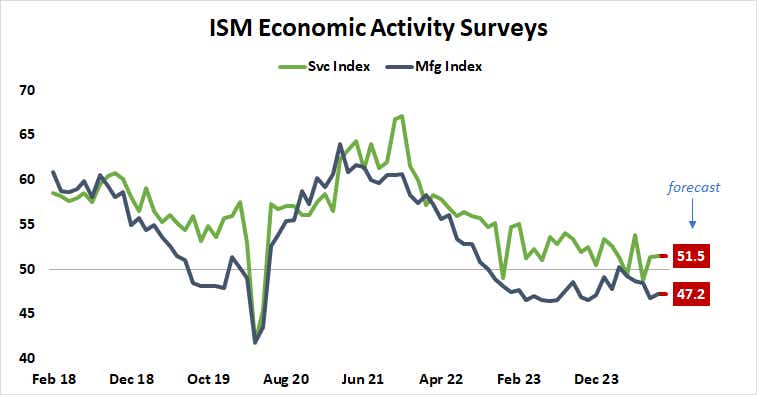

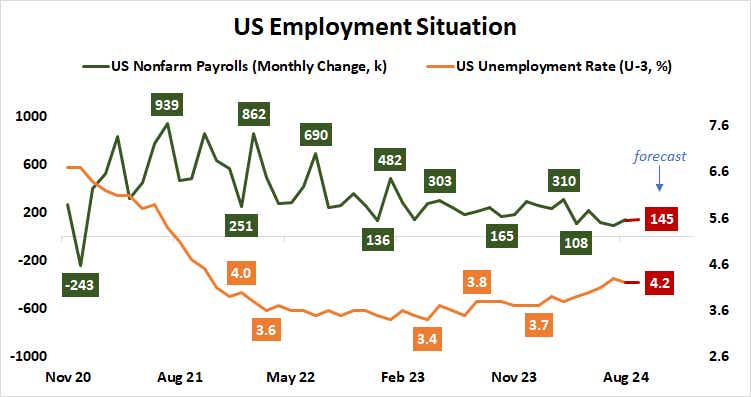

- Strong US ISM and employment data could dampen Fed stimulus bets and hurt Wall Street.

Wall Street rose for a third straight week, but the gains slowed even as economic tailwinds appeared to be strengthening. The bellwether S&P 500 index rose 0.5% last week, after rising 2.35% and 3.88%, respectively, over the past two weeks. The tech-heavy Nasdaq 100 similarly slowed, rising 1%.

Stocks soared in the second week of September as expectations for a Federal Reserve interest rate cut reached a fever pitch, with markets expecting a doubling of the rate by 50 basis points (bps). The upward momentum slowed as the US central bank implemented policy as expected. Despite the surprise from China, the economy is cooling further.

One reason for a higher risk appetite may be concerns about the future cost of capital. The yield curve has steepened, gold and copper have risen, and the dollar has fallen, as markets believe that the start of US easing will likely lead to inflation. This suggests the Fed could raise the floor on interest rates, just as many companies move to refinance their debt.

The 2021-2023 rate hike sequence was unique among previous tightening cycles since the advent of the modern financial system following the end of the gold standard in that companies' net interest payments fell, rather than increased. . This is because funds became abundant during the coronavirus pandemic, and refinancing at higher interest rates was delayed by three to five years.

Fed Chairman Jerome Powell seemed to add to the market's fears in a speech on Monday when he pushed back against traders' dovish myth-making. He said the U.S. central bank was in no hurry to cut interest rates, adding that the risks to the economic outlook were “two-sided.” As expected, this clearly surprised the market.

Against this backdrop, here are some macro waypoints that could shape what comes next.

Eurozone Consumer Price Index (CPI)

Eurozone inflation is expected to slow further in September, falling to a three-year low of 2% year-on-year. Ominous Purchasing Managers Index (PMI) data showed economic activity contracting again this month and price pressures dispersing. Analogue statistics for Germany released ahead of the region-wide report showed faster-than-expected inflation.

A poor result could increase expectations for a rate cut from the European Central Bank (ECB). As it stands, the benchmark ESTR rate futures are pricing in a 47bps rate cut this year, suggesting that two more standard-sized rate cuts are almost certainly on the menu. If this number rises even slightly due to the influence of CPI statistics, the euro is likely to come under selling pressure.

US ISM Purchasing Managers Index (PMI)

According to a survey of business activity by the Institute for Supply Management (ISM), the US economy is expected to remain strong in September. Manufacturing is expected to continue contracting, while services continue to grow, with the pace of change in both holding relatively steady for the third consecutive month.

Overall, this paints a similar picture to the S&P Global PMI statistics released last week. However, data from Citigroup suggests that the flow of economic news in the U.S. has improved compared to median forecasts in recent weeks. If that signals unexpected strength, a reduction in expectations for Fed rate cuts could hurt stocks and send the dollar higher.

US employment data

Similar steady progress is expected in the labor market when September's official employment figures are released. The economy is expected to add 145,000 nonfarm payrolls, a barely noticeable increase from August's 142,000. The unemployment rate is expected to remain flat for the third consecutive month at 4.2%.

Again, further market reaction will likely depend on how much the realized outcome influences traders' Fed policy outlook. An upside surprise against the upbeat tone of U.S. economic news in recent weeks could raise hopes for reflation and reduce the scope for rate cuts next year. While this may bode poorly for stocks and bonds, it could help the US dollar.

Ilya Spivak, TastyLive's Head of Global Macro has 15 years of experience in trading strategies and specializes in identifying thematic movements in currencies, commodities, interest rates and stocks. he will host macro money and co-sponsor over time, Monday to Thursday. @Ilyaspivak

For daily live programming, market news and commentaryvisit delicious live or YouTube channel delicious live (for option traders), and delicious live trends Stocks, Futures, Forex, Macro.

Trade with a better broker, Open a tasting trade account today. Tastylive, Inc. and Tastytrade, Inc. are separate but related companies.