Bitcoin spot ETFs have attracted more than $1 billion in net inflows over the past week, the highest level since July. Experts said this is evidence that institutional investors are becoming increasingly receptive to digital assets.

This surge in investment comes as Bitcoin prices hover around $64,000, despite a slight decline in early Monday trading.

BlackRock's Ethereum ETF (ETHA) topped the list with $94.9 million in inflows, followed by Fidelity's Ethereum ETF (FETH) with $64.9 million. This positive move came despite $127 million in outflows from Grayscale's ETF (ETHE), suggesting that investor capital was being redirected to newer products. , SoSo Value data shows.

Robust inflows into Bitcoin ETFs have not gone unnoticed by industry experts. Avinash Shekhar, co-founder and CEO of Pi42, an Indian crypto derivatives platform, said the surge in net inflows into Spot Bitcoin ETFs has been a huge boost, especially after the Federal Reserve's interest rate cut. It reflects a strong revival in investor confidence, he told Decrypt.

Shekhar also noted a resurgence of interest in Ethereum ETFs, which recorded its second-strongest week since its launch.

“The trends we are observing indicate that the market is increasingly embracing digital assets, suggesting promising opportunities for both Bitcoin and Ethereum in the future,” he said. .

Capital inflows into Bitcoin-based financial products clearly indicate growing confidence in the cryptocurrency market amid macroeconomic developments, especially in Japan, where the country is planning a review of its cryptocurrency regulations. This could reduce taxes on digital assets and encourage the launch of Bitcoin. According to a report by Bloomberg, the percentage of domestic funds investing in tokens.

As of early Monday morning European time, Bitcoin (BTC) was trading at $63,880, down about 2.8% from previous levels. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, also experienced some decline, trading 0.7% lower at $2,630, according to CoinGecko data.

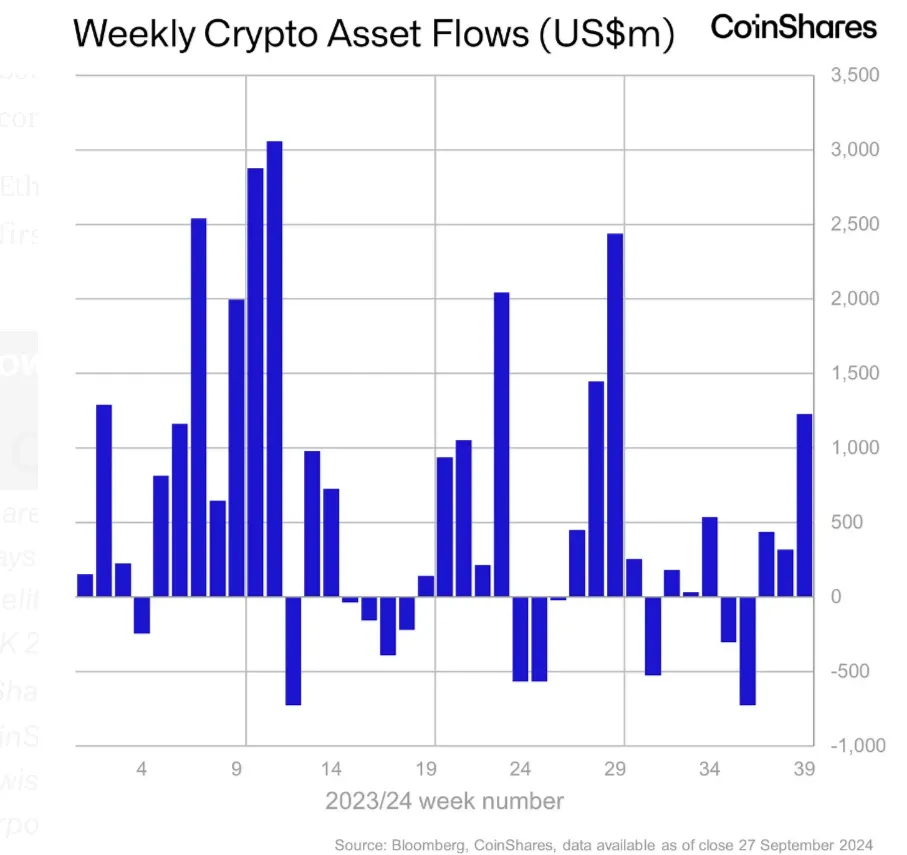

Data from crypto asset management firm CoinShares further supports this bullish sentiment. The company reported total inflows of $1.2 billion into its digital asset investment products for the third consecutive week. The trend is driven by expectations for dovish monetary policy in the US and positive price momentum, with total assets under management increasing 6.2% last week.

Interestingly, while Bitcoin dominated inflows, Ethereum also recorded significant inflows for the first time since early August, breaking its five-week negative streak with $87 million in inflows. Altcoins had a mixed response, with Litecoin (LTC) and (XRP) receiving inflows of $2 million and $800,000, respectively, while Binance and Stax (STX) received inflows of $1.2 million and $900,000, respectively. faced an outflow.

Meanwhile, CryptoQuant data shows that Bitcoin's profit supply remains at a high level, which historically indicates a bullish trend in the market. Typically, during bull cycles, Bitcoin's profit supply remains above 80%.

There were moments when the stock was below 80%, but these dips often present buying opportunities. While recent summer volatility has temporarily pushed profit supply below this threshold multiple times, investors have used these conditions as buying opportunities, confirming the bullish cycle narrative, CryptoQuant analysts say. said.

Edited by Stacey Elliott.

daily report meeting Newsletter

Start each day with the current top news stories, plus original features, podcasts, videos, and more.