- Monero price is facing rejection from the daily resistance level at $180.79, which suggests a further decline.

- On-chain data is showing a bearish picture as XMR’s long/short ratio has fallen below 1, the lowest level in a month.

- The bearish thesis will be invalidated if the daily close remains above $180.79.

Privacy-focused cryptocurrency Monero (XMR) continued to decline on Tuesday after facing a resistance barrier rejection on Monday. On-chain data suggests bearish sentiment among XMR traders as the long-to-short ratio is below 1, signaling further price declines for Monero.

Monero Price May Drop from Key Resistance

Monero price has faced difficulties since Sept. 20, with multiple retests of the daily resistance level near $180.79, which it fell 2.78% on Monday. As of Tuesday, Monero was continuing its decline at $169.13, below the ascending trendline (drawn by joining multiple lows from early August).

If the daily resistance at $180.79 holds as resistance and Monero closes below the ascending trendline, the drop could extend by 10% and retest the 61.8% Fib retracement level of $152.73 (the drawdown from the early August low of $135.95 to the September high of $179.84).

The Moving Average Convergence Divergence (MACD) indicator further supports Monero’s decline, showing a bearish crossover on the daily chart. The MACD line (blue line) is below the signal line (yellow line), indicating a sell signal. Also, red histogram bars are appearing below the neutral line of zero, suggesting that Monero price may move lower.

Moreover, the Relative Strength Index on the daily chart is trading at 48, below the neutral level of 50 and indicating a downward trend. A cross below the neutral level generally indicates strengthening bearish momentum.

XMR/USDT daily chart

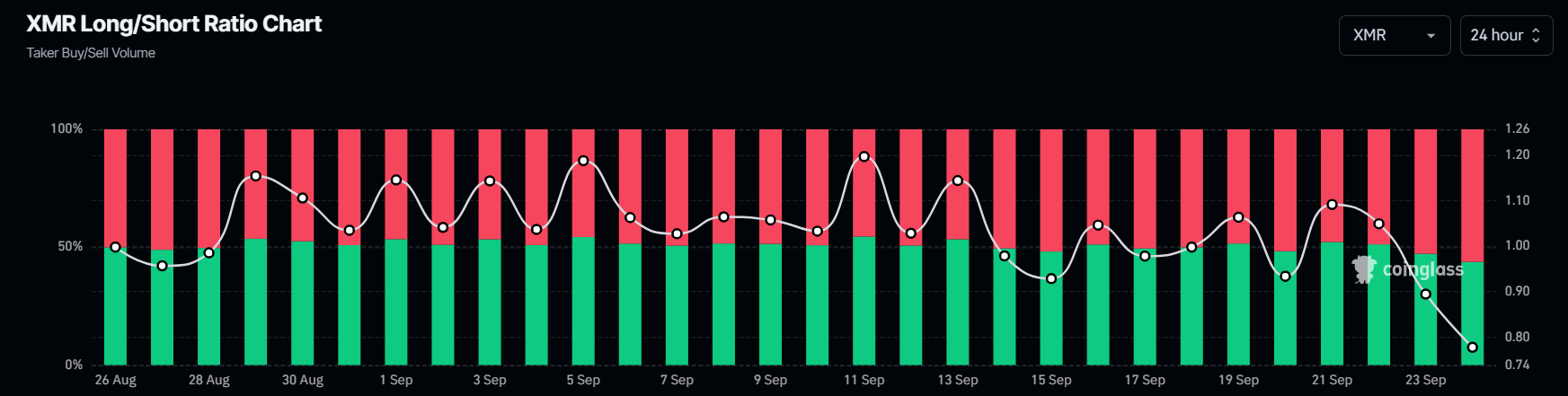

Monero on-chain data also supports the bearish outlook. Monero’s long/short ratio on Coinglass is at 0.766, the lowest level in a month. This sub-1 ratio reflects bearish market sentiment as more traders expect the asset’s price to fall.

Monero long/short ratio chart

However, the bearish thesis will be invalidated if Monero’s daily candle closes below the daily resistance level of $180.79. In this scenario, the price of Monero may rise and retest the psychologically important level of $190.