See what's clicking on FoxBusiness.com

As President Donald Trump prepares to address an estimated 20,000 bitcoin enthusiasts in Nashville, Tennessee later this week, crypto-friendly Republican Senator Cynthia Lummis of Wyoming is also looking to make headlines, drafting new legislation that could fundamentally change the burgeoning cryptocurrency business by cementing Bitcoin as a mainstream financial asset, FOX Business has learned.

According to three crypto industry executives with knowledge of the bill, Lammis has been quietly working to announce a bill at the annual Bitcoin Conference that would require the Federal Reserve to hold Bitcoin as a strategic reserve asset. As of this writing, Lammis' plans are in flux and the announcement could be delayed. But people who have been in direct contact with some of Lammis' staff say she hopes to unveil her ideas at a meeting on Saturday, just before President Trump's scheduled speech. Staffers are hopeful that President Trump will support the bill and the thinking behind it.

Senator Cynthia Lummis speaks at the Bitcoin Conference in Miami, Florida on June 4, 2021. (Eva Marie Uzcategui/Via Bloomberg/Getty Images)

One option, these people said, is to announce the bill at a fireside chat on Friday afternoon moderated by former Democratic Rep. Tulsi Gabbard, who has supported Trump's bid to retake the White House.

No news about the bill has been made public, but Lummis teased a big announcement on his X account this week, writing, “Big things coming this week! Stay tuned!”

Details of the bill are scarce, but a person who has seen an early draft said its purpose would be to direct the Fed to buy Bitcoin and hold it as a reserve asset, just as the U.S. central bank holds gold and foreign currencies to manage the U.S. monetary system and stabilize the value of the U.S. dollar.

The person said Mr. Lummis has been quietly pitching the bill to some of his colleagues on the Senate Banking Committee, hoping to get them to sign on as co-sponsors.

“The Fed holding bitcoin as a strategic reserve asset would be a significant move to bring stability to the U.S. dollar and capital markets,” said Alex Chizik, chief commercial officer at Harris X. “It also sends a strong message that our nation's central bank is open to innovation and, as an independent institution, is a natural bipartisan home for bitcoin.”

Trump raises funds at Bitcoin conference, asking $844,600 per seat

Introducing Bitcoin as a reserve asset would require presidential and congressional support, a tall order given skepticism in political and business circles about the digital coin's validity as a financial asset. The $2 trillion cryptocurrency industry has been plagued by fraud, and many mainstream economists are skeptical of Bitcoin's use as a store of value.

Still, the introduction of a bill classifying Bitcoin as a reserve asset (and likely backing from President Trump) would represent high-level government recognition that Bitcoin is a legitimate financial asset, something the crypto industry has been striving for in its quest for mainstream acceptance.

“Classifying the world's largest cryptocurrency as a strategic reserve asset would be the starting gun for the 'Bitcoin space race,'” said Sam Lyman, director of public policy at bitcoin miner Riot Platforms. “If the United States, the richest country in the world and home to global capital, begins accumulating bitcoin on its balance sheet, other countries will have a strong incentive to do the same.”

The United States already has a head start as it is the largest country in the world that holds Bitcoin. Currently, the U.S. holds approximately 210,000 Bitcoin, with a current value of just over $66,000 per token. This is due to the Department of Justice having seized large amounts of money from illegal actors over the years.

Click here to see live cryptocurrency prices

“This will rapidly accelerate the Game Theory of Nations as sovereign nations rush to accumulate the scarcest monetary assets on the planet,” Lyman added.

A spokesman for Lummis had no comment for this story, and a spokesman for the Trump campaign did not immediately respond to a request for comment.

The conference, which is set to feature other notable figures including MicroStrategy’s Michael Saylor, Ark Invest’s Cathie Wood, former presidential candidate Vivek Ramaswamy and independent candidate Robert F. Kennedy Jr., comes as the national political climate remains turbulent and November’s presidential election looks set to be closely contested, with both parties mining for cryptocurrency-holding voters.

MicroStrategy CEO Michael Saylor spoke at the Bitcoin Conference in Miami on April 7, 2022. | Getty Images

With President Biden dropping out of the election race, Vice President Kamala Harris has emerged as the Democratic Party's leading candidate. While Harris has many challenges ahead of her, including choosing a running mate, pro-cryptocurrency Democrats such as tech billionaire Mark Cuban have been advising her campaign to ease ties with the cryptocurrency industry, which is under strict scrutiny from the Biden administration's regulatory regime.

Harris declined to attend the Bitcoin conference after discussions with conference organizers, according to a person familiar with the matter.

But Democratic Party officials say Trump seems open to the possibility of winning the support of cryptocurrency holders, given that they represent roughly 50 million potential voters, many of whom have no interest in politics except to protect their investments.

A spokesman for Harris did not immediately comment.

Republicans already have an advantage in the crypto space. Ramaswamy, a former Republican presidential candidate and current Trump ally, has been lobbying the industry for months. Trump has done the same, and in a speech scheduled for Saturday, he is set to promote platform promises such as promoting bitcoin mining, self-custody of digital assets and abandoning the issuance of central bank digital currencies (CBDCs).

Cryptocurrency Firm Flowdesk Hires Ex-NYSE Advisor as It Looks to Build U.S. Presence

Lammis is a Bitcoin investor herself, and has been dubbed the Senate's “cryptocurrency queen,” advocating for the use of Bitcoin to bolster the nation's financial situation.

In 2022, she floated the idea of decentralizing the Fed's $40 billion worth of foreign currency with Bitcoin, stressing that the asset's decentralized nature would make it more “ubiquitous” over time. Earlier this month, in an interview with FOX Business' Larry Kudlow, she raised the idea of having Bitcoin as a reserve, saying it could help support the strength of the dollar.

It's unclear how Trump, a former bitcoin skeptic, feels about the currency as a potential reserve asset or whether he would support it. A person who has reviewed Lummis' draft bill said bitcoin's big selling point is that it strengthens the U.S. dollar, which, unlike any real asset, is backed by the full faith and credit of a nation's taxing authorities.

Former President Trump waves to the crowd from the field during halftime of the Palmetto Bowl, a game between Clemson University and the University of South Carolina, at Williams-Brice Stadium on November 25, 2023 in Columbia, South Carolina. (Shawn Rayford/Getty Images)

Still, the move could be controversial. Some say adding cryptocurrencies to the currency could undermine the value of gold, a major pillar of the U.S. economy. Crypto skeptics worry that bitcoin's volatile tendencies could make it difficult for the Fed to effectively deploy it as a hedge against economic headwinds.

Federal Reserve Vice Chairman Randy Quarles said the central bank needs to move toward funding its balance sheet entirely with Treasury securities to avoid the “dangerous path” of using the central bank's balance sheet for political credit allocation.

Federal Reserve Vice Chairman Randal Quarles (Andrew Haller/Bloomberg/via Getty Images)

As of June, the Fed's balance sheet stood at a staggering $7.3 trillion, which includes assets such as Treasury bonds, foreign exchange holdings, and gold.

“There is no safer investment than U.S. Treasuries, so I don't see why anyone would want to hold Bitcoin as a strategic reserve,” Steve Moore, an economist and adviser to former President Trump, said in a statement to Fox Business. “I think the positive point is that this would be a good way for the government to diversify its assets.”

Click here to get FOX Business on the go

Ramaswamy echoed similar sentiments, suggesting backing the U.S. dollar with a “basket of commodities” that would include Bitcoin as a way to combat the inflation that has been raging in the early days of the Biden administration. Kennedy, a Bitcoin advocate, proposed a similar approach but received pushback from cryptocurrency industry skeptics, who said it would be an unrealistic return to the gold standard that the U.S. abandoned in 1971.

While the idea of using Bitcoin as a potential strategic reserve asset is not new, a new wave of support is emerging for bringing this digital asset into the mainstream. Bitcoin has received strong support from Wall Street after Larry Fink, CEO of BlackRock, the world's largest asset manager, changed his position from opponent to enthusiastic supporter. Fink, who once called Bitcoin a “money laundering indicator,” now calls it “digital gold” and a “long-term store of value” after his company launched a Bitcoin exchange-traded fund earlier this year. Since its launch, the fund has raised nearly $19.5 billion from investors.

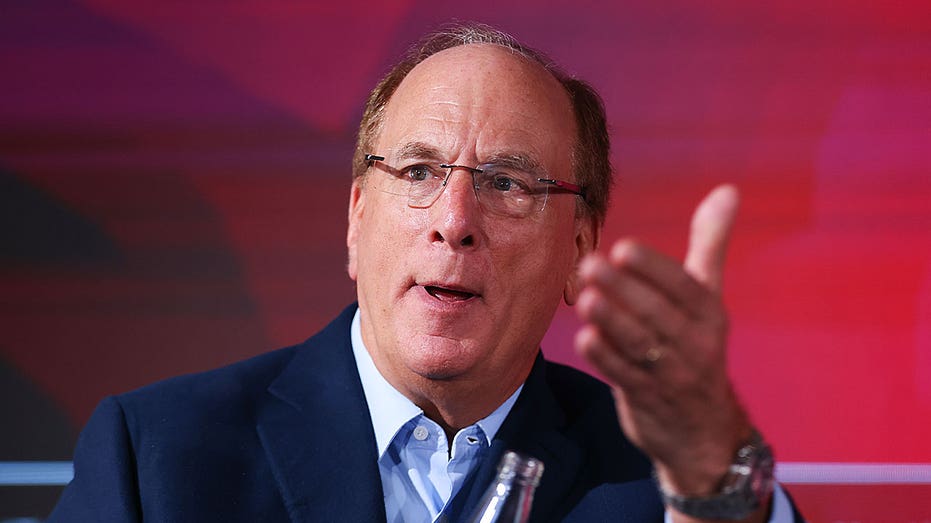

BlackRock CEO Larry Fink speaks at a World Economic Forum event in Davos, Switzerland on January 17, 2023. (Holly Adams/Bloomberg via Getty Images/Getty Images)

Trump is also a recent convert.

“If we don't do it, China is going to take it over,” Trump said of his latest push into digital assets in an interview with Bloomberg last week. “I don't want to be responsible for letting another country take over this space.”

For more information on FOX Business, click here

Cryptocurrency holders, on the other hand, are likely to make a killing if Lammis' bill becomes law: Since the amount of income provided is fixed, entities who buy large amounts of Bitcoin could drive up the asset's price in a relatively short period of time.

“Price-wise, strategic adoption of Bitcoin means it has the potential to rise into the stratosphere as market interests become much stronger financially,” Swarm Markets co-founder Philip Pieper told FOX Business.

It's unclear how Lummis' bill will be received by other lawmakers. Whether such a bill passes will depend in large part on the makeup of the House and Senate, and who wins the White House in November.