- Monero's emphasis on privacy is a double-edged sword, but it is also its greatest strength and a deterrent to price increases.

- Despite being recently delisted from major exchanges, XMR has proven resilient in the spot market.

Prices for most cryptocurrencies fell late Tuesday, with Bitcoin (BTC) dropping below $59,000, while Ethereum (ETH) saw a more pronounced drop, closing below $2,500. Despite most cryptocurrencies attempting to regain stability after the unexpected selloff, the market remained lower 24 hours later.

For example, Toncoin (TON) was trading on Wednesday slightly higher than its price on Aug. 27, but had calmed down from the massive drop triggered by news of the arrest of Telegram founder Pavel Durov.

But beyond Toncoin, the arrest of the tech founder has focused attention on privacy-focused crypto projects, especially those that prioritize anonymity and security, such as Monero (XMR).

Could Monero (XMR) benefit from the social buzz?

Monero has undergone several network upgrades to increase the network's efficiency and improve privacy, but these milestones have not translated into a decent price increase.

XMR price movement has remained relatively stagnant and trading volumes on major exchanges are reported to be low, indicating waning investor interest.

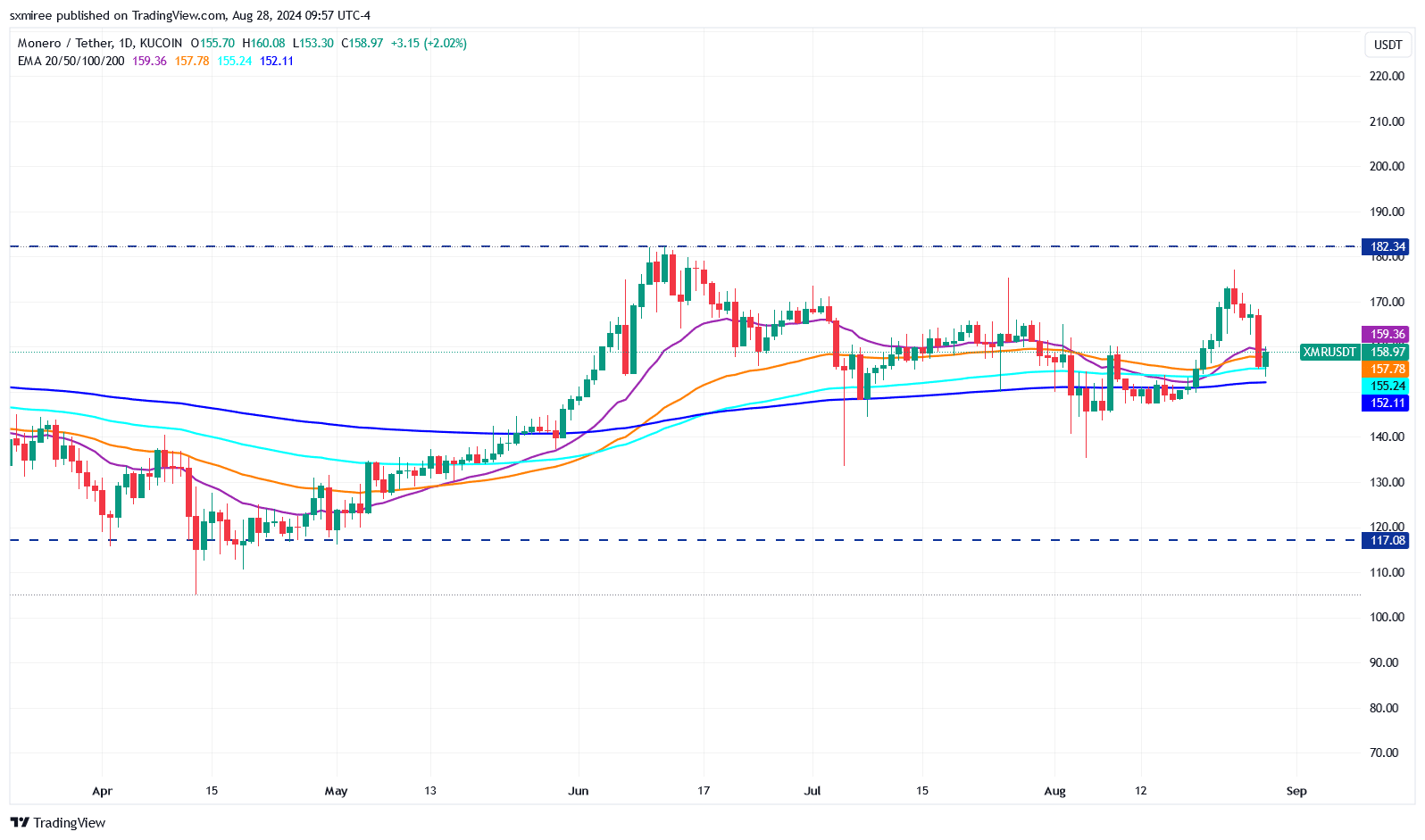

Source: TradingView

Over the past four months, Moreno (XMR) has languished between $117 and $182 in price, failing to rise significantly despite the sector-wide market rally. This can be seen in the fact that XMR/USDT's 200-day simple and exponential moving averages have been roughly linear over this period.

At the time of writing, XMR is above the 20-day, 50-day, and 100-day EMAs, confirming strength at the current price range.

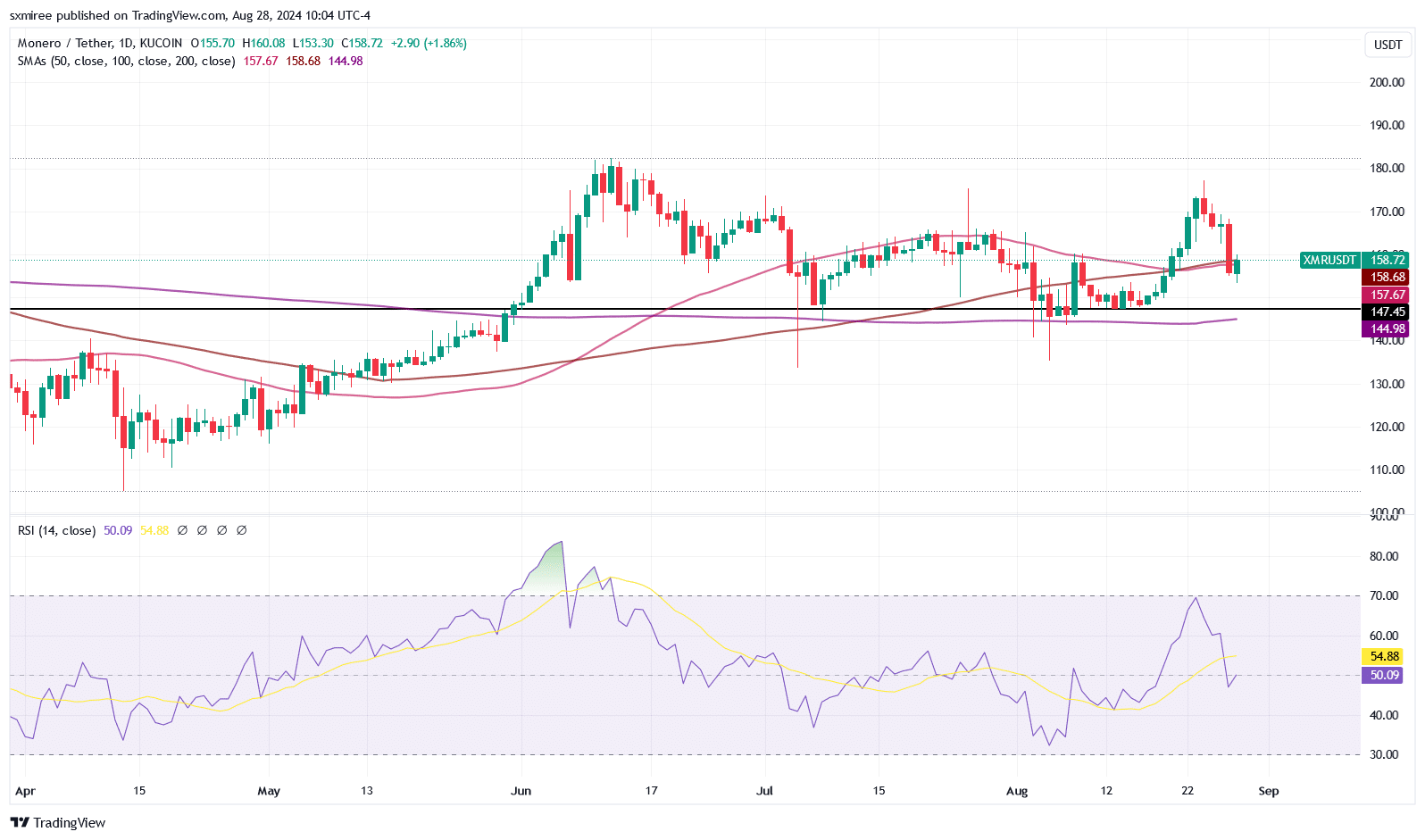

Source: TradingView

However, if XMR sinks below the 50 and 100-day SMAs on the daily chart, the pair risks dropping to lows of around $147 in the short term.

Hurdles outside the market

Despite its unique proposition, XMR has faced several challenges in the market, struggling to gain value and mainstream acceptance.

First, Monero's privacy features, which allow users to hide transaction details, have attracted the attention of regulators around the world. Several exchanges and centralized platforms, including Bittrex and ShapeShift, have delisted XMR in recent years due to anti-money laundering (AML) and know-your-customer (KYC) compliance issues.

In February, Binance announced it would delist XMR and is finalizing the process this month. Kraken also notified them in June that it would delist XMR from Ireland and Belgium. These setbacks have limited the availability and liquidity of XMR on major trading platforms, hindering its price growth.

Monero's utility has also been its Achilles heel preventing wider adoption: its association with illegal activity has negatively affected its reputation, weakening its appeal among institutional investors and casual users.

Is Monero (XMR) still worth considering?

The recent focus on privacy may reignite interest in Monero (XMR), but hurdles remain in navigating the regulatory environment, increasing adoption, and shifting market perception.

Nevertheless, Moreno (XMR) has shown its resilience this year, recovering from the blow of its delisting, and this tenacity, along with the future development of its ecosystem, is likely to set it up for long-term success.