- The minutes of the FOMC meeting held in July suggested that interest rates would be cut in September.

- Rising inflation and rising unemployment provide a reason to cut rates by 25 basis points

- Bitcoin rose more than 3% after the minutes were released.

- Ethereum and other altcoins also saw modest gains.

Bitcoin (BTC) and several other cryptocurrencies briefly rose on Wednesday after the Federal Open Market Committee (FOMC) released the minutes of its July meeting.

Bitcoin and crypto markets may be on the brink of a bull market relaunch

According to minutes from the July FOMC meeting, the Federal Reserve is leaning toward a 25 basis point interest rate cut in September. Participants agreed that the U.S. has made progress in containing inflation and is now on track to reach its 2% target. Participants also noted rising unemployment and falling inflation as reasons for a 25 basis point interest rate cut in the coming months.

Many participants also agreed that slowing interest rates would weaken the economy. After the minutes were released, CNBC reported that traders were in agreement that it was 100% certain the Fed would cut interest rates in September.

Thus, the question among most traders has shifted from whether the Fed will cut rates to by how many basis points it will cut them.

Following the release of the minutes, the cryptocurrency market capitalization as a whole rose by more than 2%. Bitcoin, which had languished in the $59,000-$60,000 range over the past week, rose by more than 3% to close in on $62,000. Ethereum (ETH) also rose by more than 2% following the report.

Risky assets such as cryptocurrencies and stocks tend to perform well in low interest rate environments.

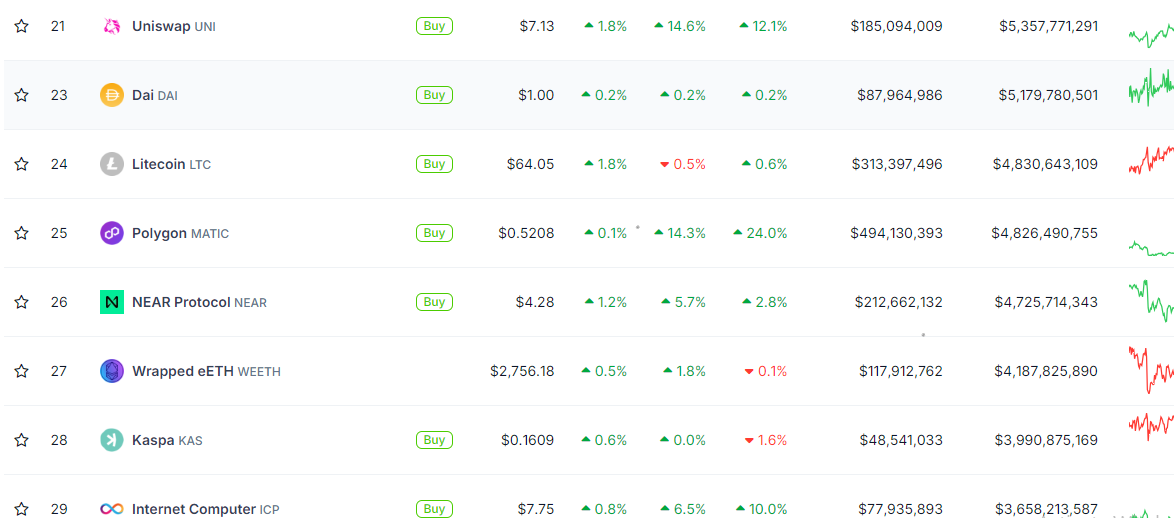

Cardano (ADA) and Avalanche (AVAX) also notably rose 8% and 5%, respectively, which were among their best one-day performances since the market began to turn around in late March to mid-April. Tokens such as Chainlink (LINK), Polkadot (DOT), Uniswap (UNI), Polygon (MATIC), Near Protocol (NEAR) and Internet Computer (ICP) also saw modest gains.

Some of the top cryptocurrencies

These crypto-wide gains also sparked increased liquidation in derivatives, with short traders seeing over $31 million liquidated in the past four hours.

Several members of the crypto community said they believe the recent rally could signal a resumption of the bull market, especially if the Fed finally cuts interest rates in September.