- Ethereum has fallen 2% over the past week, with a key resistance at $2,850 pointing to a possible recovery.

- On-chain data shows an increase in active addresses, suggesting renewed interest and possible price stabilization.

Ethereum [ETH]Bitcoin, the world's second-largest cryptocurrency by market capitalization, has been experiencing a decline that began in August and has continued into September.

At the time of writing, ETH was trading at $2,338, down 1.3% in the past 24 hours and 2% in the past week.

The asset has failed to register any significant gains since the start of the month, leaving investors concerned about its short-term trajectory.

The long road

Prominent cryptocurrency analyst Dean Crypto Trade recently commented on Ethereum’s outlook, saying it may continue to trend downward for some time. In a post on X, the analyst said:

“ETH has shown a solid bounce off support so far, but I think volatility will continue while the price trades within the $2,100 to $2,850 range.”

He further highlighted that a key resistance level for Ethereum is $2,850, adding:

“The bulls know what they need to do to get things back on track, but it's going to be a long process.”

This suggests that while a recovery may be on the way, it may take some time for Ethereum to break out of the current trading range and resume bullish momentum.

Source: Daan Crypto Trades on X

Evaluating Ethereum Fundamentals

Despite the bearish vibes surrounding Ethereum’s price action, some fundamental indicators are offering glimmers of hope for a possible recovery, and one key factor to consider is the level of retail interest in the network.

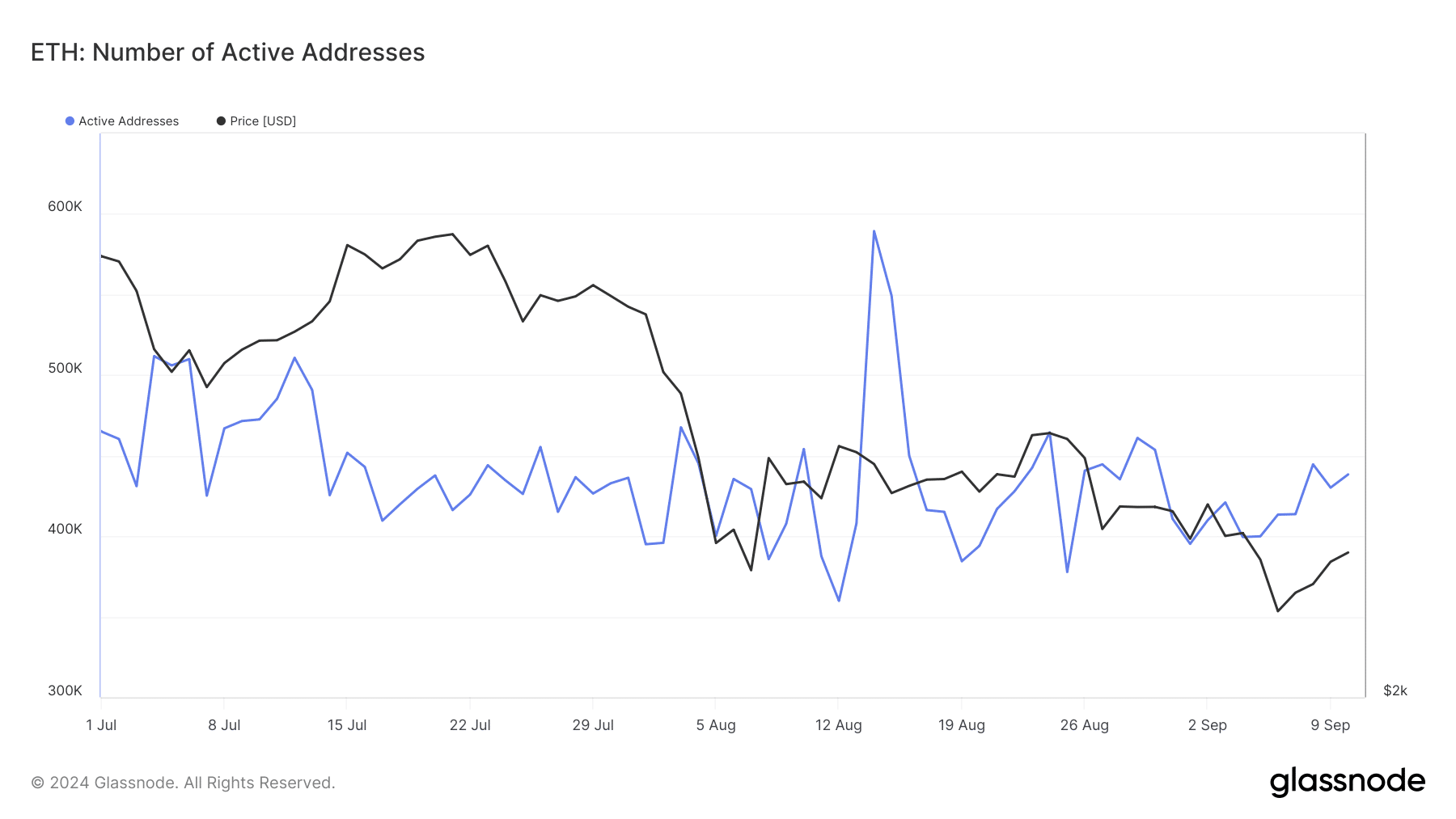

data According to data from Glassnode, Ethereum active addresses peaked at over 589,000 on August 14 but have since declined significantly, dropping to 377,000 by the end of August.

Ethereum active addresses

However, since early September, active addresses have been steadily recovering and now stand at over 438,000.

This increase in active addresses could indicate renewed interest from retail investors, which could support asset prices in the coming weeks.

An increase in active addresses often correlates with increased network activity, which in turn helps drive demand for ETH and support price levels.

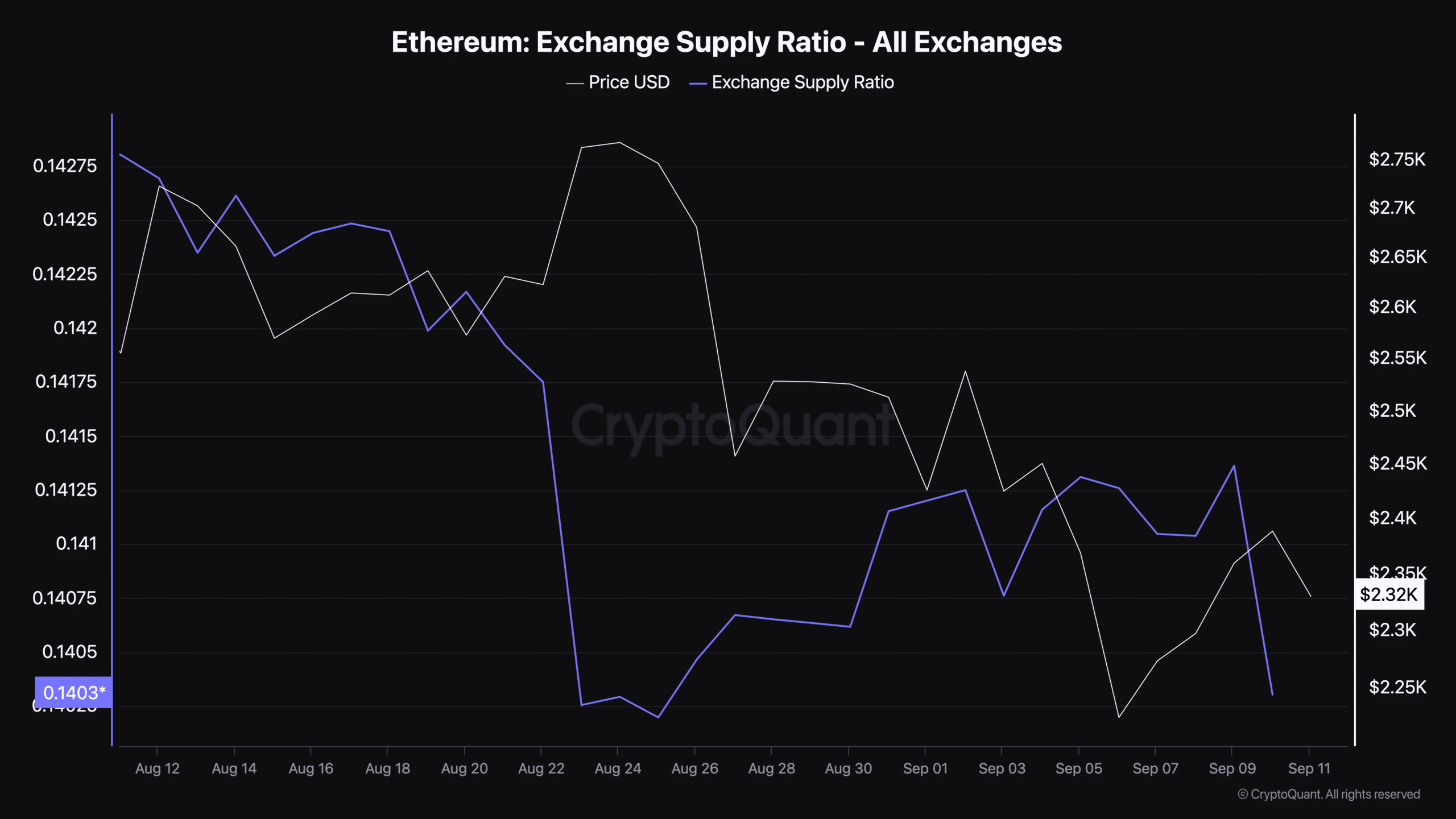

Another fundamental metric worth analyzing is Ethereum’s exchange supply ratio, which measures the percentage of the total supply of ETH held on exchanges.

According to CryptoQuant, the ratio is currently stand As of today it is 0.141.

Ethereum [ETH] Price forecast 2024-2025

A low exchange supply ratio generally means that investors are moving assets off exchanges and into cold storage, indicating they are less likely to sell in the near term.

Source: CryptoQuant

This could reduce selling pressure on ETH and lead to greater price stability. However, it is also important to monitor this metric closely as large changes could signal a shift in market sentiment.