Bitcoin has been around for 15 years, but there are still very few legitimate use cases for it. Currently, Bitcoin and other cryptocurrencies are primarily used for financial speculation and facilitating organized crime. Meanwhile, the cryptocurrency industry as a whole has been rocked by scandals, including the spectacular collapse of FTX and criminal charges against Binance.

But cryptocurrency lobbyists still have one trump card up their sleeve: lots of money.

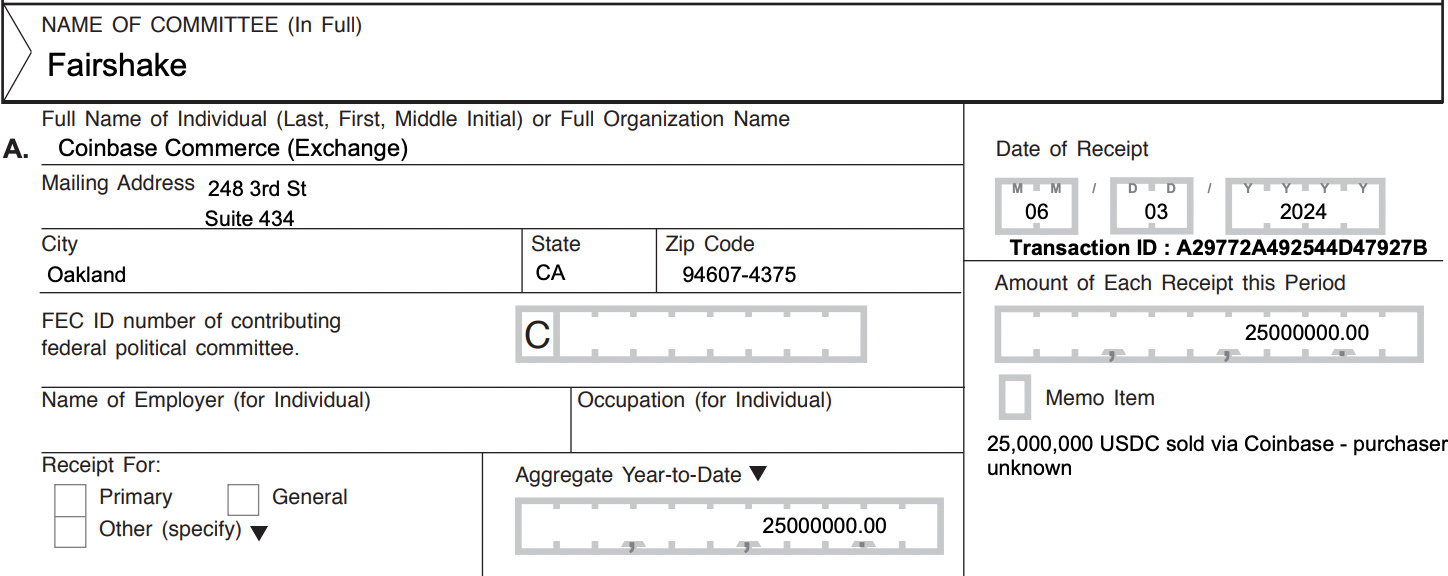

The industry's leading super PAC, Fair Shake, has raised more than $202 million for the 2024 election cycle, most of this money in the form of eight-figure donations.

Coinbase alone has donated $70 million so far, while crypto investors such as Ben Horowitz, Marc Andreessen and the Winklevoss twins have written multimillion-dollar checks. The largest individual donors are also backing Trump's candidacy, far more than Sam Bankman Freed has spent in the 2022 election cycle. Of the roughly $45 million FairShake and its subsidiaries have spent so far, two-thirds has gone to attack Democrats or support Republicans. This cash stockpile will make the industry one of the most powerful forces in politics over the next 100 days.

This strategy appears to be paying off.

Speaking at the Bitcoin Conference in Nashville on Friday, Sen. Cynthia Lummis (R-Wyo.) said the federal government “should be able to take legal action against the government.”Strategic Bitcoin ReserveLammis plans to introduce legislation that would mandate the federal government purchase one million Bitcoins (about 5% of the total supply) for $68 billion. Lammis described his proposal as a “solution” to America's monetary problems and the opportunity to buy large amounts of Bitcoin as a “Louisiana Purchase moment.”

According to Lummis, her plan to buy Bitcoin comes as the U.S.Debt-freeMore specifically, Bitcoin isCut debt in half by 2045But even if the federal debt never increased over the next 20 years, cutting the current $34 trillion debt in half would require a 250-fold increase in the price of Bitcoin — in other words, the price of one Bitcoin would need to rise from $68,000 to $17 million.

Jacob Silverman, a journalist covering the cryptocurrency industry and co-author of a New York Times bestseller Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of FraudHe explained that Lummis' predictions put him in the same league as die-hard Bitcoin bulls like Michael Saylor. At the Bitcoin convention, Saylor said Bitcoin is $13 million by 2045(Saylor's company, MicroStrategy, currently holds 226,331 bitcoin.)

While Lummis called the Bitcoin reserve proposal “strategic,” holding Bitcoin has no significant strategic value to the federal government. Unlike oil, there is no room for the federal government to get involved with Bitcoin other than holding it as a speculative investment.

However, if the federal government were to purchase 5% of available Bitcoin, the price of Bitcoin would rise, not only because it would reduce the available supply of Bitcoin, but also because it would give Bitcoin a federal endorsement. Artificially inflating the price of Bitcoin would be of interest to potential donors to Lummis, and to Lummis himself.

In May 2022, Lammis reported holding between $100,000 and $250,000 in Bitcoin. He purchased Bitcoin in August and September 2021, a few months after he became a senator. If Lammis' proposal to create a Federal Strategic Bitcoin Reserve becomes law, it is likely that his personal wealth will increase significantly.

Trump addressed the group the day after Lammis attended the Bitcoin conference. While Trump did not specifically endorse Lammis' proposal, he did say he was “supportive of the Bitcoin initiative” as a national “National Strategic Bitcoin StockpilePresident Trump declared that he would “ban” the sale of cryptocurrencies, starting with Bitcoin already held by the federal government. He also promised to end the practice of selling cryptocurrencies that have been seized or acquired by the federal government. When the government sells large amounts of cryptocurrencies, the price of cryptocurrencies can plummet. This announcement and President Trump's attendance at the conference were good news for the cryptocurrency industry.

More broadly, Trump sees the U.S. asThe cryptocurrency capital of the planet and the world's Bitcoin superpowerHe also promised to end what he called the Biden administration's “assault on crypto,” describing efforts to enforce the law and protect consumers as “part of a much larger pattern of left-wing fascists weaponizing government against threats to their power.” Instead, he promised to create new regulations “written by people who love the industry, not people who hate the industry.”

Silverman said that while the federal government buying Bitcoin is a welcome development, the crypto industry's priority is creating a friendly regulatory structure that reduces legal risks — something Trump has promised to do.

This is a surprising policy shift from Trump. In 2021, Trump called cryptocurrencies “scam” and “Potentially a disaster waiting to happen”

The trip to Nashville contained some clues that may have changed Trump's mind. He reminded the audience that he is “the first major party candidate in American history to accept donations in Bitcoin or cryptocurrency.” On Saturday night, Trump Hosting a fundraiser for cryptocurrency enthusiastsTickets are priced at a whopping $844,600.

Democrats are also not immune to the allure of the industry, which has hundreds of millions of dollars to spend on political campaigns. Vice President Kamala Harris did not attend the Bitcoin conference, but the Financial Times reported that report On Saturday, it was reported that Harris' advisers have “approached major crypto companies in an attempt to 'reset' her relationship with the Democratic Party.” According to the report, Harris' political campaign is seeking meetings with a number of leading crypto companies, including Coinbase and Ripple, which have both provided funding to FairShake.

Harris campaign advisers said the outreach effort had “little to do with raising new campaign funds” and was aimed at building constructive relationships that would ultimately set up a sensible regulatory framework that would help the entire asset class grow.

According to the Financial Times, Harris herself is interested in changing “the perception among many of America's top leaders that the Democratic Party is anti-business,” and crypto industry executives “hope she will be more sympathetic to them.”

Additional research by Mohan Legum.