- The conflict between Russia and Ukraine has caused the global cryptocurrency market to lose nearly 10% in value.

- Bitcoin and Ether both hit monthly lows as Russia launches “special military operation” against Ukraine.

- Bitcoin price has fallen to Rs 27 lakh and Ether to less than Rs 18 lakh.

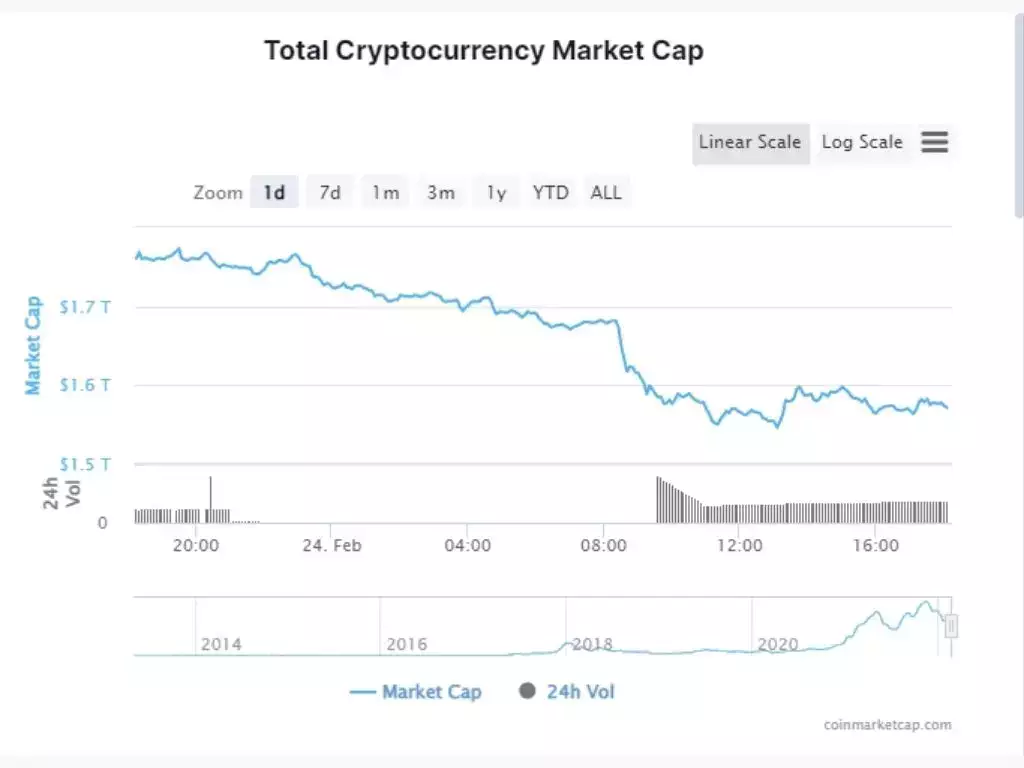

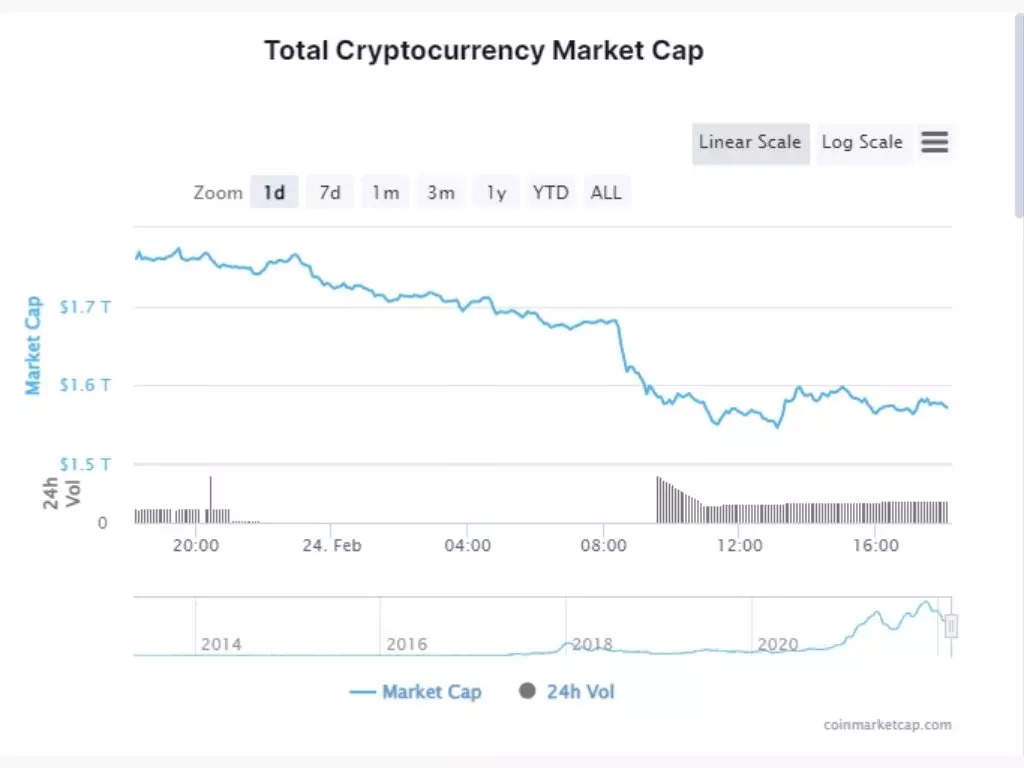

The ongoing conflict between Russia and Ukraine has had an impact on every asset class. Similar to the massive sell-off in the stock market, the cryptocurrency market has also plummeted by nearly 10% in the past 24 hours. Most major cryptocurrencies, except stablecoins, have seen double-digit declines.

The data shows that more than $200 billion has been cashed out since Russia and its President Vladimir Putin announced a “special military operation” against Ukraine.

Which cryptocurrencies have been hit the hardest?

The cryptocurrency market crash has hit Ethereum, Cardano, Avalanche and Polkadot the hardest, aside from meme coins Dogecoin and Shiba Inu.

Bitcoin and Terra are the only major cryptocurrencies that managed to limit declines to less than 10% in the past 24 hours.

| Cryptocurrency | Market value decline in the last 24 hours |

| Bitcoin | 8.5% |

| Ethereum | 12.7% |

| Binance Coin | 11.4% |

| Solana | 12% |

| Cardano | 18% |

| Terra | 9.5% |

| avalanche | 18.2% |

| Dogecoin | 16.7% |

| Polka dot pattern | 16.2% |

| Shiba Inu | 18.9% |

Source: Coinbase, 6:30 PM IST

Cryptocurrencies lose their luster as “digital gold”

Cryptocurrencies have seen a sharp drop in value since the new year, spurring speculation that a new “crypto winter” may be on the way – the price of Bitcoin, for example, has fallen by around 50% since November.

Russia's move against Ukraine appears to have made things worse, but the fact that most cryptocurrencies are dropping in value may not come as a big surprise to investors, as the cryptocurrency market has recently shown a tendency to react to traditional markets.

Cryptocurrencies are no longer seen as a “safe haven” investment, rather an asset where investors can park their funds when the global economy is at risk due to inflation, geopolitical tensions, or other factors.