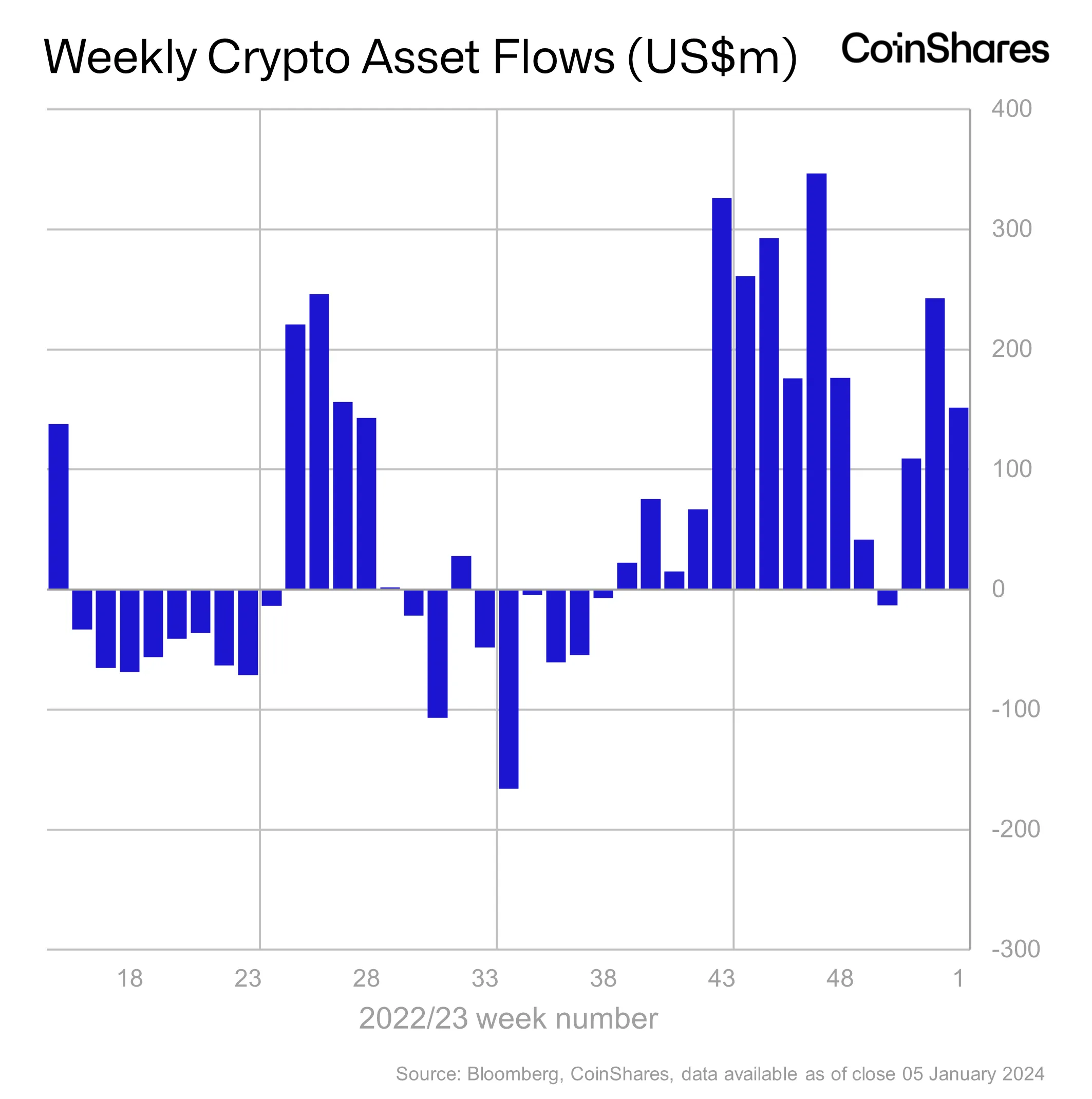

Digital asset management firm CoinShares says Bitcoin (BTC) and other cryptocurrency markets are off to a strong start to the new year amid growing institutional interest.

Institutional investors are pouring funds into cryptocurrencies ahead of the U.S. Securities and Exchange Commission's (SEC) much-anticipated approval of a spot BTC exchange-traded fund (ETF), CoinShares revealed in its latest Digital Asset Fund Flows report.

“Inflows into digital asset investment products totaled US$151 million in the first week of 2024, bringing total inflows since the Grayscale v. SEC lawsuit to US$2.3 billion, accounting for 4.4% of total assets under management (AuM).”

Despite the fact that spot-based ETFs have not yet been launched in the US, 55% of inflows came from US exchanges, followed by Germany and Switzerland at 21% and 17%, respectively.”

According to the firm, BTC accounted for the majority of inflows, at $113 million, far outstripping BTC short selling, suggesting that institutional investors believe the SEC will approve the ETF.

“Bitcoin had the largest inflows, with total inflows over the past nine weeks reaching $113 million, representing 3.2% of assets under management. Meanwhile, short Bitcoin saw outflows of $1 million in the first week of the year. If many truly believed that the launch of the US ETF would be a “buy the rumor, sell the news” event, one would certainly expect inflows into short Bitcoin ETPs (exchange-traded funds), but in fact outflows over the past nine weeks have totaled $7 million.”

Altcoins also started the year strong, with Ethereum (ETH) bringing in nearly $30 million, while Cardano (ADA), Avalanche (AVAX), and Litecoin (LTC) made $3.7 million, $2 million, and $1.3 million, respectively, according to CoinShares.

Don't miss out on the latest news – subscribe to receive email alerts directly to your inbox

Check price trends

follow me XFacebook, Telegram

Browse the daily Hodl mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrencies and digital assets. Transfers and transactions are at your own risk and you are responsible for any losses incurred. The Daily Hodl does not recommend buying or selling cryptocurrencies or digital assets and is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Urboshi