Altcoins fell again at the start of the week as most digital assets continued their multi-month downward trend.

At the time of writing, the total market capitalization of all crypto assets (TOTAL) was $2.32 trillion, down $70 billion from $2.39 trillion the previous day.

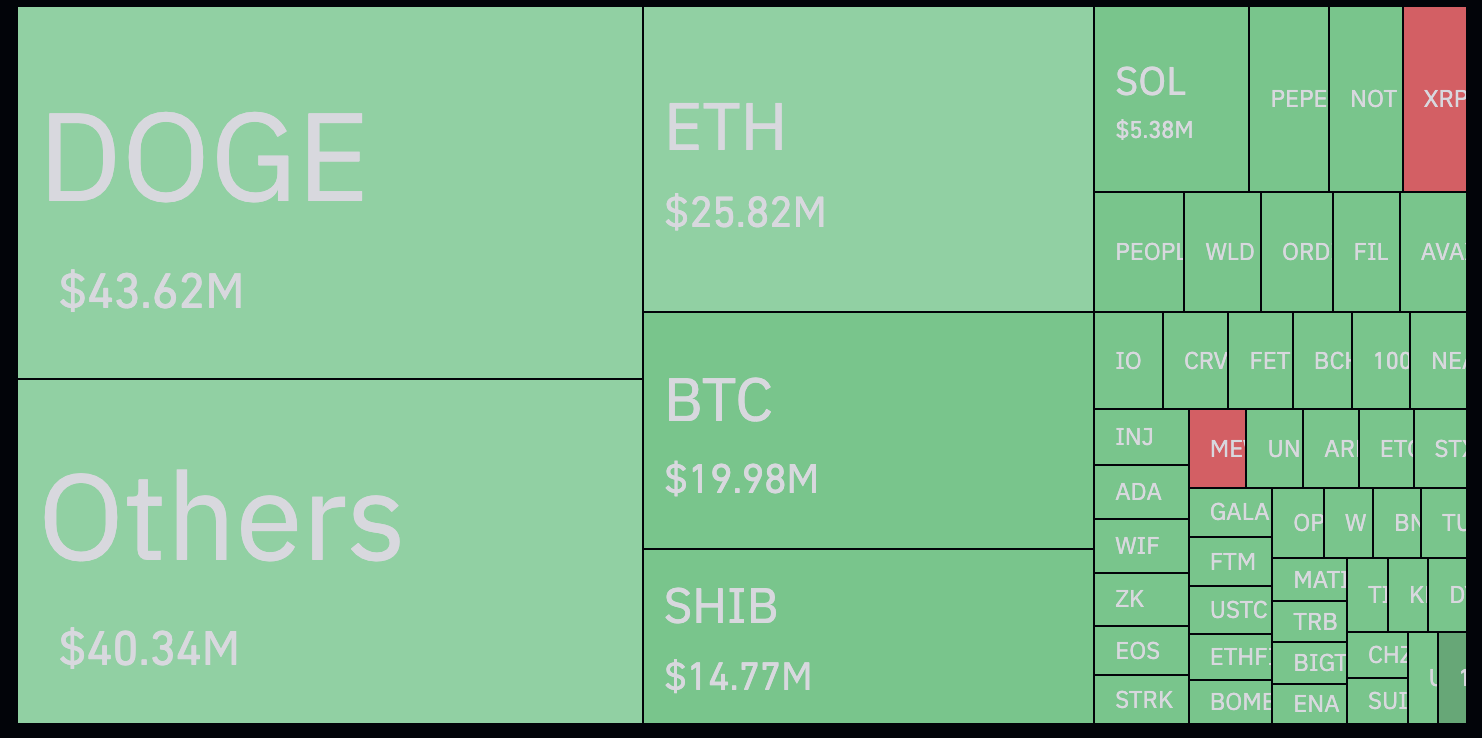

According to crypto data aggregator Coinglass, more than $242 million in positions were liquidated, with the majority of that coming from traders attempting to buy altcoins.

According to the latest data from Coinglass, traders bullish on Dogecoin (DOGE) have been hit the hardest in the past 12 hours, followed by other altcoins in the memecoin sector such as Shiba Inu (SHIB).

The decentralized finance (DeFi) sector is also facing carnage, with several coins currently at or near all-time lows.

DYDX, the native token of the Ethereum-based decentralized exchange (DEX), hit $1.40 early Monday morning, currently down 95% from its all-time high and just 28% from its all-time low.

CurveFinance (CRV), one of the industry’s largest DEXs, hit an all-time low of $0.23 over the weekend after its founder faced liquidation of roughly $100 million.

Institutional investors pulled more than $600 million from exchange-traded funds (ETPs) last week, according to digital asset manager CoinShares, likely due to a more hawkish than expected outcome from the most recent Federal Open Market Committee (FOMC) meeting.

“This occurred under similar circumstances: large inflows followed by a more hawkish FOMC meeting than expected, causing investors to reduce exposure to fixed-supply assets. These outflows and the recent price declines have caused total assets under management (AuM) to fall from over $100 billion to $94 billion in a week.”

Don't miss out on the latest news – subscribe to receive email alerts directly to your inbox

Check price trends

follow me XFacebook, Telegram

Browse the daily Hodl mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrencies and digital assets. Transfers and transactions are at your own risk and you are responsible for any losses incurred. The Daily Hodl does not recommend buying or selling cryptocurrencies or digital assets and is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Natalia Siiatovskaia/A. Solano