Dr Shane Oliver, Head of Investment Strategy and Chief Economist at AMP, discusses how the EU elections will impact investors.

Key Point

- The victory of far-right parties in the European Parliament elections and calls for general elections in France have increased uncertainty, with the risk of a repeat of the eurozone crisis.

- However, centrist parties remain dominant in Europe and support for the euro remains strong.

- The success of the far right has coincided with a gradual trend toward larger government and more protectionist economic policies.

- Stock prices are expected to become more constrained and volatile.

introduction

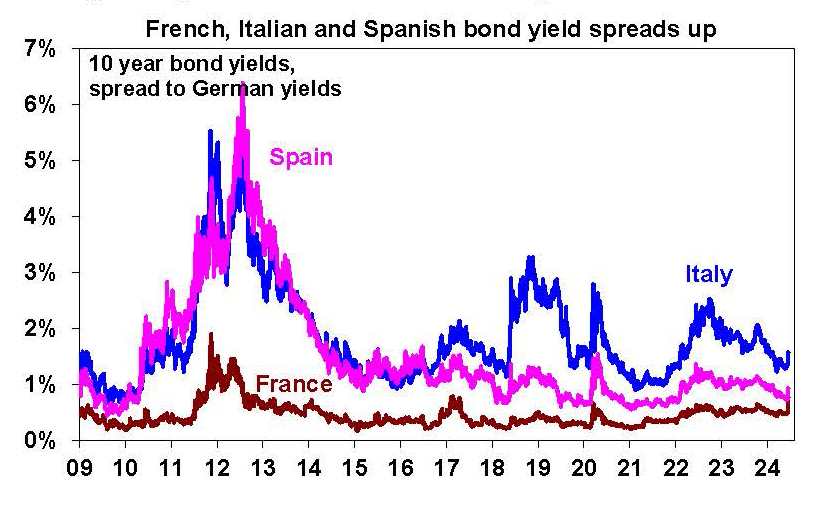

Just over a week after the results of the European Union parliamentary elections were announced, rising support for far-right parties and French President Macron's sudden decision to hold parliamentary elections have caused eurozone stocks to fall 4.2%, French stocks to fall 6.2%, and the gap between French and German 10-year bond yields to widen by 29 basis points, indicating that investors are demanding a higher premium for holding French government bonds. In fact, the gap between French and German 10-year bond yields is now back to levels seen around the 2017 French presidential election. Strength in tech stocks also continued to support U.S. stocks, but has also spilled over into Italian and Spanish bond yields, the euro, and global and Australian stocks.

Source: Bloomberg, AMP

So why all the fuss? Simply put, investors are worried that the success of the far right could lead to more populist policies, greater economic uncertainty, and ultimately the threat of the eurozone breaking up if the far right wins the French elections. If that happens, the world's third-largest economy (i.e. the 20 eurozone countries) would fall into financial turmoil and recession, weighing on global growth.

Threats to the global economy naturally pose risks to the outlook for the Australian economy, similar to what happened during the Eurozone crisis last decade, which spilled over into Australian shares.

Of course, fears of a eurozone collapse are a recurring soap opera over the past decade, with recurrent crises in Greece, Spain and Italy, worries surrounding the French elections ahead of a runoff between far-right Marine Le Pen and centrist Macron, and fears that any of these countries might leave the euro (Greece, Italy or France leaving), with repercussions for other countries seeking to leave. Investment markets threatened to make this self-fulfilling by pushing up the relative bond yields of countries perceived as weak, because a withdrawal would repay eurobond holders in devalued drachmas, liras, francs, etc. The crisis peaked in 2012 after a range of measures to strengthen European integration and an ECB pledge to “do everything to defend the euro”, backed by a range of policy tools that could be activated when bond markets were unstable. But since then, various tensions have risen around the elections in Greece, Italy, Spain and France. The UK's decision to leave the EU also temporarily increased such fears, although to a lesser extent because the UK was not in the eurozone.

The persistence of these concerns reflects the euro's fundamental flaws: monetary union without a common budget policy is problematic, and the gaps in competitiveness, work ethic and savings are huge across Europe. But how serious are the current threats, and what does the rise of the far right in Europe mean?

EU elections – not as dramatic as they are portrayed

The current concerns stem from the EU parliamentary elections, which saw increased support for far-right parties that favor less immigration, less rational economic policies, and more nationalistic tendencies. However, their success was less than feared. Although support for right-wing parties did increase, their share of seats in the new parliament only increased from 19.6% to 22%. See the following table. In this case, the increased support for right-wing populist parties indicates a bias towards more protectionist policies, a crackdown on immigration, and slower progress on climate change. However, this should not be exaggerated. First, centrist parties remain dominant with 63% of seats in the EU parliament, suggesting little substantive change in support for EU policies or the euro.

Percentages may not add up to 100% due to rounding. Source: Deutsche Bank, AMP

Secondly, EU elections are often seen as an opportunity for protest voting, given the cost of living and immigration issues. This tendency is perhaps even more pronounced because the elections are not compulsory and the turnout, at 51%, is lower than in most national elections. This means that voters tend to be more motivated and radical than the general population, so it does not necessarily translate into national elections.

Finally, it should be noted that, unlike the fascists of the 1930s, far-right parties in Europe such as the National Rally in France, the Party for Freedom in the Netherlands, and the Italian Brotherhood and Fidesz parties in Hungary have similar views on immigration and nationalism, but very different views on the euro, NATO, Ukraine, economic policy, etc.

French parliamentary elections – much bigger risks

Of course, the situation is a bit different in France, where Le Pen's National Rally won more than double the votes of Macron's Renaissance party in the EU elections, about 15%, and Macron called parliamentary elections. This would keep him in office (he cannot be re-elected until his term expires in 2027), but potentially lose control of government and domestic policy compared to the current centrist coalition he relies on to govern. The elections, coming three years earlier than scheduled, are Macron's attempt to force the French people to choose between the far right and centrist forces now, or, if the National Rally can form a government, to hope that its extreme policies will work against them and that voters will return to the center by 2027.

The first round of the election is on June 30, with the runoff on July 7. There are often more than ten candidates in each constituency in the first round, and only those with the support of at least 12.5% of registered voters advance to the second round, where the candidate with the most votes is declared the winner (not necessarily a majority). In theory, this could make it easier for extremist parties to win, but centrist parties often work together to eliminate the least likely candidates in the second round. It has been suggested in the EU elections that the far-right National Rally could form a government on its own or in alliance with other right-wing parties. However, French opinion polls are inconclusive, and a broad centrist coalition could again be the outcome. But it would be by a narrow margin.

A government led by the far-right National Rally has two possible paths forward.

- They may try too hard to implement policies such as lowering energy taxes, withdrawing from the EU electricity market, undoing Macron's pension and other reforms, and reducing compliance with EU fiscal rules. This could create conflict with the European Commission, leading to an adverse market reaction and ultimately putting France on a path to leaving the euro. This would be bad for markets, but could lead to a chaotic 2027 election in which the National Rally is rejected, which could favor Macron's strategy.

- Or he could follow the same path as Prime Minister Meloni of Italy's Brothers party, adopting a market-friendly, EU-compliant economic policy while being tough on immigration and other social issues, and hope to win the presidential election in 2027.

Of course, markets have no way of knowing the outcome of the election or which direction it will take, so uncertainty hangs heavy. France, along with Germany, is at the heart of the EU and the euro, and anything that threatens that commitment is a major concern. But there is also reason to be optimistic that a return to a full-blown eurozone crisis will be avoided and the euro will survive without another series of exits.

- First, the commitment to the European Union and the euro is very strong. Although the euro is economically flawed, it is part of a grand political vision that has brought long-lasting peace across Europe and rapid prosperity that is the envy of its neighbors. As a result, most European politicians are unwilling to give up on the successful political journey toward a more united Europe, especially at a time of growing geopolitical threats from Russia and uncertain U.S. commitment. So European leaders are likely to continue finding ways to make it work economically.

- Secondly, consistent with this, public support for the euro is high, with 67% of French people and 69% of eurozone people agreeing that the euro is good for their country. In contrast to the British, Europeans are much more likely to consider themselves Europeans, as well as nationals of their own country.

Source: Eurobarometer, AMP

- Third, those far-right parties who understand this best, including Le Pen's Rally National, have removed euro exit from their policy, arguing that it is unpopular and prevents them from gaining broad support.

- Fourth, rising bond yields are likely to influence the National Coalition government to revise its less market-friendly economic policies.

- Finally, if there are threats to the application of European-wide monetary policy, the ECB retains the tools to stabilise government bond markets.

Investment markets are nervous, and a far-right victory in the French elections could make them more nervous before they subside, but a repeat of the crisis of a decade ago and seriously threatening the euro is unlikely. In this regard, it is noteworthy that bond spreads vis-à-vis Germany, including France, are well below the extremes of 2012, as is clear in the first chart.

Government expansion and deglobalization

But on a broader level, the modest success of far-right parties in the EU elections coincides with a backlash against free-market economic policies that has been building since the global financial crisis. The political pendulum continues to swing towards more protectionism, industrial policy, tougher immigration, expanded government, and slower progress towards net-zero carbon emissions. This was seen last month with the US and EU imposing higher taxes on some imports from China (especially electric vehicles) and the “Made in Australia Future” initiative. While each move alone will have a small impact on the economy (for example, a 17-38% tariff on Chinese-made EVs in the EU will only have a small impact on European inflation as it amounts to just 0.4% of total EU imports), taken together they will mean slightly slower growth in living standards and a slightly more inflationary economy over time.

What this means for investors

Uncertainty surrounding the French elections has increased geopolitical uncertainty, reinforcing our view that equity market returns will be subdued and volatile and bonds will be stronger for the remainder of the year. The continued rise in support for populist policies may also limit medium-term returns. That said, with the far-right still far from dominant and central banks cutting interest rates at varying paces, we see reasonable returns from equities again this year.

end

Important Note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) make any representation or warranty as to the accuracy or completeness of any statements in this document, including but not limited to forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information without taking into account the objectives, financial situation or needs of any particular investor. Investors should consider the appropriateness of the information in this document and seek professional advice having regard to the investor's objectives, financial situation and needs before making any investment decision. This document is for the sole use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable law, regulation or directive and does not constitute a recommendation, offer, solicitation or invitation to invest.