Share this article

![]()

![]()

Kaiko Research reports that the upcoming MiCA regulation is poised to change the stablecoin landscape in favor of euro-backed stablecoins. Binance has announced restrictions on stablecoins that do not meet the new MiCA standards, while Kraken is evaluating its stablecoin offering to ensure it complies with European Union standards, which could result in the delisting of certain stablecoins for EU customers.

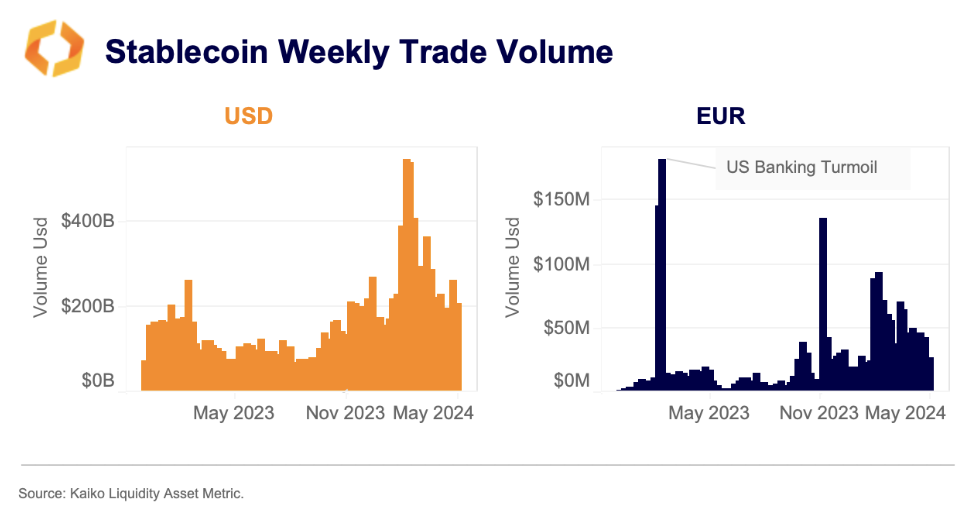

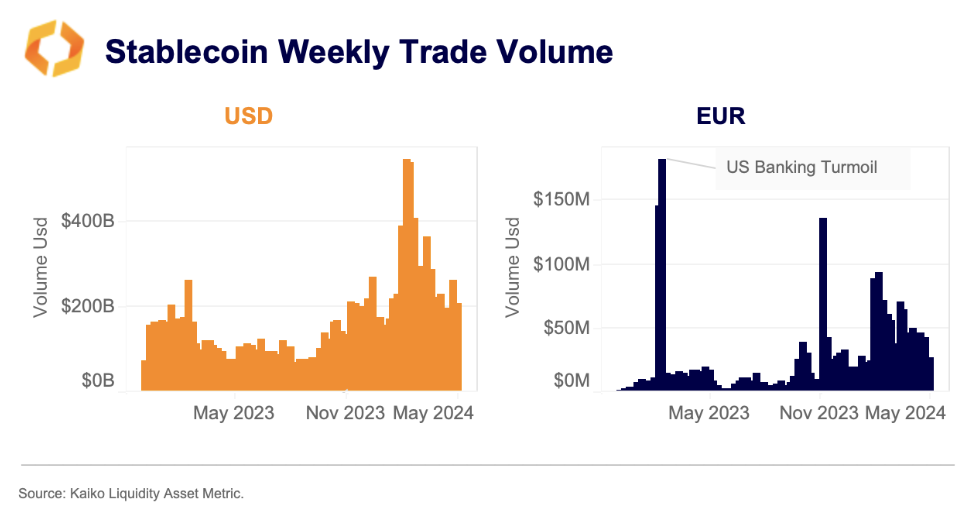

Despite a slower adoption rate in Europe compared to the US and Asia-Pacific, euro-denominated stablecoin trading volumes have surged since the beginning of the year. This increase indicates growing demand in the European market. In particular, the combined weekly trading volumes of major euro-denominated stablecoins, including Tether's EURT, Stasis EURS, and Circle's EURCV, have exceeded $40 million since March, marking a sustained period of record-high trading volumes.

Introduced by Binance in December, AEUR has quickly dominated the euro stablecoin sector, accounting for more than half of the total trading volume. While USD-backed stablecoins remain the market giants, recording a staggering $270 billion in average weekly trading volume in 2024, euro-backed stablecoins have captured a 1.1% trading share, a significant increase from nearly zero in 2020.

The USDT/EUR trading pair is now one of the most traded products, even surpassing EUR-denominated Bitcoin trading on Binance and Kraken, a trend that highlights these platforms' role as important fiat gateways for European traders.

The specific stablecoins deemed illicit have not been disclosed. However, Kraken's investigation into Tether's USDT, the world's largest stablecoin, is particularly notable given past regulatory challenges. Although the majority of trading volume occurs during U.S. market hours, USDT remains a key asset for European traders.

While over-the-counter (OTC) trading will likely maintain liquidity for USDT-EUR, a shift to regulated alternatives such as USDC may be the preferred option for many traders, the report suggests.

Share this article

![]()

![]()