The market is still in a risk-averse mood, which may be due to end-of-month inflows. It is hard to find a catalyst to reverse the current sentiment, as today's data is unlikely to change the fundamentals. A (hopefully) weaker PCE reading tomorrow might help.

Anyway, the focus today will be on Eurozone unemployment and US jobless claims. We will also see the release of US Q1 flash GDP numbers, the second estimate after the flash number released last month. As markets are generally looking to the future, I won't worry too much about GDP as it is old news.

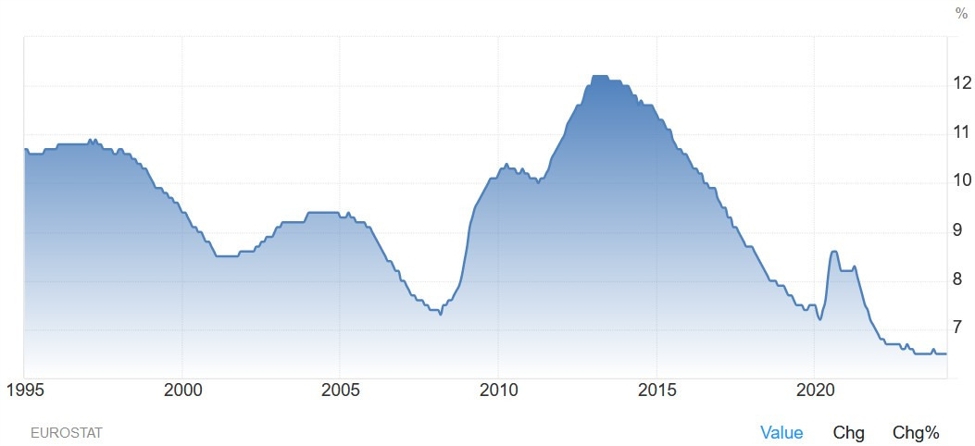

09:00 GMT Eurozone unemployment rate

The eurozone unemployment rate is expected to remain unchanged at 6.5% from the previous 6.5%. The unemployment rate has been at record lows for a year now, indicating a tight labor market. Moreover, the recent eurozone negotiated wage increase for Q1 2024 was higher than the previous quarter, which the ECB “dismissed” as temporary due to delays in Germany's inflation-fighting wage hike measures, a setback of sorts for the ECB. That said, favorable economic data will likely lessen the ECB's confidence on the path of rate cuts beyond June.

Eurozone unemployment rate

12:30 GMT/08:30 ET US unemployment claims

US unemployment claims are one of the most important releases to watch each week because they are a timely indicator of the state of the labor market. This is because a weakening labor market increases the likelihood of deinflation against the Fed's target. However, a less resilient labor market could make it harder to meet that target.

Initial unemployment claims remain near cyclical lows, while continuing claims remain steady at around 1.8 million.. Initial jobless claims this week are expected to be 218,000 compared to the previous 215,000, and continuing jobless claims are expected to be 1,800,000 compared to the previous 1,794,000.

US unemployment claims

Central Bank Speakers:

- 16:05 GMT/12:05 ET – Fed President Williams (Neutral – Voter).

- 21:00 GMT/17:00 ET – Fed's Logan (Neutral – No Vote).