Learn more about global forecasts and analysis

Understanding the trajectory of interest rates is essential for businesses and investors to make informed decisions. We explore the factors influencing interest rates, European Central Bank (ECB) monetary policy decisions, and indicators that forecast future interest rate movements.

Q: What will happen to interest rates in the eurozone?

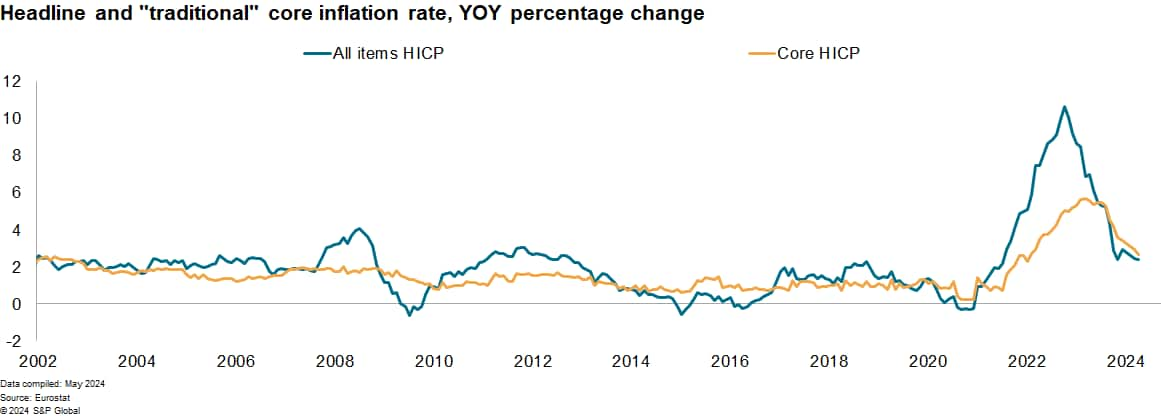

A: Interest rates depend on a variety of factors, but inflation developments have been large enough for the ECB to begin easing policy. Headline inflation in the euro area has fallen significantly and core inflation has also fallen. We expect core inflation to fall further in 2024 due to slowing nominal wage inflation and easing corporate profit margins.

Q: When does S&P Global Market Intelligence expect the ECB to start cutting interest rates?

Market Intelligence expects the ECB to cut interest rates by 25 basis points at its June meeting. We have been expecting a June rate cut for almost a year, with market consensus having recently shifted to this view, having previously priced in an earlier rate cut in early 2024.

Q: Will the ECB continue to cut interest rates after June?

A: The direction of monetary policy beyond June is more uncertain. The ECB has stressed that it will rely on data and take a meeting-by-meeting approach. Policy rates will remain tight enough for as long as necessary. In its May update, the ECB is expected to cut rates by 75 basis points in 2024 (down from the 100 basis points forecast in April), 125 basis points in 2025 and a further 50 basis points in 2026.

This uncertainty is driven in part by persistently high services price inflation. We expect services price increases to moderate for the remainder of 2024 and into 2025. With labor market conditions still relatively strong, there is a risk that services price inflation will remain uncomfortably high in the second half of 2024. If services prices do not moderate, disinflationary trends in both headline and core inflation could stagnate. This is particularly a risk during the April-July period, when we expect higher oil prices and higher energy price inflation compared to 2023, even without further escalation in the Middle East conflict.

Q: How do lower interest rates affect economic conditions and activity?

A: We still expect low interest rates to provide some support to economic activity, but that will not occur until late 2024. The impact will be minor initially, as some borrowers will still face higher interest rates, especially when refinancing loans that were taken out before interest rates started to rise.

Market expectations of upcoming rate cuts have already led to a decline in the Interbank Offered Lending Rate (Euribor), a benchmark commonly used to price short-term commercial loans. That decline has already led to lower borrowing costs, particularly mortgage rates. Bank lending rates for non-financial corporations, which rose sharply following the ECB rate hike, will be slow to react to the reduction in policy rates. Still, the combination of lower interest rate expectations and slightly improving economic conditions has already led to corporate spreads narrowing.

Lower policy rates also lead to lower deposit rates for both households and businesses, which is an important transmission channel, but deposit rates have not responded as strongly to higher policy rates since 2022, limiting the impact of the expected decline.

Q: What metrics do you follow to ensure your predictions are accurate?

A: We closely monitor service price inflation and nominal wage growth. Forward-looking indicators such as the HCOB PMI survey and the monthly Indeed Wage Tracker provide valuable insights into pricing pressures and wage inflation.

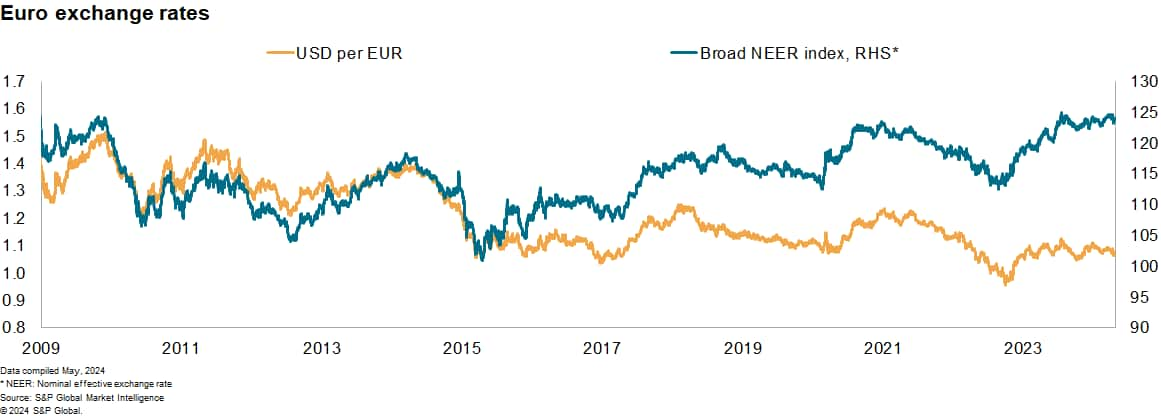

Q: Will the upcoming expected policy shift by the US Federal Reserve have an impact on the ECB's monetary policy decisions?

A: The outlook for Fed rate cuts has receded, and we expect the first and only rate cut of 2024 to come at the December meeting. The ECB has emphasized its independence and may have some influence, but the ECB and the Fed have disagreed in the past. The ECB will consider a number of factors, including core inflation, the state of the labor market, and potential risks.

Global economists release their top 10 economic predictions for 2024

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, a division of S&P Global.