- Meme coins have been a hot topic during the current bull market and have been performing well since late February.

- There is an allure to these tokens that attracts thousands of investors, even though they don't solve anything.

Meme coins have captured the public imagination and attention during this bull market, at least so far, as crypto analyst Joan Wesson noted in a recent X (formerly Twitter) post:

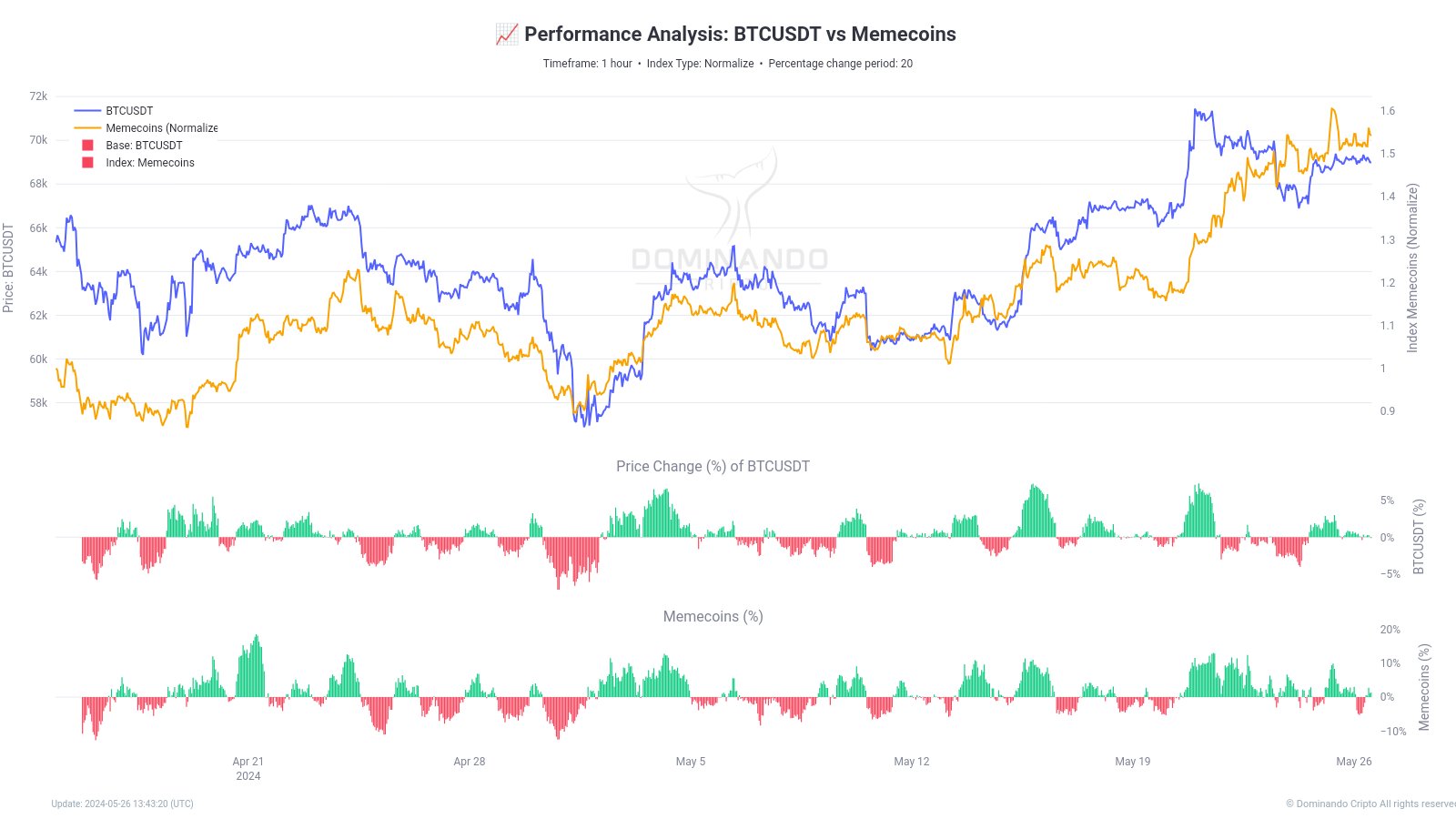

When it comes to the rate of price change, meme coins have been dominating lately.

Does this mean that meme coins are stealing attention from Bitcoin? Will the public attention and capital inflow into the meme market have a significant impact on the demand for Bitcoin?

Most meme coins exist one moment and are gone the next.

The recent meme coin trend that has been booming in the Solana ecosystem is a great example of how easy it is to create a token and capture the attention of the public, even if only for a moment.

Source: Joan Wesson of X

But in terms of market capitalization, meme coins are only a fraction of Bitcoin, which has increased by $233 billion since its May 1 drop.

By comparison, the combined market capitalization of the top 10 meme coins is $57.26 billion at the time of writing.

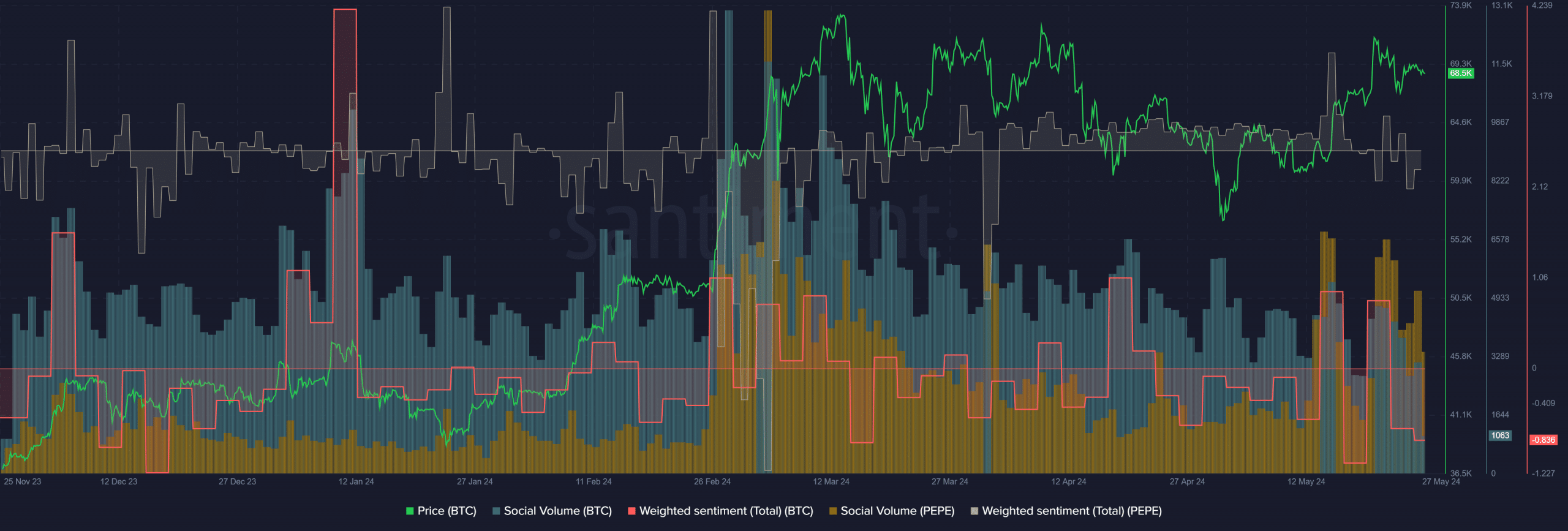

Source: Santiment

The chart above shows that on May 26th, Bitcoin (cyan) had a social volume of 3135, while PEPE (yellow) had a volume of 350.

While this is just one meme coin, not the entire sector, the difference is still huge considering PEPE rose 75% in the last week and is one of the more hotly discussed memes online.

As such, social media engagement was still in Bitcoin's favor. Additionally, Bitcoin's derivatives and spot markets may be too large for meme coins to chip away at in any meaningful way.

The appeal of meme coins

The number of cryptocurrencies on the market has increased significantly over the years. In January 2021, there were an estimated 4,154 tokens on the market. In March 2024, that number increased to 13,217 and continues to grow.

Most of these tokens are based on vaporware, products that are promised to the public but never actually built. This massive dilution among altcoins is a stark difference from the past two cycles.

OG crypto traders say that during bull markets, the token randomly spikes, making triple-digit percentage gains in a matter of days.

The problem right now is that there are so many tokens that have seen at least one bear market, and the cryptocurrency industry is so saturated, it’s hard to imagine them all trending upwards in a bull market.

In that respect, MemeCoin is upfront and honest about its intentions: it brings the community together through jokes and vibes, and it has fun with the potential for investment returns and the journey to profitability, but it does not promise any product.

Win or lose as a team of bag holders.

Pepe's [PEPE] Price Forecast 2024-25

People who don't have the time or know-how to sift through dozens or even hundreds of crypto tokens are naturally attracted to these down-to-earth meme tokens and are willing to bet small sums on them.

This isn't to say that there aren't tokens with great development teams trying to solve specific problems, but they are harder for the general public to find – perhaps that's why meme coins have fared better than other sectors so far.