- Rising market inflation indicates that BTC holders are selling off some of their assets.

- The data suggests prices could rise to $72,000 before a major correction.

AMBCrypto's signal from Glassnode's on-chain data shows that Bitcoin [BTC] A significant price drop is expected.

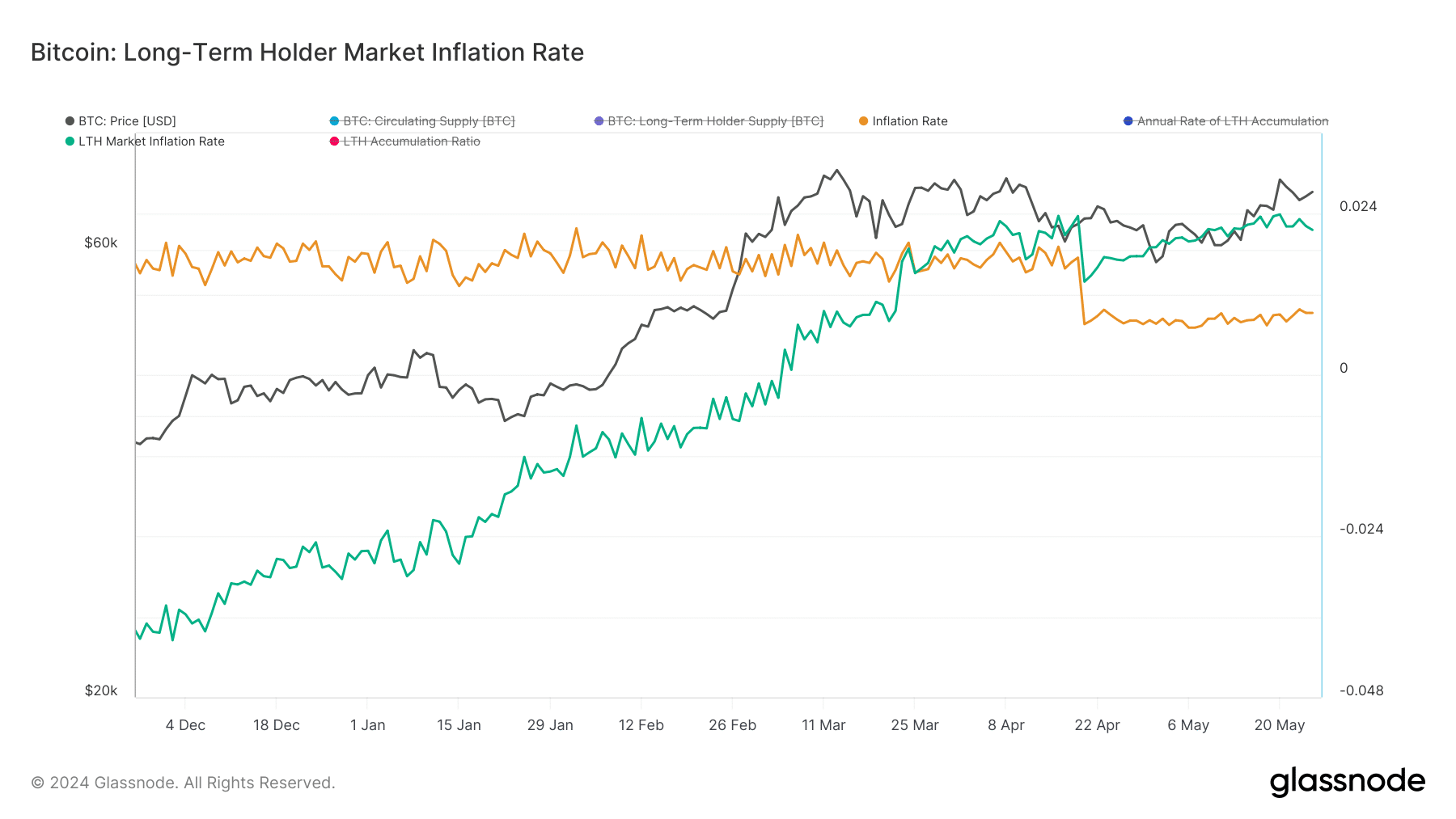

Leading this forecast is the LTH market inflation rate. LTH stands for long term holders in the market.

The LTH market inflation rate will use the accumulation or distribution level to determine Bitcoin's next direction.

However, there are two lines present in this chart as shown below: green represents the market inflation rate and manila colour indicates the nominal inflation rate.

Investor beliefs don't translate into action

During a bull market, when market inflation rates fall below nominal inflation rates, it indicates that long-term holders are accumulating wealth, which can drive up the price of Bitcoin.

Meanwhile, market inflation rates exceeding nominal inflation rates suggest that holders are significantly increasing selling pressure.

Therefore, BTC could be on the brink of a significant drop. At the time of writing, the indicators were forming the latter pattern.

Source: Glassnode

At press time, Bitcoin was trading at $69,164, up 2.98% over the past seven days.

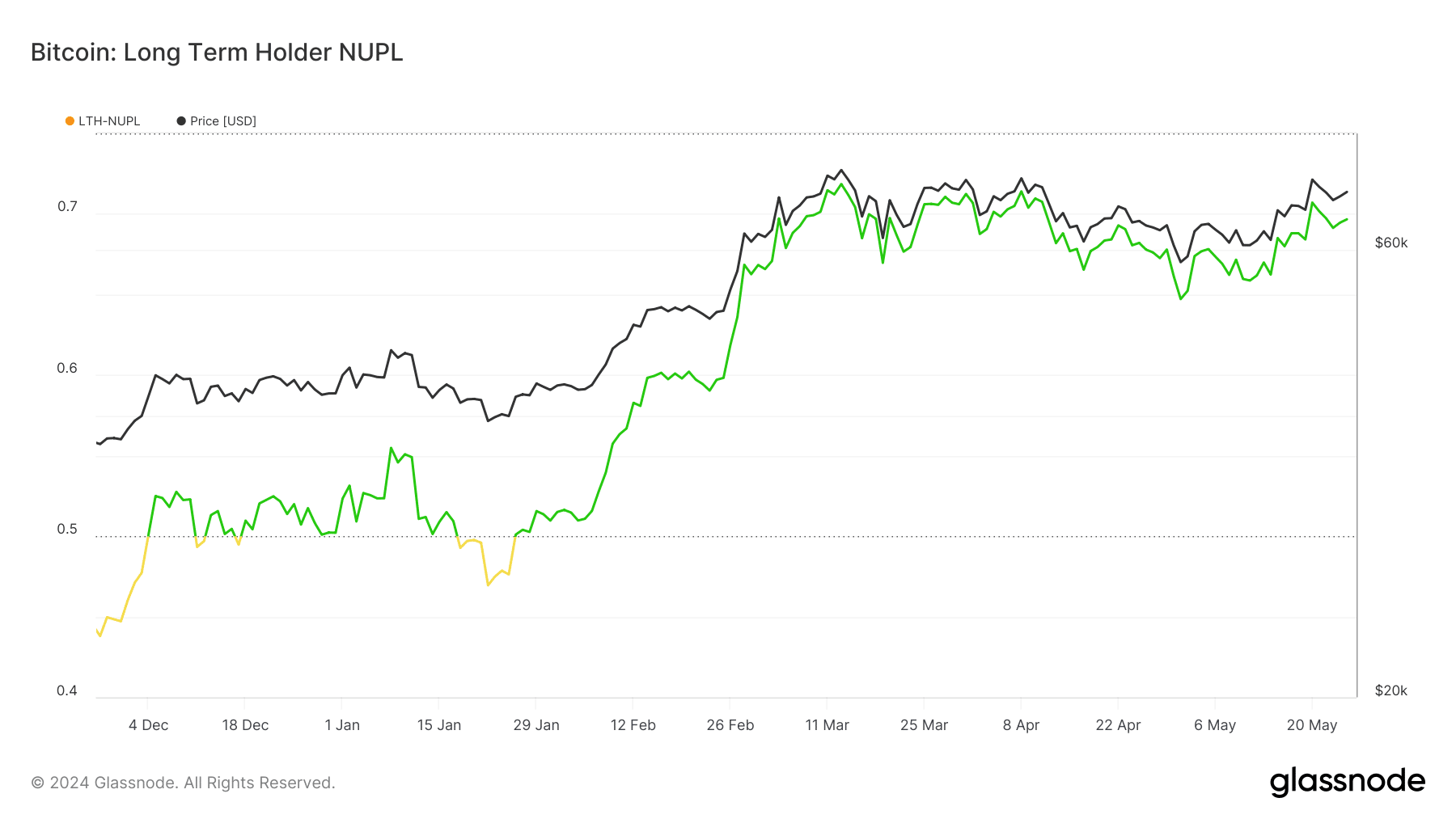

However, before concluding that holders are likely to drop their BTC, AMBCrypto analyzed the sentiment holders have towards the coin.

To do this, we looked at LTH-NUPL, an acronym for Long Term Holder – Net Unrealized Profit/Loss, which gives us insight into the behavior of long-term holders.

At the time of writing, LTH-NUPL was in the confidence zone (green), indicating that holders who have held onto their coins for at least 155 days have confidence in Bitcoin’s potential.

Source: Glassnode

However, this may not be a short-term thing, as the same people may still contribute to the distribution of BTC.

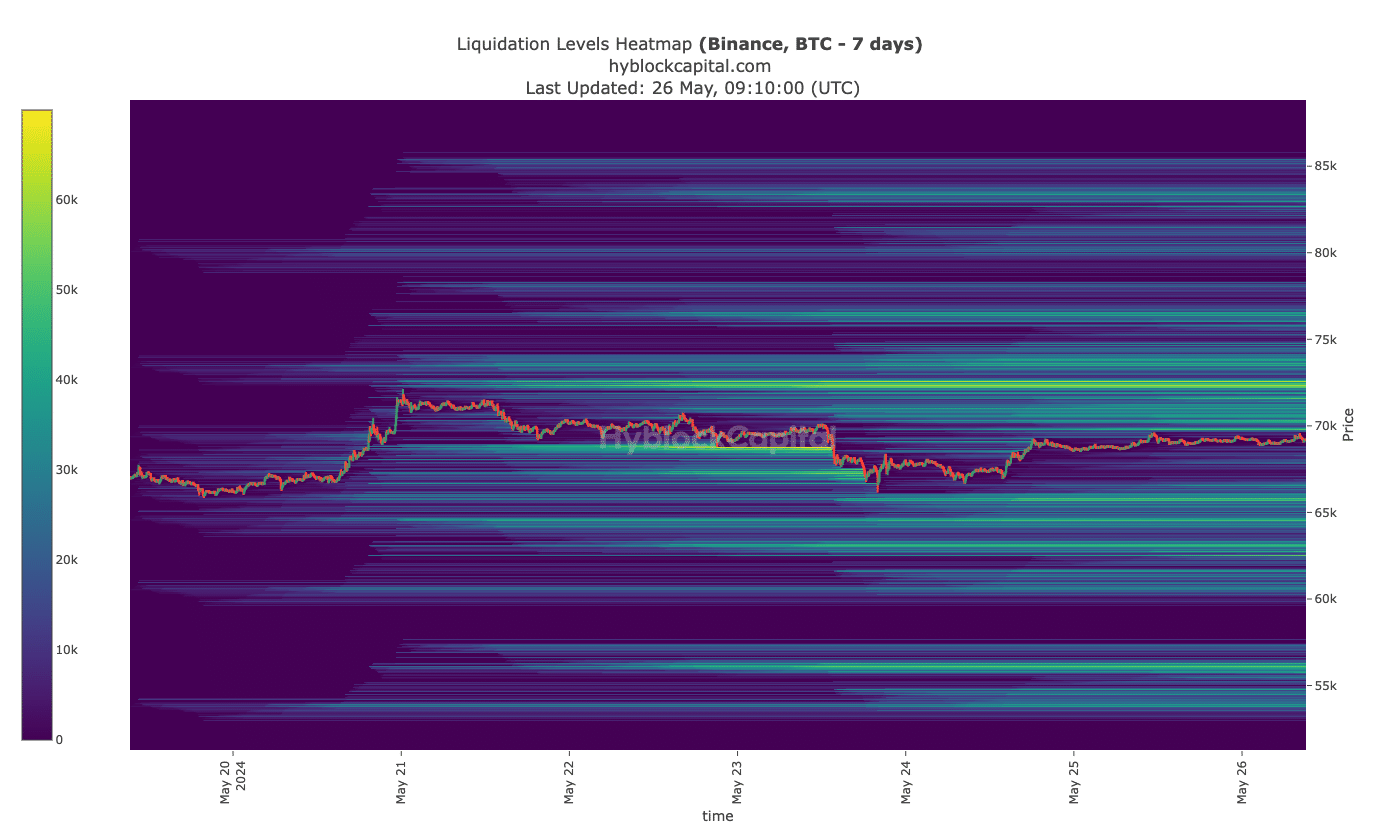

In terms of price prediction, the liquidation heatmap provided insight into the coin's movements.

$72,000 and $63,000

Liquidation Heatmap helps traders find the best liquidity positions. If liquidity is concentrated in a particular area, the price is likely to move in that direction. However, high liquidity zones can also be resistance or support zones.

Using data from Hyblock, AMBCrypto identified a magnetic zone at $72,350 and indicated that Bitcoin price could move towards that area.

However, the same zone could act as a resistance for the coin: if BTC rises to the aforementioned price and is rejected, it could mean disaster for the cryptocurrency.

This is because the other major area of high liquidity was at $63,050.

Source: Hiblock

Is Your Portfolio Green? Check out our BTC Profit Calculator

Judging by the signs above, Bitcoin price may rise, but if a correction occurs, it may be difficult for the coin to recover.

If the coin fails to hold above $63,050, the next drop could send BTC down to $56,200. However, if this doesn’t happen, Bitcoin could bounce back towards $70,000 once again.