Ethereum (ETH) price has begun to correct, days after hitting a one-month high of $3,943.

The initial rise came after the U.S. Securities and Exchange Commission (SEC) approved applications from the NASDAQ and NYSE to list an Ethereum exchange-traded fund.

While the ETF issuer still needs to receive final approval before launching its product, the SEC's May 23 decision marks a significant and unexpected victory for the filing companies and the cryptocurrency industry as a whole.

Until Monday, many had expected regulators to reject the application. Nine issuers, including VanEck, ARK Investments/21Shares and BlackRock, are hoping to launch Ethereum-linked ETFs after the SEC approved a Bitcoin ETF in January, another milestone for the sector.

However, after an initial surge following the ETF approval, the price of the second-largest cryptocurrency by market cap has fallen more than 4% from that level and is currently trading at $3,760.

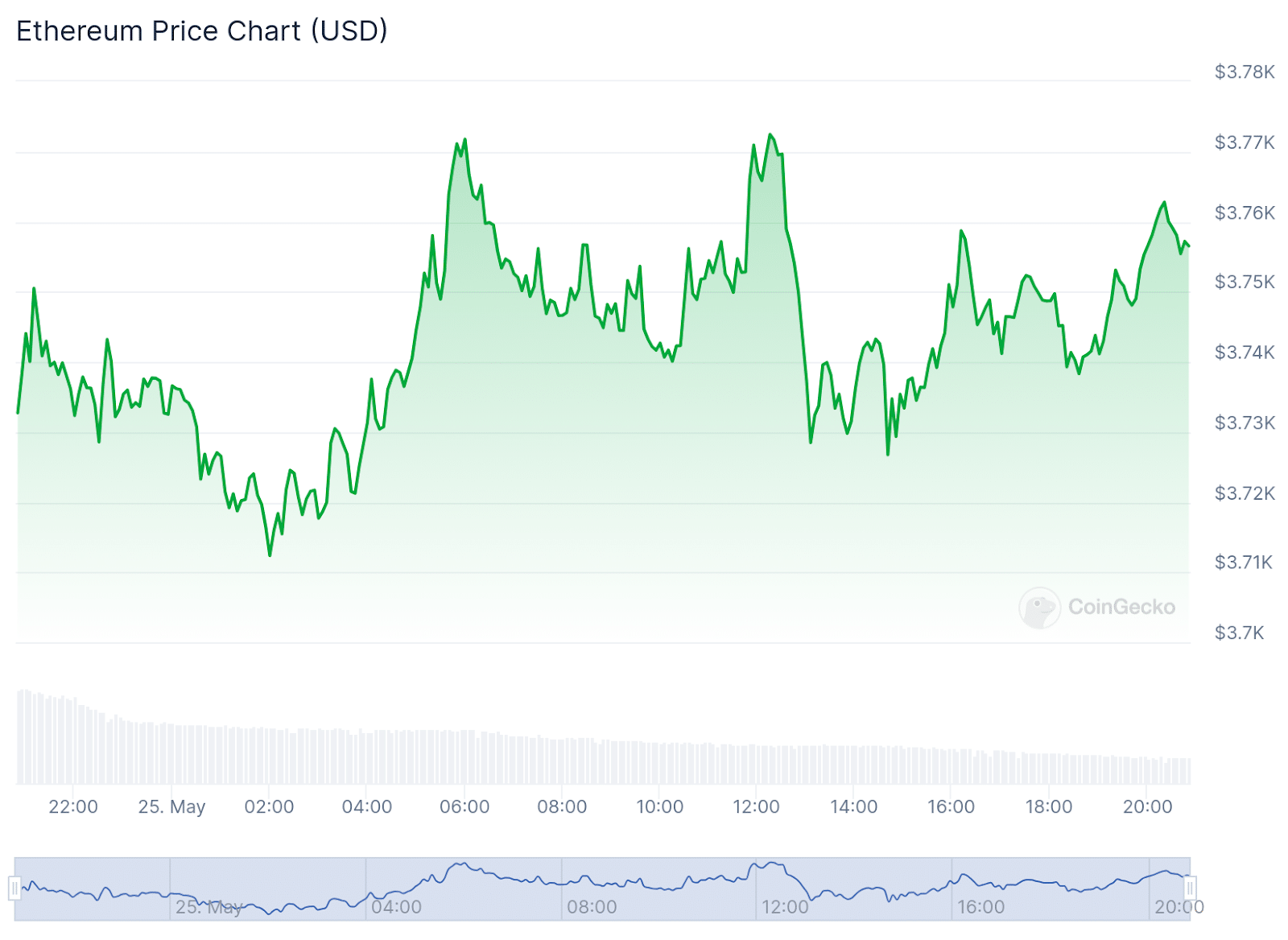

Still, the new price reflects a very modest increase of 0.9% over the past 24 hours and a more substantial increase of 20.7% over the seven-day period. Similarly, according to data from CoinGecko, the current price represents a 28.5% improvement from where ETH was trading two weeks ago, and a 19% increase over the 30-day period.

Over the past 24 hours, the price of Ethereum has remained stable while fluctuating between $3,776 and $3,710. Such price fluctuations usually indicate a rise in momentum that could lead to a breakout above or below the current stable range.

At this point, it’s unclear where ETH will go next.

However, analysts at trading firm QCP Capital suggest that if the SEC approves a spot Ethereum ETF, the price of ETH could rise to $5,000 by the end of the year.