- SEC Approves Spot Ethereum ETF – A Sign of Growing Crypto Acceptance

- However, the difference between the approval of BTC and ETH spot ETFs raises some questions.

Cryptocurrency adoption appears to be on the rise after the U.S. Securities and Exchange Commission (SEC) gave the green light to Ethereum. [ETH] Spot Exchange Traded Funds (ETFs).

The approval finally came on May 23, about five months after the SEC approved Bitcoin. [BTC] The spot ETF will be listed on January 11th.

However, a closer look at the approval process of these two cryptocurrencies reveals clear differences.

The Spot Bitcoin ETF was approved by a vote of a five-member committee that includes SEC Chairman Gary Gensler, while the Spot Ethereum ETF was approved by the SEC's Division of Trading and Markets.

This raises an important question – why did SEC Chairman Gary Gensler not vote for the ETH ETF? Does he still consider Ether a security rather than a commodity?

Was the ETH ETF approval a political ploy?

Bloomberg Intelligence research analyst James Seifert addressed this question by suggesting that the main reasons behind the distinction are broader political influences and the SEC's internal dynamics. On May 24, he tweeted:

Source: James Seifert/X

Here, Seifert emphasizes that the approvals were issued through delegated authority, which is common practice, but that in the absence of a public commissioner vote, there remains ambiguity as to the individual positions.

He added that while the approval is final for now, SEC commissioners like Crenshaw could still request review.

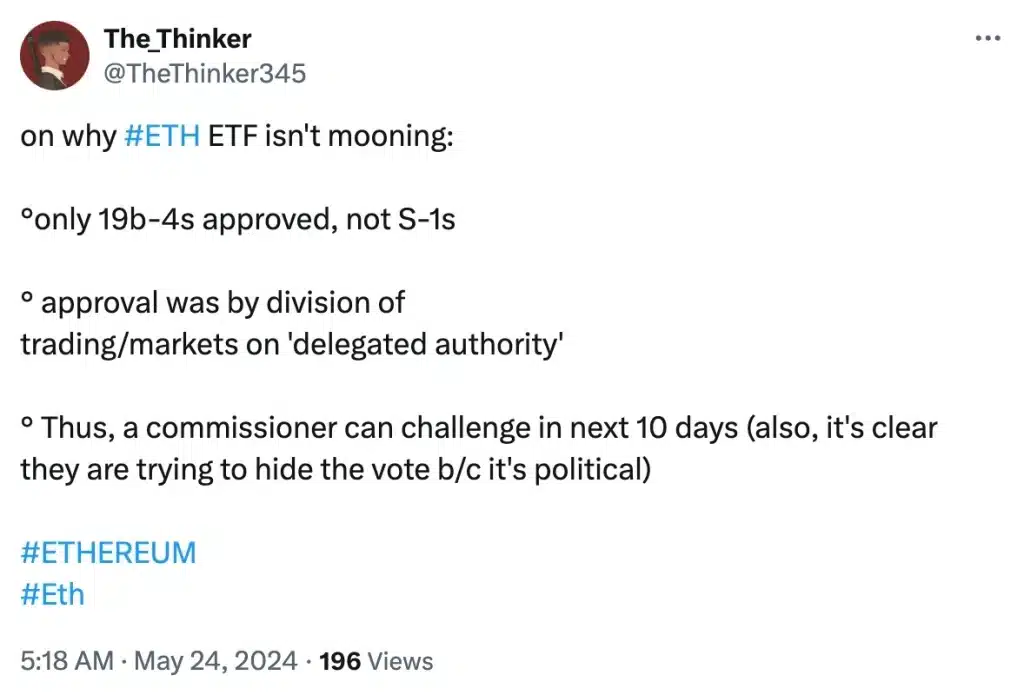

These differences did not go unnoticed among many in the crypto community, especially given the lack of interest in ETH’s charts immediately following its approval. Indeed, one commentator noted:

Source: The Thinker/X

Bitcoin vs Ethereum

The difference between the two ETFs was not only evident in the approval process, but also in the subsequent price fluctuations of both cryptocurrencies. After the BTC ETF was approved, the price of Bitcoin soared from just under $46,000 to around $47,500, while ETH rose 11% to surpass $2,500 for the first time in 20 months.

However, after the ETH ETF was approved, the market reacted in a totally different way. On May 24, Bitcoin, along with various other altcoins, including Ethereum, recorded a significant drop on the charts.

Gensler maintains anti-cryptocurrency stance

As expected, people are still speculating about Gensler’s voting approach when approving the BTC ETF and why he sat out the ETH ETF, but his history of anti-cryptocurrency positions suggests he has no favoritism for either Bitcoin or Ethereum.

The same is evident from his recent statement:

“Cryptocurrencies are a small part of the overall market, but they are a big part of the fraud, the abuse and the problems in the market.”