Breathing Room for Bitcoin Bulls

Bitcoin continues to be at the center of discussion, with its recent price volatility drawing particular attention as the asset struggles to recover from its all-time high of over $73,000 in March and peaked above $71,000 earlier this week, before its price has since fallen to around $68,231 at the time of writing.

This retracement represents a 7.3% drop from the March peak, signaling a volatile period for the cryptocurrency as it is affected by a variety of market factors.

Long-Term Holders Selling Less, What Does It Mean for BTC?

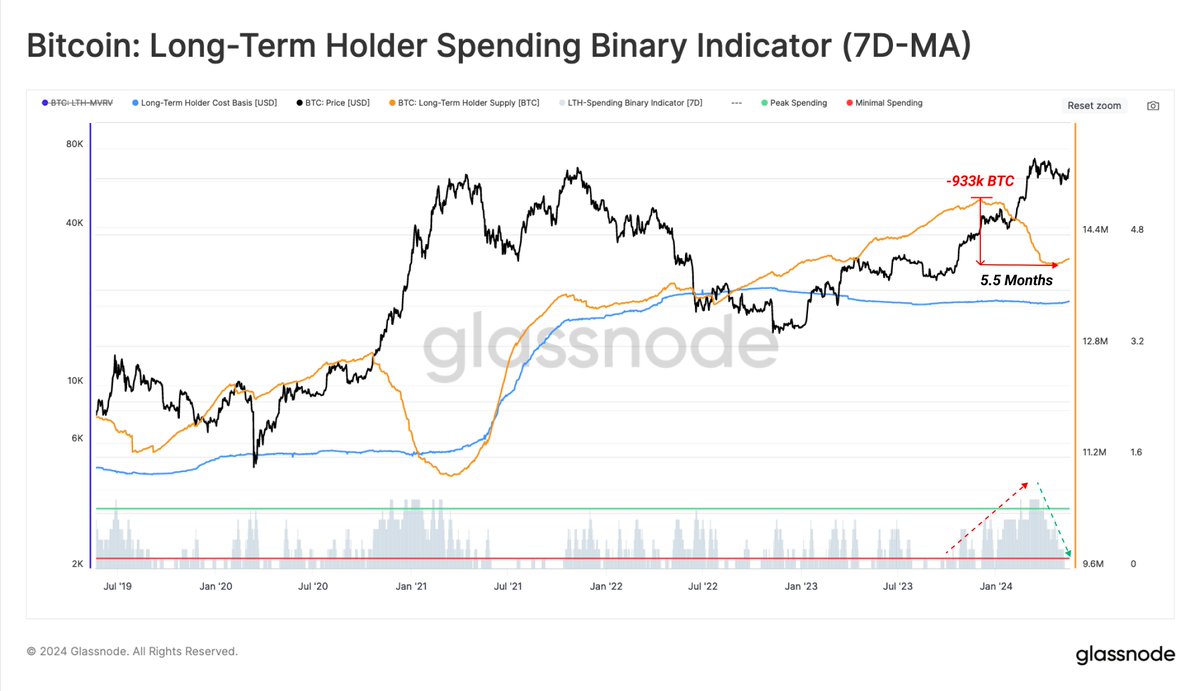

Glassnode, a well-known market intelligence platform, has noted a significant development in Bitcoin market trends. According to the platform's recent analysis, there has been a noticeable decrease in distribution pressure from long-term Bitcoin holders (LTH).

Glassnode's Long Term Holders Binary Spending Index tracks the selling activity of long-term Bitcoin holders, and recent data shows a notable decrease in selling pressure from this group.

Historically, when long-term holders reduce their sales, downward pressure on prices eases and can create a more bullish market environment.

Further insight into Bitcoin price trends comes from prominent crypto analyst Rekt Capital. I got it. Social media platform X noted that Bitcoin faced resistance at the top of the range following the halving, suggesting a prolonged re-accumulation phase.

With the crypto asset trading just below $69,000, RektCapital revealed that Bitcoin may not break out of its current re-accumulation range until about 160 days after the halving, with a significant breakout predicted by September 2024. This analysis is highly significant as it raises hopes for investors who are looking for signs of Bitcoin’s next big move.

Historically, Bitcoin has always been rejected from the top of the range during the first breakout attempt after the halving.

Moreover, history suggests that this reaccumulation will continue for much longer.

Bitcoin is only likely to break out of these reaccumulation ranges after 160 days… https://t.co/Jw7FcQui2Q pic.twitter.com/beLdOPqZOi

— Rekt Capital (@rektcapital) May 24, 2024

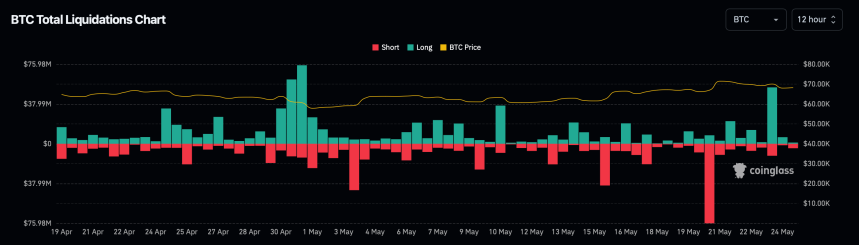

Meanwhile, Bitcoin’s recent price volatility has led to significant losses for some traders, with long Bitcoin traders losing around $41.68 million in the past 24 hours, while short Bitcoin traders lost around $14.34 million, according to data from Coinglass.

Overall, the cryptocurrency market saw a total of $292.07 million in liquidations during the period, affecting 78,874 traders.

Future challenges for the Bitcoin market

according to Greek LiveThe market's immediate outlook is further complicated by the imminent expiration of a large amount of Bitcoin and Ethereum options: 21,000 BTC options are expiring soon, with a put-call ratio of 0.88, a Max Pain Point of $67,000 and a notional value of $1.4 billion.

Similarly, 350,000 ETH options are nearing expiration, with a notional value of $1.3 billion and a put-call ratio of 0.58, so their movements could impact the overall market.

Options data for May 24

21,000 BTC options are expiring with a put-call ratio of 0.88, Max Pain Points of $67,000, and a notional value of $1.4 billion.

350,000 ETH options are expiring with a put-call ratio of 0.58, Max Pain Points of $3,200, and a notional value of $1.3… pic.twitter.com/rftA9kBm4q— Greeks.live (@GreeksLive) May 24, 2024

In this context, a put option gives the holder the right to sell an asset at a pre-determined price within a specific time period. It is often used as protection against a decline in the asset's price.

Conversely, call options offer the right to buy under similar terms and are usually used in anticipation of an increase in price.The put-call ratio is a useful tool for gauging market sentiment, with a higher ratio indicating a bearish outlook and a lower ratio suggesting bullish conditions.

Featured image created by DALL·E, charts taken from TradingView