Euro area business activity increased for the third consecutive month in May, with growth accelerating to its highest level in a year, according to preliminary “flash” PMI® survey data. At the same time, price pressures eased, with services sector inflation falling to its lowest level in three years, despite its recent strength being a major concern for policymakers worried about sustained high inflation.

Here are five key takeaways from the flash PMI data for May:

1. Economic growth hits highest level in one year

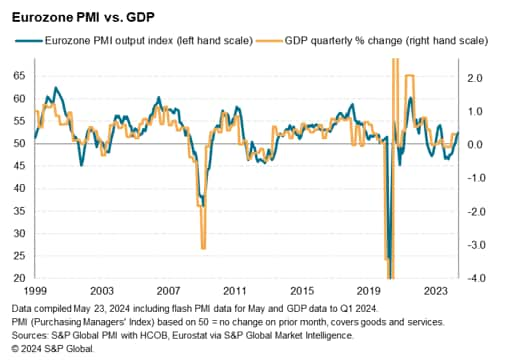

The seasonally adjusted HCOB flash euro area composite PMI production index, compiled by S&P Global based on about 85% of normal survey responses, rose to 52.3 in May from 51.7 in April, the highest level in 12 months, signalling a third consecutive month of growth in combined manufacturing and services output.

According to a simple OLS regression model based only on historical PMI and GDP data, the current PMI level roughly indicates that euro area GDP is growing at 0.2% per quarter.

Further growth is expected in the coming months, with companies reporting their most optimistic future production forecasts for 27 months in May.

2. Manufacturing is nearing stability

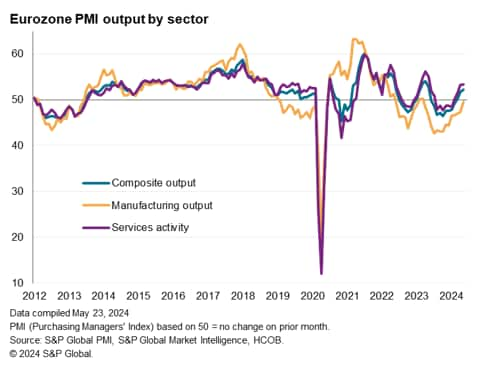

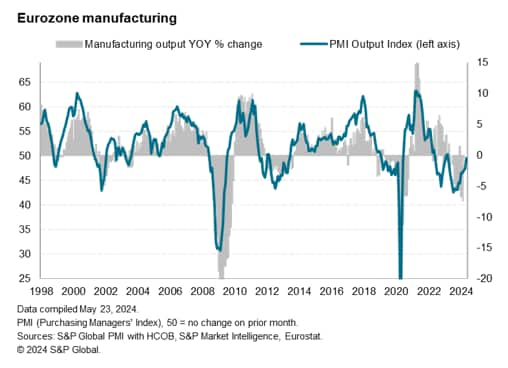

The services sector continued to lead the economic recovery, growing at its strongest rate in a year in May, while manufacturing output came very close to stabilizing, posting its smallest contraction in 14 months, following an almost continuous easing in the rate of decline over the past year.

Manufacturing orders and new export orders both posted their smallest declines in two years in May, suggesting demand for goods and trade flows were stabilizing.

3. The periphery leads the recovery

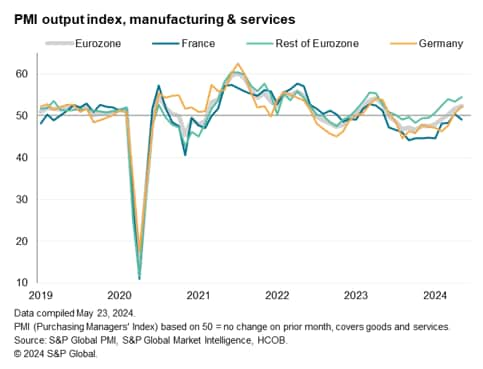

The preliminary PMI data includes responses from companies in Italy, Spain, Ireland, the Netherlands, Austria, Greece, France and Germany, although the preliminary data publication only provides national data for France and Germany. Data for the other member states, however, are presented as a GDP-weighted aggregate for the “rest of the euro area”. The rest of the euro area actually led the region's overall economic recovery in May since output began to pick up at the start of the year, with growth reaching its highest in 13 months in May. Services output rose particularly sharply in the “periphery”, while manufacturing output also rose.

The data points to particularly strong expansion in the services sector in countries such as Italy and Spain, where demand, particularly for travel and tourism-related activities, has increased above normal seasonal levels in recent months.

But Germany also continued to recover, with output increasing for a second straight month after nine months of declines, recording the fastest growth in 12 months. Further growth in the services sector was accompanied by the smallest manufacturing contraction in more than a year.

France bucked the recovery trend, with production falling slightly in May amid a decline in both goods and services, but over the past two months combined, French production has remained stable on average, marking its best performance in a year.

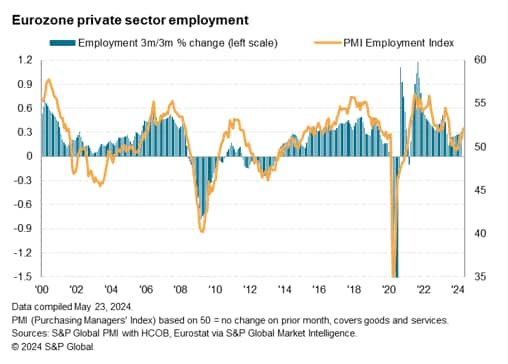

4. Job growth will help sustain the economic recovery

Employment across the euro area increased for a fifth consecutive month in May, after two months of slight declines at the end of 2023, with net job creation accelerating to an 11-month high. The rate of decline in manufacturing employment eased to an eight-month low, accompanied by further employment gains in the services sector (an 11-month high).

Strong employment growth is encouraging for the region in terms of improving job security and the impact on consumer spending, which if sustained should support overall economic growth in the coming months.

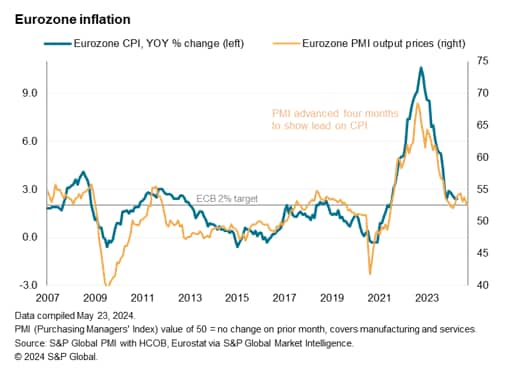

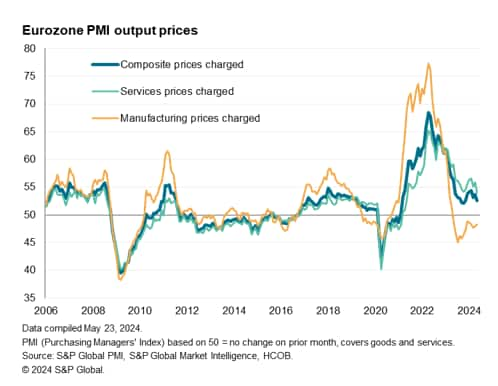

5. Price growth slows as service sector inflation falls to three-year low

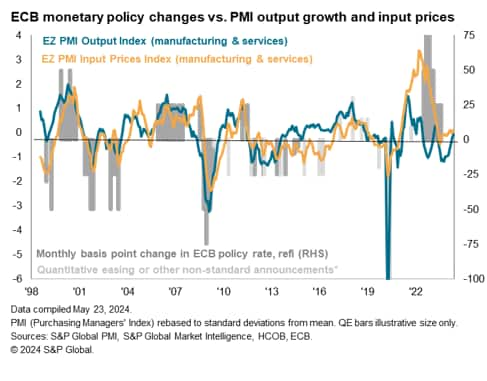

One of the factors that has boosted business confidence in recent months and led to increases in demand, production and employment has been the subdued inflation and the associated speculation that interest rates will soon start to fall. In this regard, the flash PMI for May provided further reason for optimism: average prices for goods and services rose at the slowest rate of increase in the past six months and at a level roughly in line with headline consumer price inflation meeting the European Central Bank's 2% target.

Manufacturing prices fell for the 13th consecutive month in May, while service sector price growth slowed since October and was the slowest in three years. Service sector input costs, which are highly dependent on wage pressures, notably rose at the slowest rate in three years.

Containing services inflation is particularly important because it has been the toughest area of price growth in recent months and a major concern for policymakers.

Please see the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Phone: +44 207 260 2329

chriswilliamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data is compiled by S&P Global for more than 40 economies around the world. The monthly data comes from a survey of senior executives from private companies and is available only via subscription. The PMI dataset includes headline figures that indicate the overall health of the economy and sub-indices that provide insights into other key economic factors, including GDP, inflation, exports, capacity utilization, employment and inventories. PMI data is used by finance and corporate professionals to better understand the direction of the economy and markets and to uncover opportunities.

PMI data details

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, a division of S&P Global.