- Bitcoin whale activity has increased, which usually does not happen during this part of the cycle.

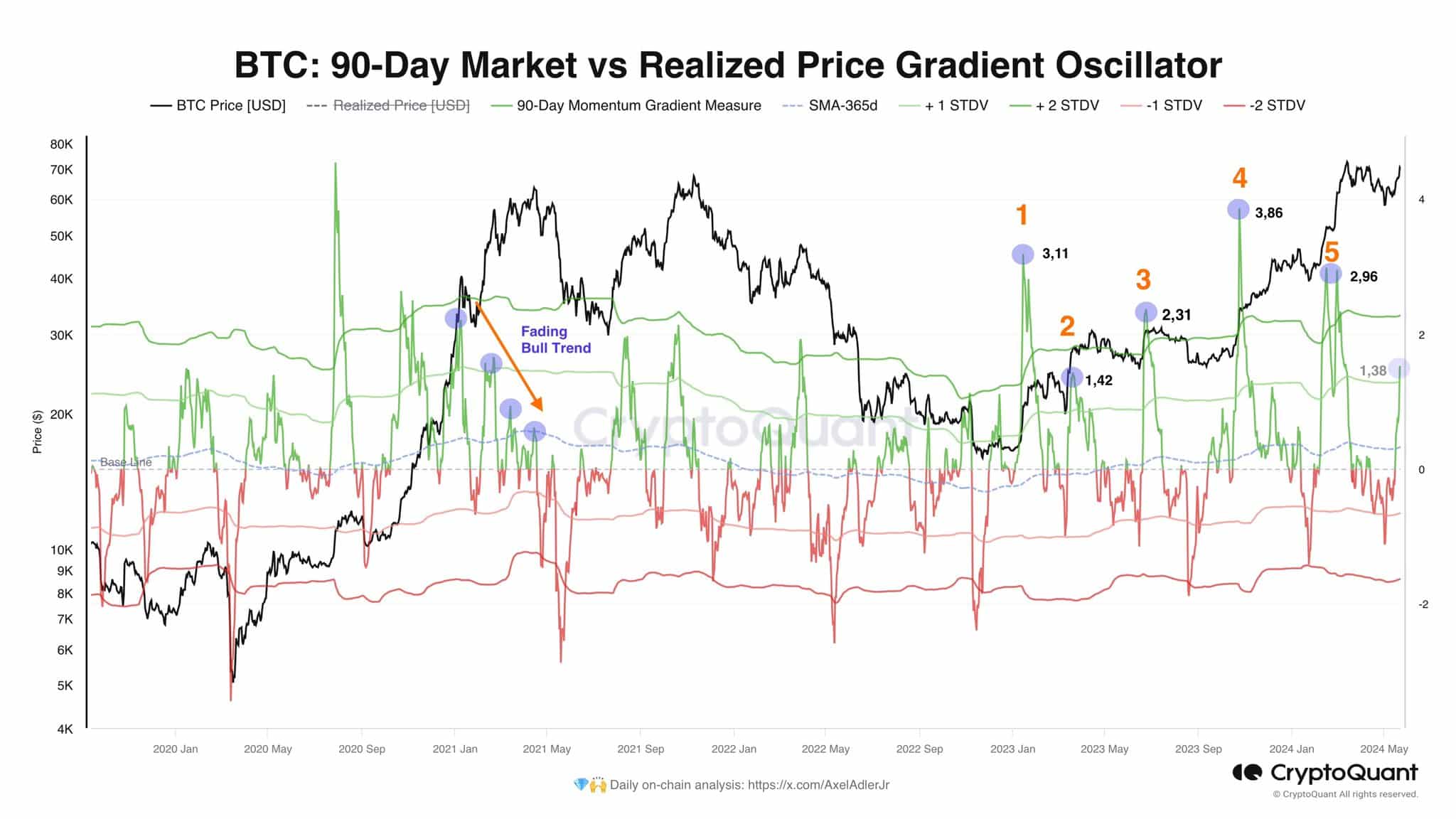

- The realized price gradient oscillator indicated that the bulls need to maintain momentum.

Bitcoin [BTC] The price was gaining bullish momentum as it approached its all-time high. The past two days saw a 4% drop and it retested the $69,000 support zone. Technical indicators continued to be bullish.

Prices stagnated in April and early May, but accumulation continued rapidly.

A recent AMBCrypto report highlighted data suggesting Bitcoin could be poised to embark on a 300-day bull run, and the evidence at hand only strengthened the bullish trend.

This momentum indicator indicates there is a risk of decline if the bulls do not maintain pressure.

Source: AxelAdlerJr from X

Crypto analyst Axel Adler posted an on-chain analysis on X (formerly Twitter) highlighting Bitcoin’s current momentum and the values its slope has reached over the past 18 months.

The price slope oscillator above measures how fast the market cap is growing compared to the realized market cap.

During the 2021 rally, the oscillator formed lower highs as BTC approached its final high, indicating a decline in the bullish trend.

In 2024, the oscillator formed a low high of 2.96. Therefore, a move above 3 would be desirable for the bulls to avoid a repeat of the 2021 pattern, which would signal a bullish decline.

At the time of writing, the oscillator reading was 1.38.

It's only a matter of time before Bitcoin hits a new all-time high

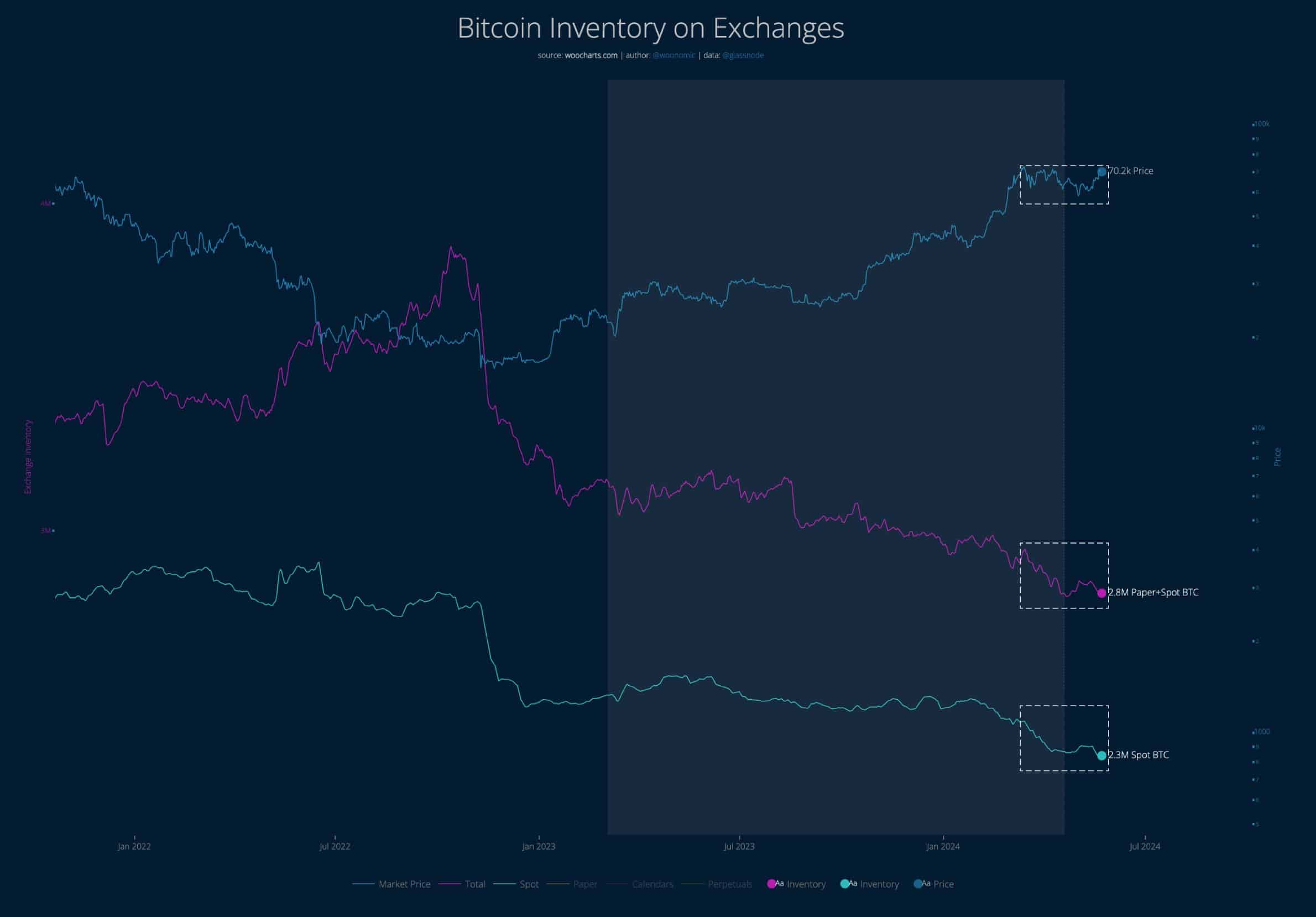

Source: Woonomic on X

Analyst Willy Woo noted that available Bitcoin has been scooped up over the past two months, when the price has not seen any real upward trend.

This caused panic among retail holders, but the demand for spot BTC was substantial.

The analyst believed it was only a matter of time before prices surpassed all-time highs against the US dollar.

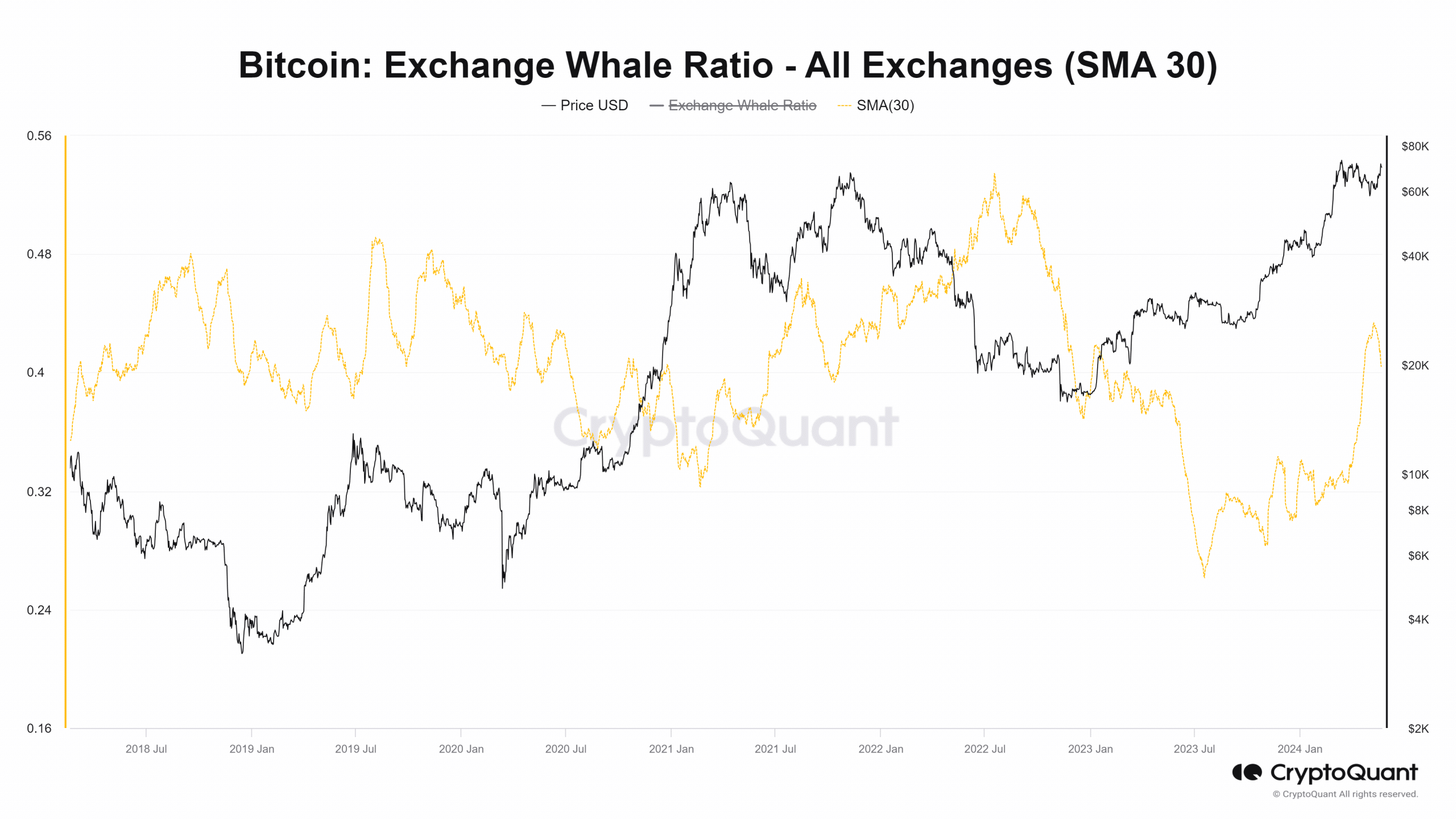

Source: CryptoQuant

The whale ratio on exchanges showed an upward trend in April and May, indicating increased whale activity, which is unusual in a bull market. Usually, whale activity quiets down during a long-term bullish trend.

Once it hit a ceiling, it rose and the price started to fall.

read bitcoin [BTC] Price prediction for 2024-2025

While the outflows from exchanges that Willy Wu pointed out earlier were a good rebuttal to the unsustainable all-time highs, increased whale activity could cause investors to hesitate.

However, the exchange whale ratio is inconclusive and the evidence at hand points to this bull market continuing further.