Share this article

![]()

![]()

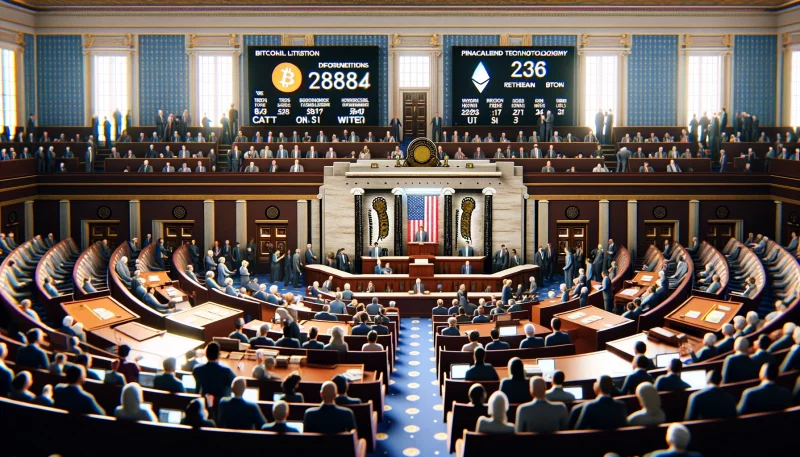

The U.S. House of Representatives has approved the 21st Century Financial Innovation and Technology Act (FIT21), a sweeping bill regulating digital asset markets.

The bill passed with a vote of 279-136, marking the largest policy victory ever for the cryptocurrency industry in the United States and the first time any major cryptocurrency bill has passed Congress.

The vote showed significant bipartisan support, with 208 Democrats voting in favor of the bill and 208 Republicans, plus 71 Democrats voting against it. Passage of the bill came despite opposition from White House SEC Chairman Gary Gensler, who argued that the bill was unnecessary and would jeopardize existing securities regulations.

Rep. Josh Gottheimer (D.N.J.), one of the Democrats who sponsored the bill, called it “a well-reasoned, thoughtful, bipartisan bill,” adding, “We hope we can work together.” If that happens, it will be appropriate for it to be enacted.” Meanwhile, Rep. Maxine Waters (D-Calif.), the ranking Democrat on the House Financial Services Committee, criticized the bill, saying it seeks to reward illegal activities by legalizing them.

FIT21 seeks to establish a regime to regulate the US cryptocurrency market, enact consumer protections, and establish the Commodity Futures Trading Commission (CFTC) as the lead regulator of digital assets and oversight of non-securities spot markets. The bill also seeks to more clearly define what makes a crypto token a security or commodity. Ahead of the vote, the White House expressed opposition and said it would not veto the bill.

Before the final vote, the House debated and voted on several amendments to the bill. Amendments by Rep. Brittany Pettersen (D-Colorado), Rep. Ralph Norman (R-South Carolina), and Rep. Scott Perry (R-Pennsylvania) were adopted, but the amendments by Rep. Greg Cassar (R-Texas) were adopted. The amendment proposed by the Democratic Party of Japan was rejected.

With FIT21 passed in the House of Representatives, focus now shifts to the US Senate, where the future of the bill remains uncertain. Support for such an effort is unclear, as there is currently no corresponding bill in the Senate and the necessary committees have not done the equivalent level of work on cryptocurrencies in the House.

From a macro perspective, the United States has lagged behind other countries in the world in establishing cryptocurrency regulation, and while the approval of FIT21 by the House of Representatives is an important step forward, implementing comprehensive oversight of digital asset markets remains a challenge. is far from perfect.

Share this article

![]()

![]()