- Schiff's comments came as Bitcoin briefly topped $70,000.

- Bitcoin spot ETFs are attracting significant institutional investment despite concerns.

As the world waits for Ethereum to be approved [ETH] Spot Exchange-Traded Fund (ETF), Prominent Bitcoin Critic Peter Schiff Used the Opportunity to Attack Bitcoin [BTC].

Schiff predicts a future bearish trend for BTC

In a post on X (formerly Twitter) on May 21, Schiff suggested that Bitcoin could be bearish if an Ethereum spot ETF is approved. He said:

“#Bitcoin The rumors gained new momentum #Ethereum The ETF is likely to be approved. However, the funds to purchase the new Ethereum ETF will likely come from existing Bitcoin ETFs. #cipher We will not be increasing the allocation for purchasing Ether.”

Schiff emphasized that while recent rumors about the approval of an Ethereum ETF have temporarily boosted the value of Bitcoin, the situation could play out differently.

He believes these new Ethereum ETFs will likely be funded from funds currently invested in existing Bitcoin ETFs.

In his view, investors who have already allocated funds to cryptocurrencies are unlikely to increase their overall investment in the crypto market just to buy an Ethereum ETF.

Instead, they may move their investments from Bitcoin to Ethereum, which could have a negative impact on Bitcoin's price.

Should we believe what Schiff is saying?

Needless to say, Schiff's comments sparked a lot of criticism. Bitcoin educator Rajat Soni argued:

“Peter…the price of Bitcoin doesn't go up because of Ether. The price of Ether goes up because of Bitcoin. If you don't understand that, your opinion means nothing.”

But Santiment's latest tweet echoed Schiff's comments.

“#Ethereum sees its most #bullish crowd sentiment since September as #SEC looks likely to approve first #ETF and $ETH price soars, while #Bitcoin and #Solana’s sentiment is slightly #bearish.”

Source: Santiment

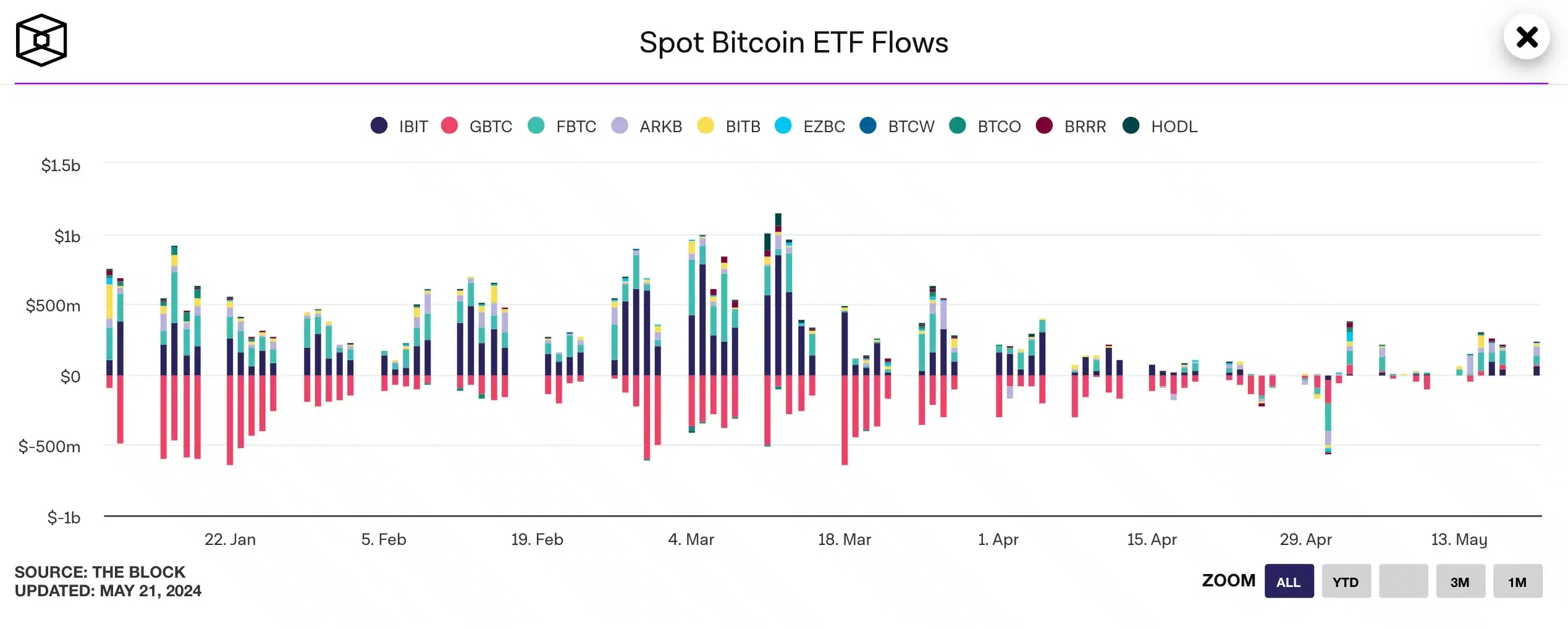

A large amount of money flows into Bitcoin ETF

Despite the criticism and uncertainty, Bitcoin Spot ETFs remain popular among financial institutions. On May 21st, Bitcoin ETFs had net inflows totaling $305.7 million.

BlackRock topped the list with $290 million, followed by Fidelity with $25.8 million. However, Bitwise and VanEck lost $4.2 million and $5.9 million, respectively.

Source: The Block