- Bitcoin miners' reserves have risen to the highest level since April.

- BTC falls below $70,000 again.

Recently, Bitcoin [BTC] Although the difficulty of mining has decreased, so has the income of miners.

Despite this decline in revenue, miners have yet to start selling their holdings, even though Bitcoin has fallen below $70,000. They are choosing to hold on to their Bitcoin for now.

Bitcoin Mining Profits and Difficulty Reduction

According to data from Blockchain.com, Bitcoin mining difficulty has remained flat for the past few days.

Chart analysis shows that the difficulty started decreasing around May 7th and continued until May 10th. It's been stable ever since.

This means less time and resources are required to solve block puzzles to add new blocks.

Additionally, over 30 days ago, BTC miner revenue soared to over $107 million, but has since declined sharply, dropping to $26.4 million on May 1st.

At the time of writing, it is attempting to recover, supported by the recent rise in BTC price, at around $34.1 million. This revenue level is similar to the December 2023 level.

Increase in minor reserves

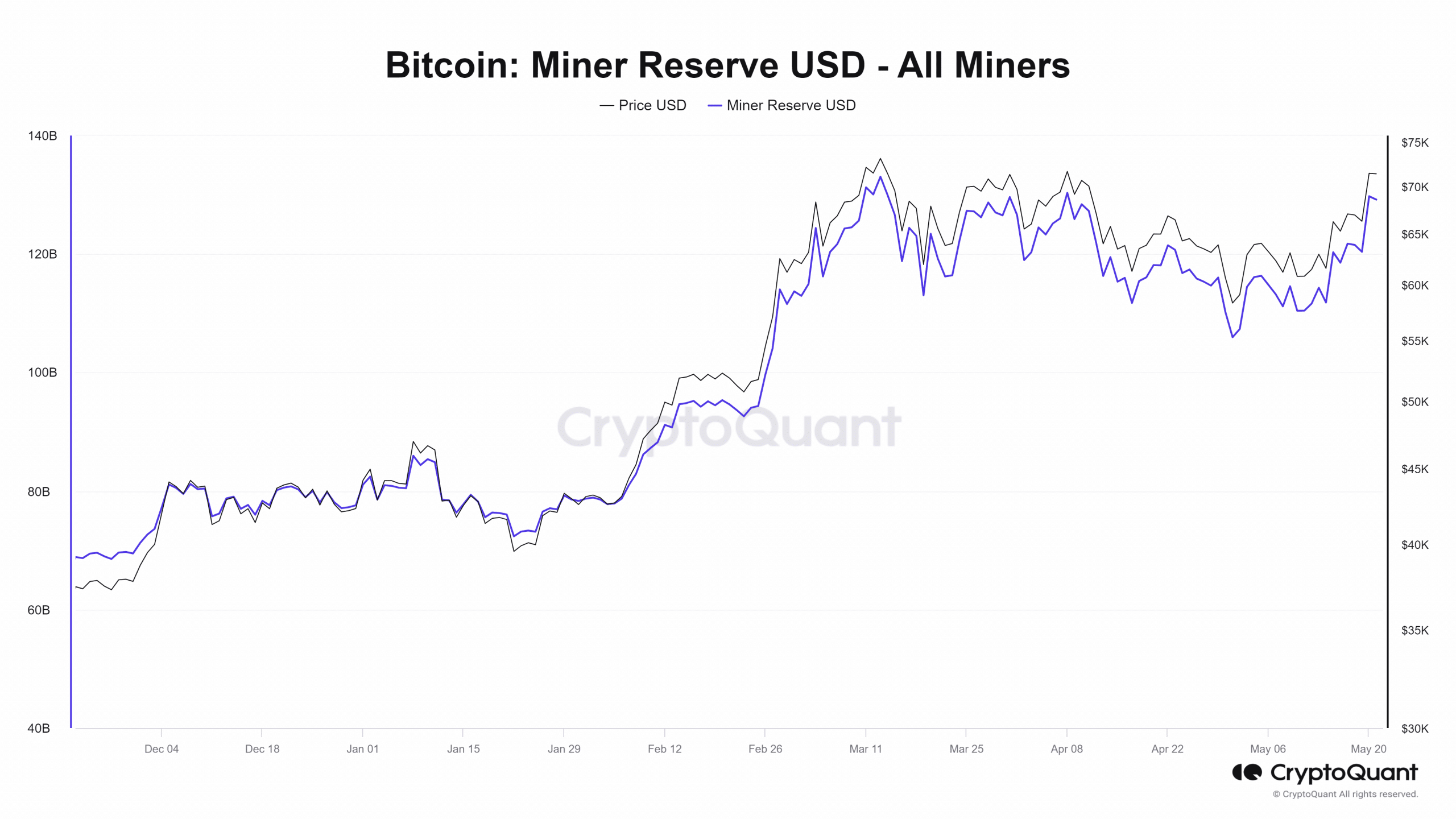

An analysis of AMBCrypto’s Bitcoin miner reserves shows that it has remained stable over the past few days, holding around 1.816 million BTC at the time of writing.

Although there have been occasional declines, reserves have remained at this level since May 6th.

However, the value of this reserve has increased significantly in recent days. The value of reserves increased from about $120 billion to more than $129 billion by May 20, according to the graph.

At the time of writing, the value of reserves is approximately $129.2 billion.

Source: CryptoQuant

Bitcoin falls below $70,000

The value of Bitcoin miners' reserves rose because the price of BTC skyrocketed. On May 20th, the price of BTC skyrocketed from around $66,000 to over $71,000, an increase of over 7%.

read bitcoin [BTC] Price prediction for 2024-2025

However, at the time of writing, BTC is back at around $69,000, down 2% in the past 24 hours.

This price range means that miners' holdings are increasing in value, even if their holdings have not increased significantly.