The current Bitcoin bull market is below the 2017 highs, a Russian expert claimed on May 20.

The comments were made in a report on Bitcoin and cryptocurrencies from the Roscongress Foundation, one of Russia's largest development-focused NGOs and conference organizers.

“Bitcoin bull market fever will wane” – experts also give their opinions

The report's authors argued that BTC's all-time high in March of this year was part of a speculative game “on the back of the approval of a Spot Bitcoin ETF.”

However, the surge in Bitcoin prices in March has since “fallen short of causing the same disruption as the situation at the end of 2017,” they wrote.

The authors noted that internet search engine queries “related to cryptocurrencies” “remain well below peak values.”

Galaxy Digital founder Michael Novogratz said Bitcoin is likely to remain in a relatively narrow trading range for at least this quarter https://t.co/KuTeCZSVlt

— Bloomberg Crypto (@crypto) May 21, 2024

The authors added that in 2024, only half as many people around the world were searching for BTC and crypto-related topics as in 2017.

ETF Approval Improves Access to Bitcoin, Experts Say

The experts also noted that analysts have argued that the Spot Bitcoin ETF will “make cryptocurrency investing more accessible to a wider range of people.”

However, the foundation claimed that evidence seems to suggest this has not yet happened.

The authors described the “Bitcoin network's mining-based transaction protocols” as an “obstacle” to its “full incorporation” into traditional financial systems. The authors write:

“In general, cryptoassets are not yet suitable for full integration into the traditional financial system. The main thing holding back traders is the fact that cryptoassets are not suitable for offsetting.”

In the world of finance, offsetting (also known as “netting”) refers to “the presentation of separate assets and liabilities, or revenues and expenses, in financial statements at their net amounts.”

The foundation added that market data shows that most investors still view Bitcoin as a “high-risk asset” akin to “tech stocks.”

Furthermore, the authors claimed that BTC has a “much stronger correlation with stock market movements” than assets such as gold. As such, it fits the characteristics of a “typical high-risk speculative asset.”

update: @JSeyff And I'm raising the probability of Spot Ether ETF approval to 75% (up from 25%). We heard this afternoon that the SEC might do a 180% on this (increasingly political issue), so now everyone is panicking (as we and everyone else thought). ) they will be rejected). Reference…https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

The authors also noted the Bitcoin market's “weak reaction” to the halving event in April, adding:

“Asset trends are increasingly determined by the general level of risk-taking of financial market participants.”

Russian government instructs loss-making Gazprom not to pay dividend in 2023 https://t.co/qnqypdsclZ pic.twitter.com/Ww1KwmbToC

— Reuters (@Reuters) May 20, 2024

However, the report was not entirely pessimistic about BTC or the impact of spot Bitcoin ETF approval in the US. In the long run, the authors write:

“The advent of Spot Bitcoin ETFs will definitely make investing in cryptocurrencies more accessible to all market participants.”

But they said the temporary price increase was the result of “speculative trading” by traders looking to profit from the ETF's approval in Washington.

The authors added that the “range of year-end Bitcoin price predictions” is “extremely wide.” The authors explained as follows.

“At the high end, the average maximum forecast is $121,764, while the average low end is $50,138.”

Do stablecoins affect Bitcoin price?

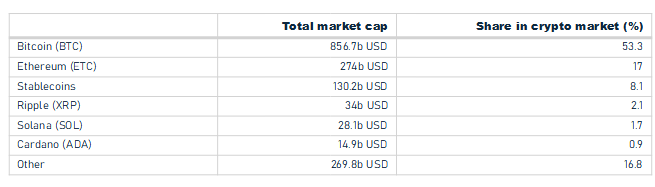

The authors also noted that there has been “increased capitalization of stablecoins” since 2017.

And this, they said, helped fuel the Bitcoin bull market in both 2021 and 2024. The authors write:

“The first wave [Bitcoin price] Growth in 2017 was driven by the adoption of cryptocurrencies. The second 2021 can be explained by the rapid increase in the supply of stablecoins and the transfer of prices to the virtual space. ”

Experts concluded that the record high in 2024 is due in part to a “stablecoin supply recovery.”

Earlier this month, Russian experts claimed that BTC and altcoin mining is expected to grow by 20-40% by the end of the year.