One analyst explained that if this indicator holds true, Bitcoin's current surge appears to have reached a halfway completion mark.

Bitcoin VWAP oscillator suggests BTC rally is only half-finished

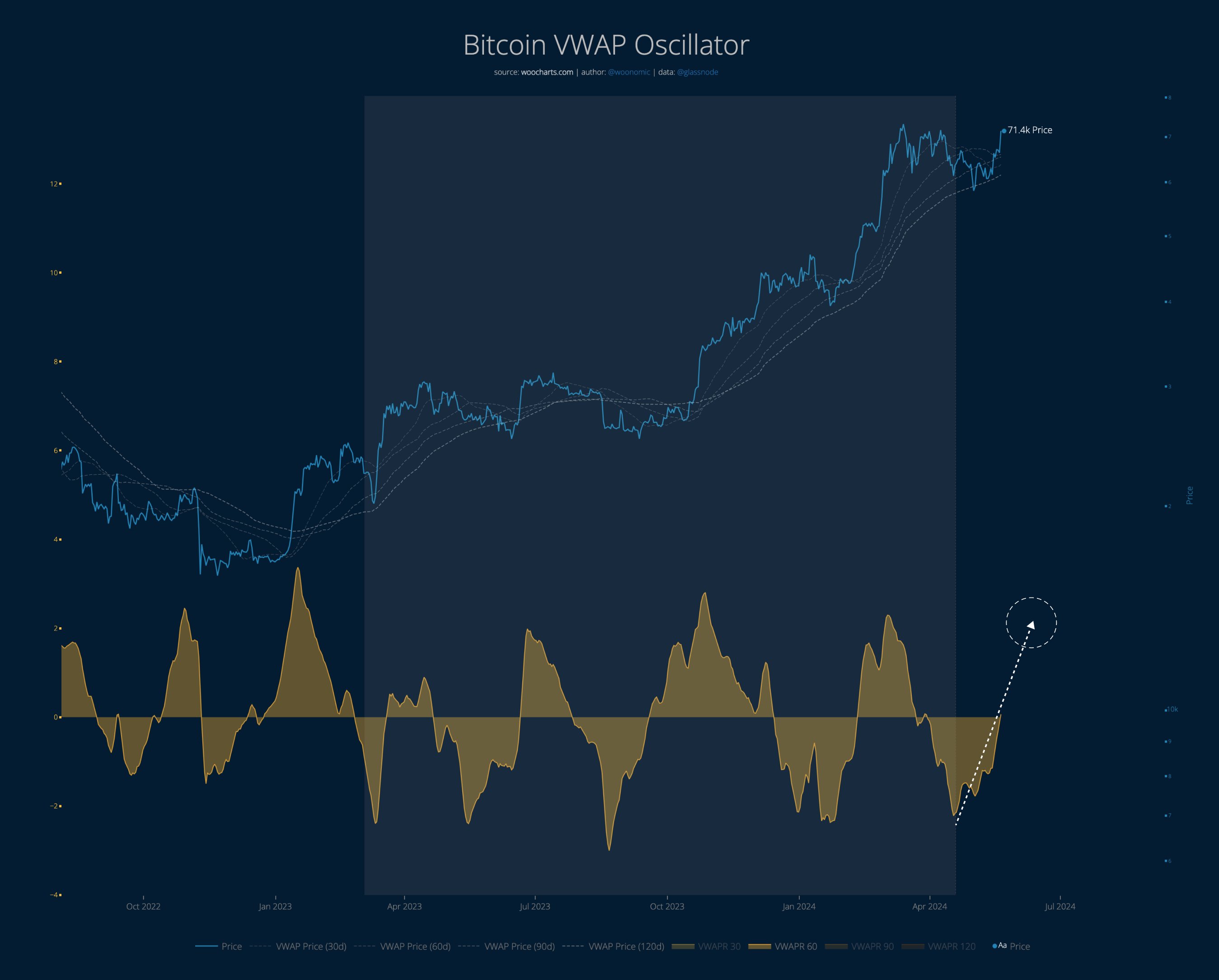

In a new post on X, analyst Willy Wu posted an update on how the Bitcoin Volume Weighted Average Price (VWAP) oscillator is doing after the latest rally.

VWAP, as its full form suggests, is an indicator that calculates the average price of a cryptocurrency based not only on the change in price throughout the day, but also on the volume traded at that price.

Related books

Typically, this volume is measured using spot volume data provided by centralized exchanges. Yet, in the case of Bitcoin, since the blockchain is open to anyone to explore, on-chain volume is used to calculate the VWAP instead.

The actual indicator in question here, the VWAP oscillator, takes the ratio between the spot price of a cryptocurrency and the VWAP and represents it as an oscillator around zero.

Earlier this month, Wu pointed out how Bitcoin's VWAP oscillator is creating a bullish divergence in the asset.

As seen in the chart, the Bitcoin VWAP oscillator formed a clear bottom at the time and then rose within negative territory. At the same time, the price of virtual currencies was on the decline.

In the past, such setups have proven bullish for the coin, and the resulting bullish momentum typically lasts until the VWAP oscillator peaks in positive territory. As such, analysts said the coin had a lot of room to run at the time.

Since then, prices have been on a recovery trend, which may suggest that the bullish divergence may be paying off. As Woo pointed out, after this run, the indicator returned to the neutral mark.

Based on the fact that historical highs have occurred after indicator peaks in positive territory and the magnitude of these peaks, analysts have concluded that this Bitcoin move is currently at its midpoint. .

Related books

As for how things will unfold next, analysts say:

Stabilization below all-time highs needs to occur for a short period of time. We then see if the second leg gives us escape velocity to a new high and the floodgates open.

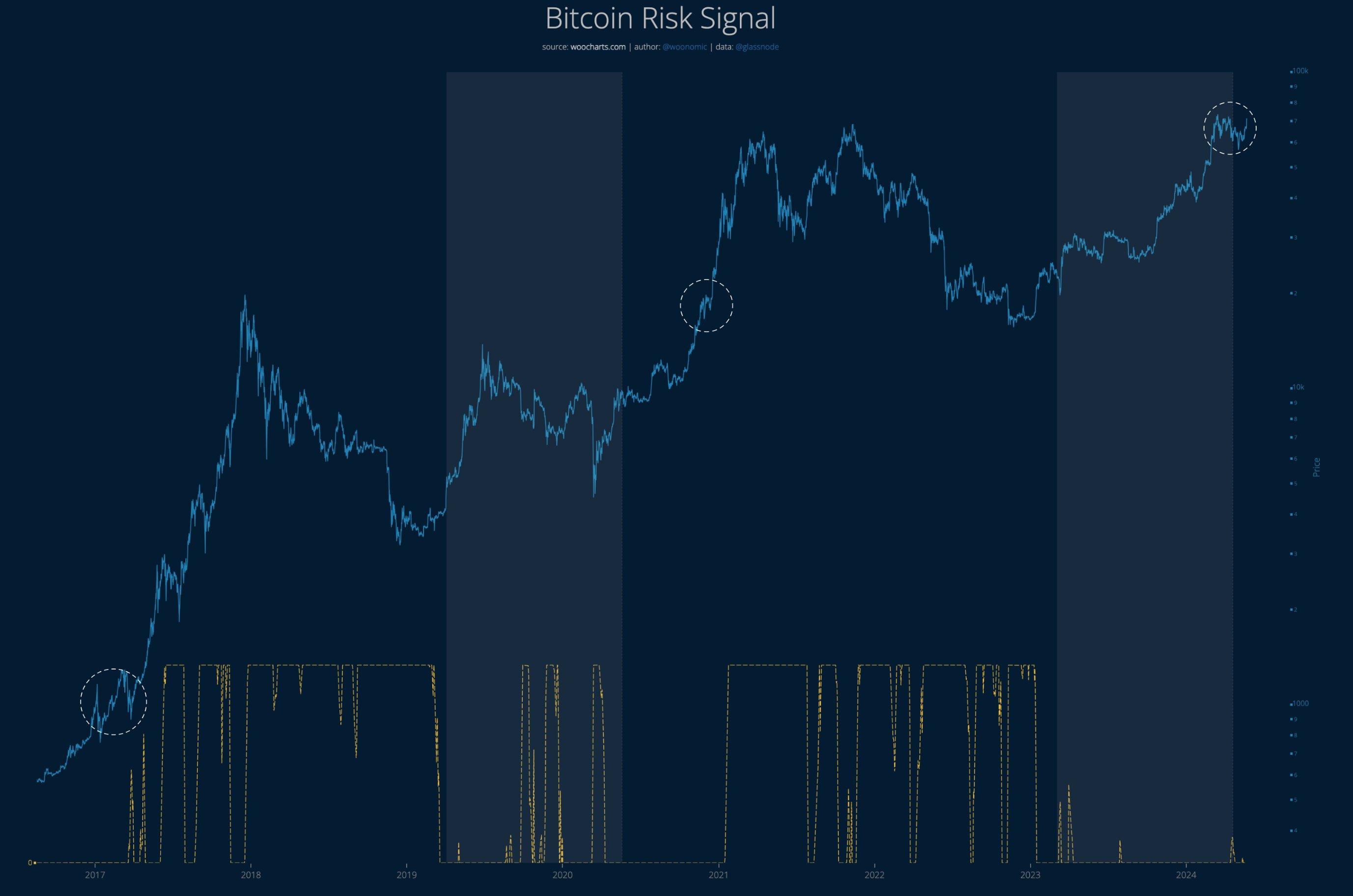

Wu also shared Bitcoin's “risk signals” that indicate where the asset is when looking at the big picture.

BTC may be part of a cycle where the price reacts violently to capital inflows and risks start to increase. “This is where most of the rapid gains will occur,” the analyst notes.

BTC price

Bitcoin had rallied above $71,000 earlier in the day, but is now below $70,000 and appears to have fallen back since then.

Featured images from Shutterstock.com, woocharts.com, charts from TradingView.com