- Eurozone economy on an improving trend in 2024

- But investors still expect ECB to cut rates in June

- Breaking PMI may impact bets from that meeting onwards

- Data will be published on Thursday at 08:00 GMT

ECB signals confidence in lowering interest rates

ECB officials decided to keep interest rates on hold as expected at a recent meeting, but sent a clearer signal that they may start cutting rates soon. Lagarde said at a press conference that the decline in inflation was reassuring and several members felt confident enough to cut interest rates.

Although he did not explicitly mention a specific timing, a few hours after his speech, a report citing three sources close to ECB discussions said policymakers were expected to cut interest rates in June. One thing became clear.

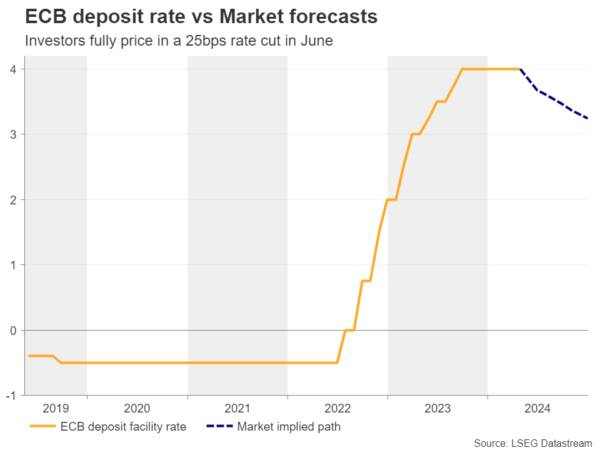

The economy improved, but completed contracts were terminated in June

Since then, headline interest rates have held steady at 2.4% y/y, with core rates decelerating less than expected, from 2.9% to 2.7% y/y, according to April's CPI statistics. In addition to that, first quarter GDP data showed that economic activity in the euro area is recovering more than expected after the euro area fell into a mild recession in the second half of 2023. According to PMI, the improvement continued in April. But investors remained confident that the ECB would implement its first quarterly point rate cut in June. They are pricing in an additional 40 basis points for the remainder of the year.

The preliminary PMI report for May will be released on Thursday, with forecasts pointing to further improvement. That said, ECB policymakers themselves continue to signal that a first rate cut is likely in June, making it difficult for investors to bet on a June rate cut even if there is an upside surprise. It is unlikely to shrink. However, it could take off the table several basis points worth of cuts expected for the rest of the year, which could still be positive for the euro.

EUR/USD seeks opportunity to break above 1.0885

From a technical perspective, EUR/USD hit resistance just above the 1.0885 zone before rebounding and the northward exodus of bulls ended on April 9th. However, EUR/USD is still above $200, above the downtrend line drawn from the December 28 high. -day exponential moving average (EMA). This currently coincides with major support at 1.0800.

Therefore, Thursday's set of better-than-expected PMIs could prompt buyers to take the reins again, pushing the price above 1.0885. Such a move would confirm further highs and possibly pave the way for the March 21st high of 1.0930. A further breakout could see room for extension towards the March 8th high of 1.0980 and the psychological round of resistance on January 5th and 11th at 1.1000. .

On the downside, the pair may need to break below the key support area at 1.0725 for the outlook to start becoming bearish. This is because it also involves a move below the short-term uptrend line drawn from the April 16 low.