Bitcoin (BTC) price is trading below the critical $67,000 level after briefly hitting an intraday high near $67,600.

BTC has fallen 0.7% in the past 24 hours and is trading at $66,500 at the time of writing. The market capitalization of this asset is on the cliff side of $1.3 trillion. However, Bitcoin's daily trading volume increased by 40% to $22.2 billion.

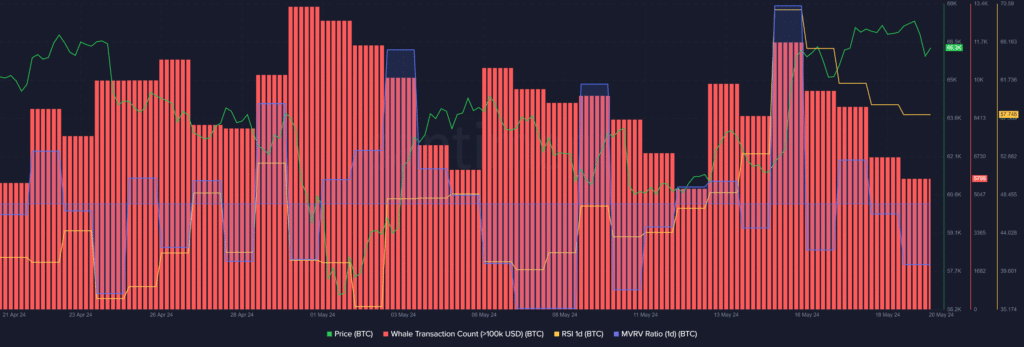

Furthermore, the sharp drop in BTC prices occurred amidst a decline in whale activity. According to data provided by Santiment, the number of whale trades consisting of at least $100,000 worth of BTC has decreased by 51% over the past five days, from 11,757 trades on May 15th to 1.5% per day at the time of reporting. reduced to 5,756 unique transactions.

In exactly the same way, the BTC Relative Strength Index (RSI) has also consistently declined in line with asset whale activity. According to the market intelligence platform, Bitcoin RSI has plummeted from 70 to 57 in the past five days.

This indicator shows that Bitcoin is expected to fall from the overvalued zone with potential price increases.

At this price range, whale activity and lower RSI would also mean lower price volatility for the largest cryptocurrency by market capitalization.

According to Santiment data, BTC's market value to realized value (MVRV) ratio stands at 143%, or 2.86x, at the time of reporting. A key indicator shows that the average price of all Bitcoins acquired so far has increased by 143% at this price point.

Additionally, the BTC MVRV ratio has declined from 146% over the past three days. Historically, Bitcoin holders typically wait for price spikes before attempting to sell their assets when the MVRV ratio declines.