- After failing to surge in transaction size, ETH could be nearing a bottom.

- Prices may fall, but traders are confident of a quick recovery.

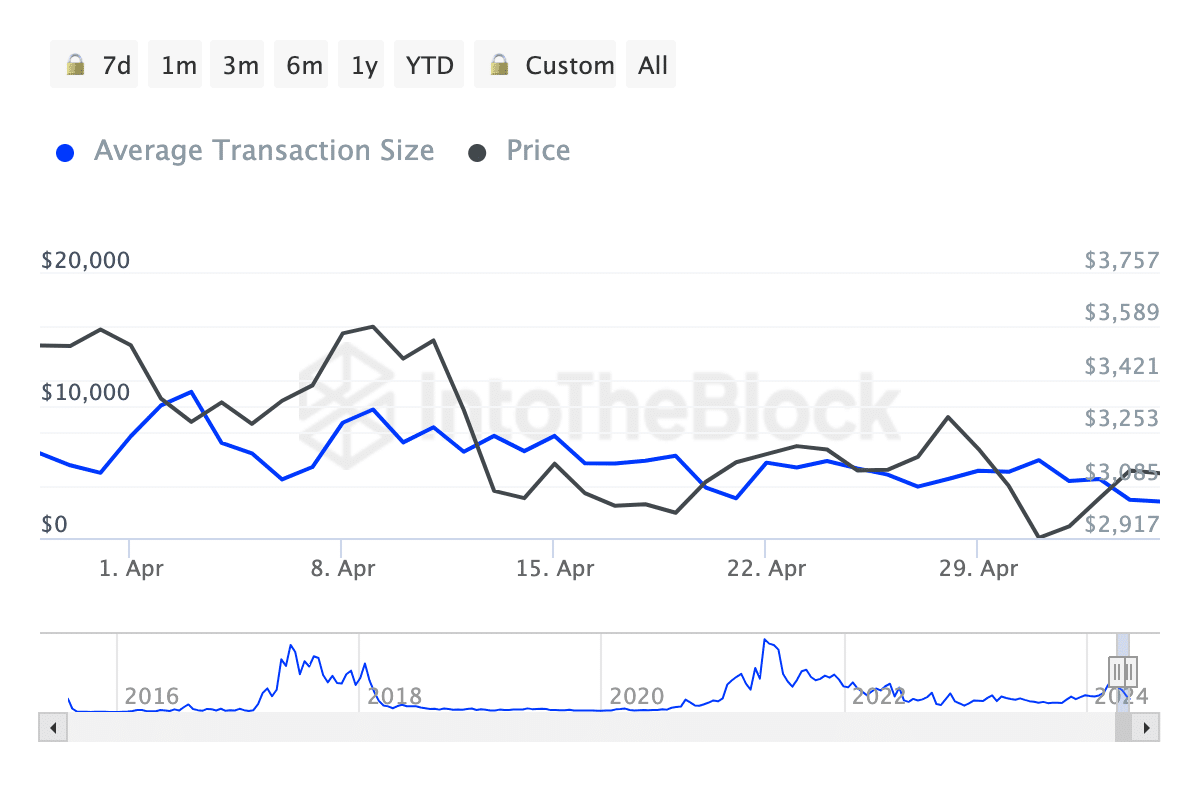

On May 19th, AMBCrypto announced that Ethereum [ETH] The average transaction value decreased to $2,767. This was a decrease of 54.13% compared to the indicator at the beginning of the month.

According to IntoTheBlock data, the average transaction size at the time was $5,893.

For the uninitiated, average trade size looks at the average trade amount of an asset on a given day in dollar terms.

Historically, spikes in this metric indicate high user activity, especially from large investors and institutions. But its decrease means that there is no institutional interaction.

Institutions are out, retail is in.

Ethereum's recent situation thus hints at the presence of more retail users. Apart from that, this indicator identifies potential tops and bottoms.

From the mentioned values, it was clear that ETH seemed closer to the bottom than the top. At the time of writing, the price of ETH was $3,106, indicating that it has fluctuated within the same range over the past 24 hours.

Source: Into the Block

According to the above analysis, the price of cryptocurrencies may be set higher in the short term. However, other indicators must be considered.

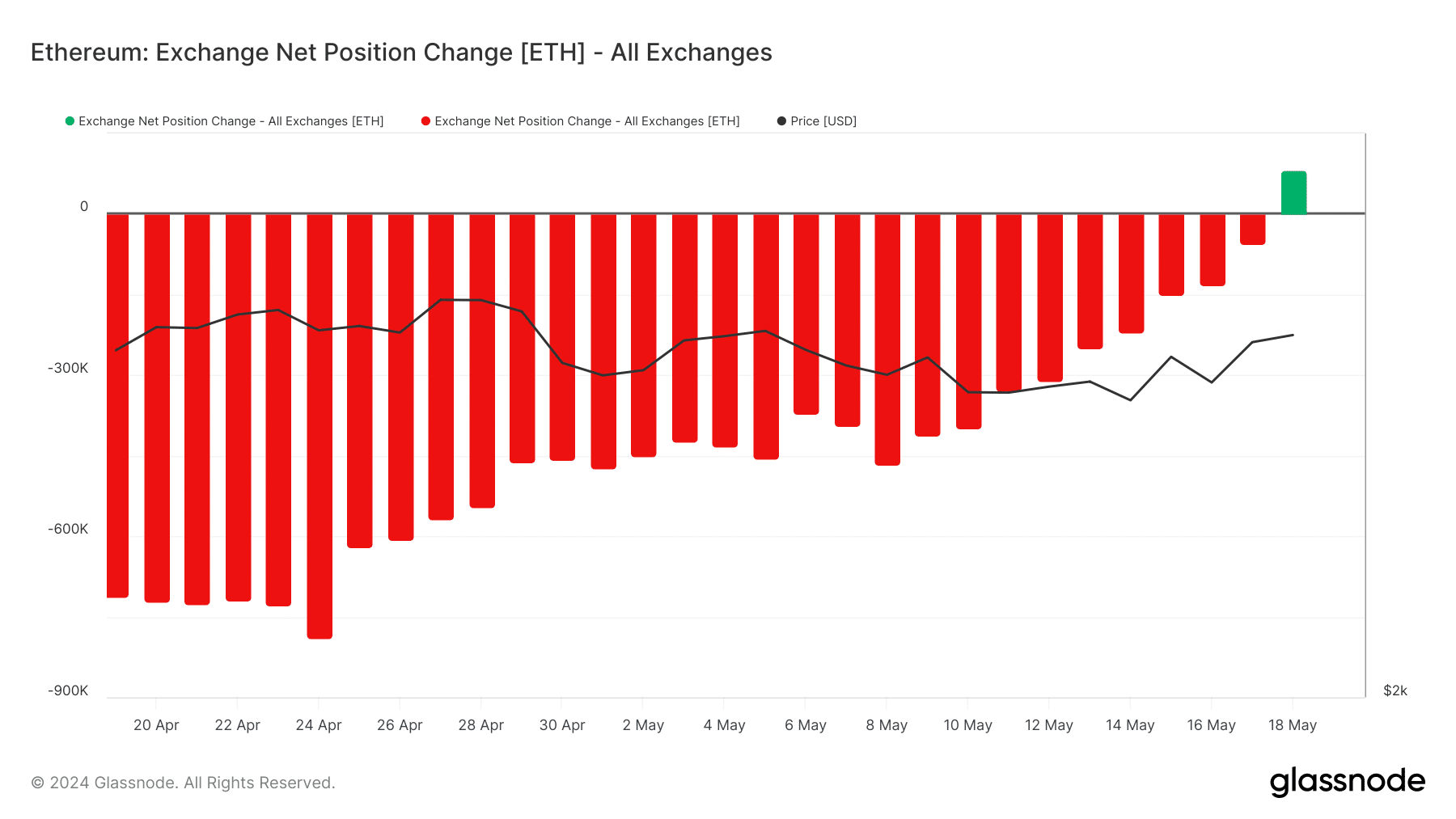

As a result, AMBCrypto looked at changes in the net position of Ethereum exchanges. Exchange's net position change has been in negative territory for most of the past 30 days, according to data obtained from Glassnode.

ETH gears up for big move

This indicator tracks 30-day changes in the supply held in exchange wallets. A positive value indicates that more coins are being exchanged.

On the other hand, a negative value indicates an increase in withdrawals from the exchange.

One thing we noticed was that on May 18th, the indicator suddenly became positive. At the time of writing, ETH's net position change was 81,715.

This increase could indicate that Ethereum participants are starting to take profits from last week’s 6.50% increase.

If this number continues to increase, the price of ETH could drop below $3,000 before any potential upside occurs.

Source: Santiment

However, if currency withdrawals intensify again, the price could start to slowly rise towards $3,500. In a very bullish situation, a hike to $4,000 could also be an option.

On Friday, May 17th, AMBCrypto reported that options traders expect the price of ETH to reach $3,600 from May to the end of June.

At the time of writing, Glassnode data showed sentiment remained unchanged. This is due to the signal from the put/call ratio (PCR).

Is your portfolio green? Check out the Ethereum Profit Calculator

A PCR above 0.70 indicates bearish sentiment and means there are more puts than calls.

However, if the measurement is less than 0.50, it means this is not the case. At the time of writing, Ethereum's put/call ratio was 0.35. This means that most traders expect the value of the cryptocurrency to increase in the coming weeks.