- Bearish sentiment prevailed in the cryptocurrency market.

- BTC and ETH led the bearish sentiment with unfavorable price trends.

While holders of certain meme coins may have made significant gains in recent days, the broader cryptocurrency market appears to be in the doldrums.

Recent data shows that negative sentiment is prevalent across the market, which could pave the way for an uptrend in the near future.

However, the market capitalization is currently on the decline, with major assets decreasing in value over the past 24 hours.

Negative sentiment dominates the crypto market

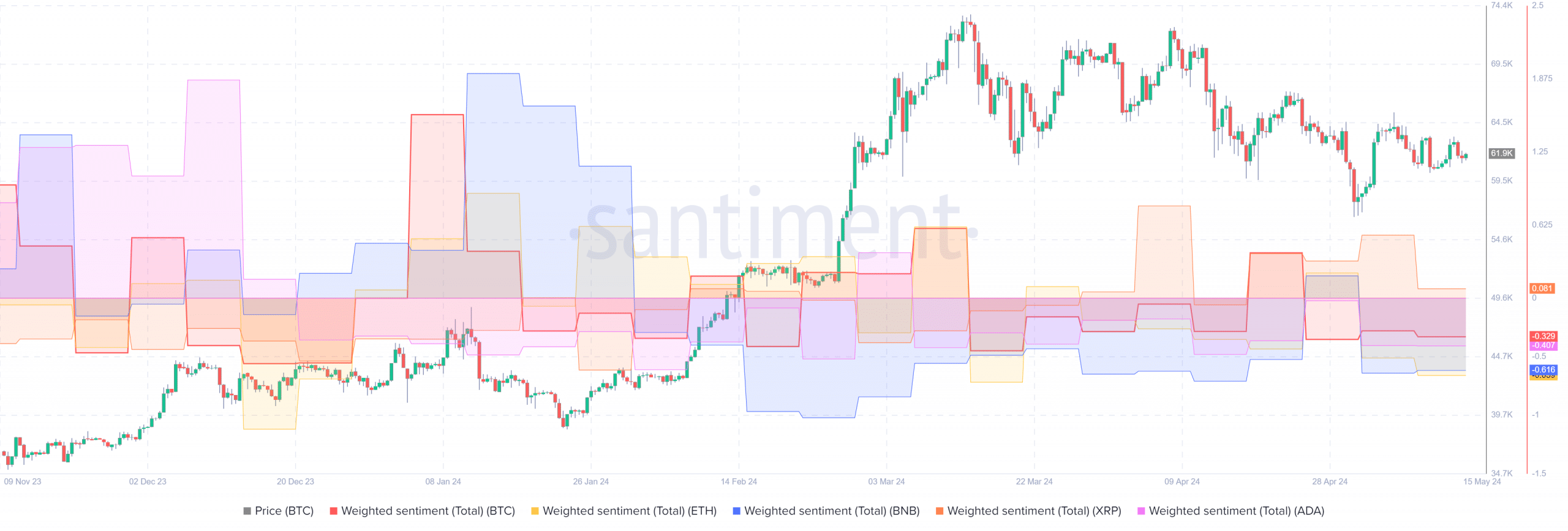

AMBCrypto’s analysis of weighted sentiment in the cryptocurrency market, with a focus on large-cap assets such as Bitcoin [BTC]Ethereum [ETH]and Binance BNB revealed general negative sentiment as of this writing.

of Santimento The chart shows the overall bearish sentiment in the market from May 8th to May 14th.

A similar universal bearish pattern was also observed from April 10-16 and March 13-19.

At the time of writing, Ripple had the lowest weighted sentiment, followed by Bitcoin.

Source: Santiment

Virtual currency market capitalization declines

AMBCrypto investigated crypto market data on CoinMarketCap and found a decline in market capitalization over the past 24 hours.

At the time of writing, market capitalization was down more than 1.3% to approximately $2.27 trillion. Despite this decline, trading volumes soared, increasing by more than 27% to approximately $68 billion.

Furthermore, the Fear and Greed index reflects neutral sentiment and was 55 at the time of writing. But it seemed to be creeping closer to horror.

This decline in market capitalization is due to the lackluster performance of major assets such as Bitcoin and Ethereum in recent hours.

Bitcoin and Ethereum remain bearish despite rally

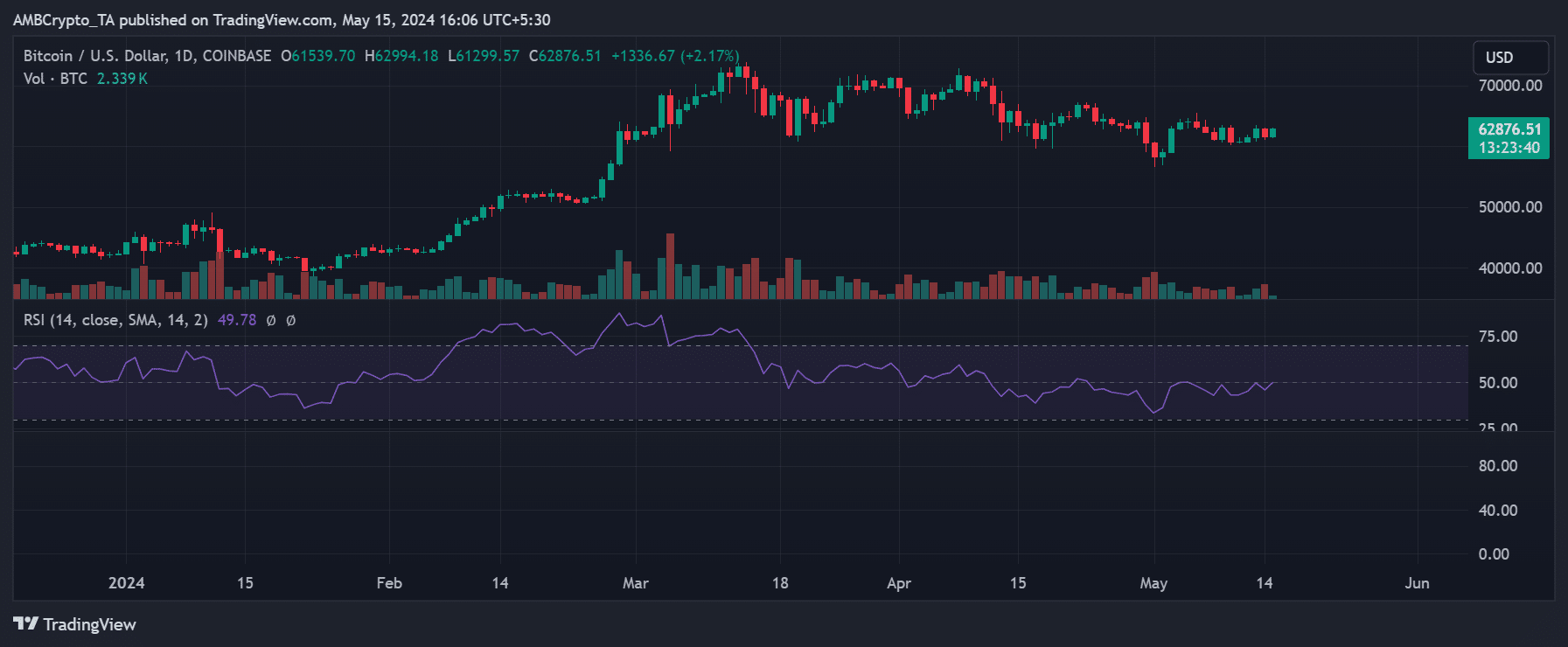

AMBCrypto’s analysis of Bitcoin price trends on a daily time frame reveals that the recovery attempt has faltered.

The drop of more than 2% was noticeable on May 14th, when the price returned to the $61,000 zone.

However, as of this writing, Bitcoin had recovered with an increase of over 2% and was once again trading above $62,000.

Source: TradingView

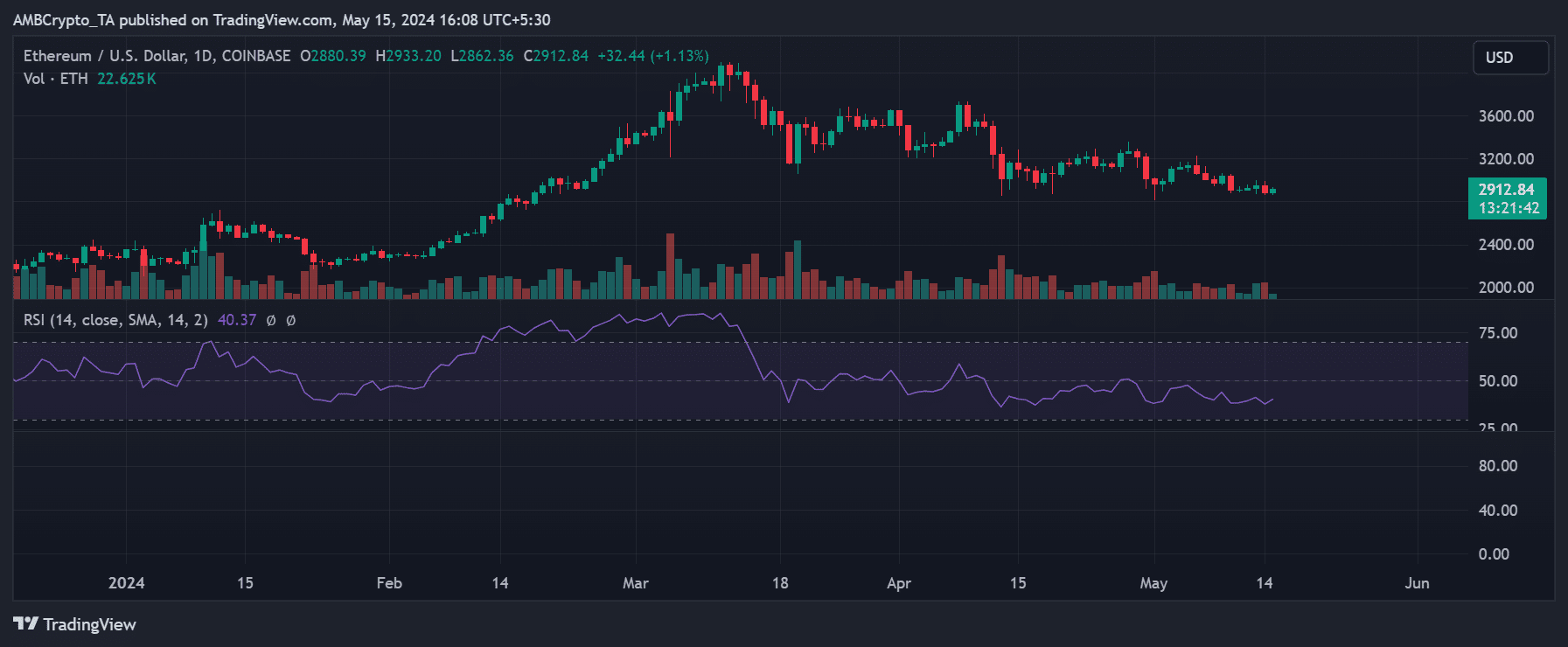

read ethereum [ETH] Price prediction for 2024-2025

Similarly, Ethereum experienced a drop of over 2% in the previous trading session, settling at around $2,800. Nevertheless, at the time of writing, the stock had rebounded more than 1% and was trading at around $2,900.

Despite these fluctuations, both assets continue to trend bearishly, contributing to bearish sentiment across the crypto market.

Source: TradingView