- Bitcoin's cumulative trend score was 0.021.

- This indicates that large companies are diversifying their holdings or not accumulating more coins.

Bitcoin's [BTC] According to Glassnode data, the cumulative trend score is trending towards zero at the time of writing, indicating an increase in coin distribution by larger entities.

This indicator measures the activity of different BTC wallet cohorts. Specifically, we track whether they are buying or selling coins.

If its value is close to 1, it indicates that a larger entity or a significant part of the network is accumulating BTC.

Conversely, scores close to zero indicate that these entities are dispersed or not accumulating.as At the time of writing, BTC had a cumulative trend score of 0.021.

Source: Glassnode

The move towards this value could be due to the coin’s narrow price movements over the past few weeks. It continues to face significant resistance at the $63,000 price level.

According to the article, at the time of writing, this leading cryptocurrency was trading at $62,003. CoinMarketCap data.

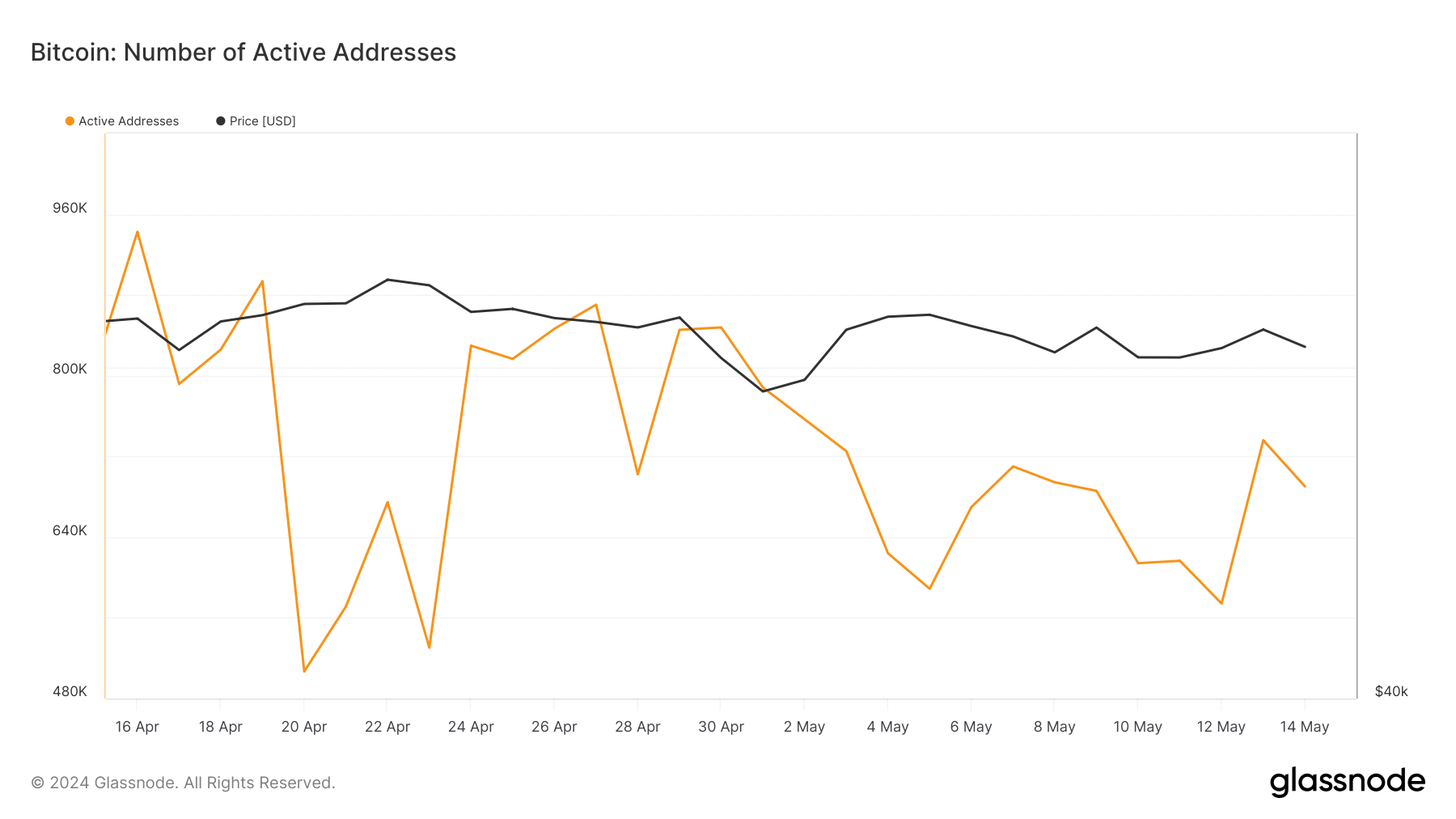

BTC on-chain activity last month

On-chain assessment of BTC whale activity confirms reduced accumulation by its large wallet group.

According to Glassnode, the number of unique addresses holding at least 1,000 coins has decreased over the past 30 days. 2113 at the time of writing, it has fallen by 0.1% during this period.

This decrease in whale accumulation on the BTC network reflects an overall decline in activity on the network.

According to data from Glassnode, the number of unique addresses active as senders or receivers in the network has decreased by 27% in the last month.

Source: Glassnode

During the same period, there was a noticeable decline in new demand for BTC.

According to the on-chain data provider, the number of unique addresses appearing for the first time in BTC transactions decreased by 35% over the 30-day period studied.

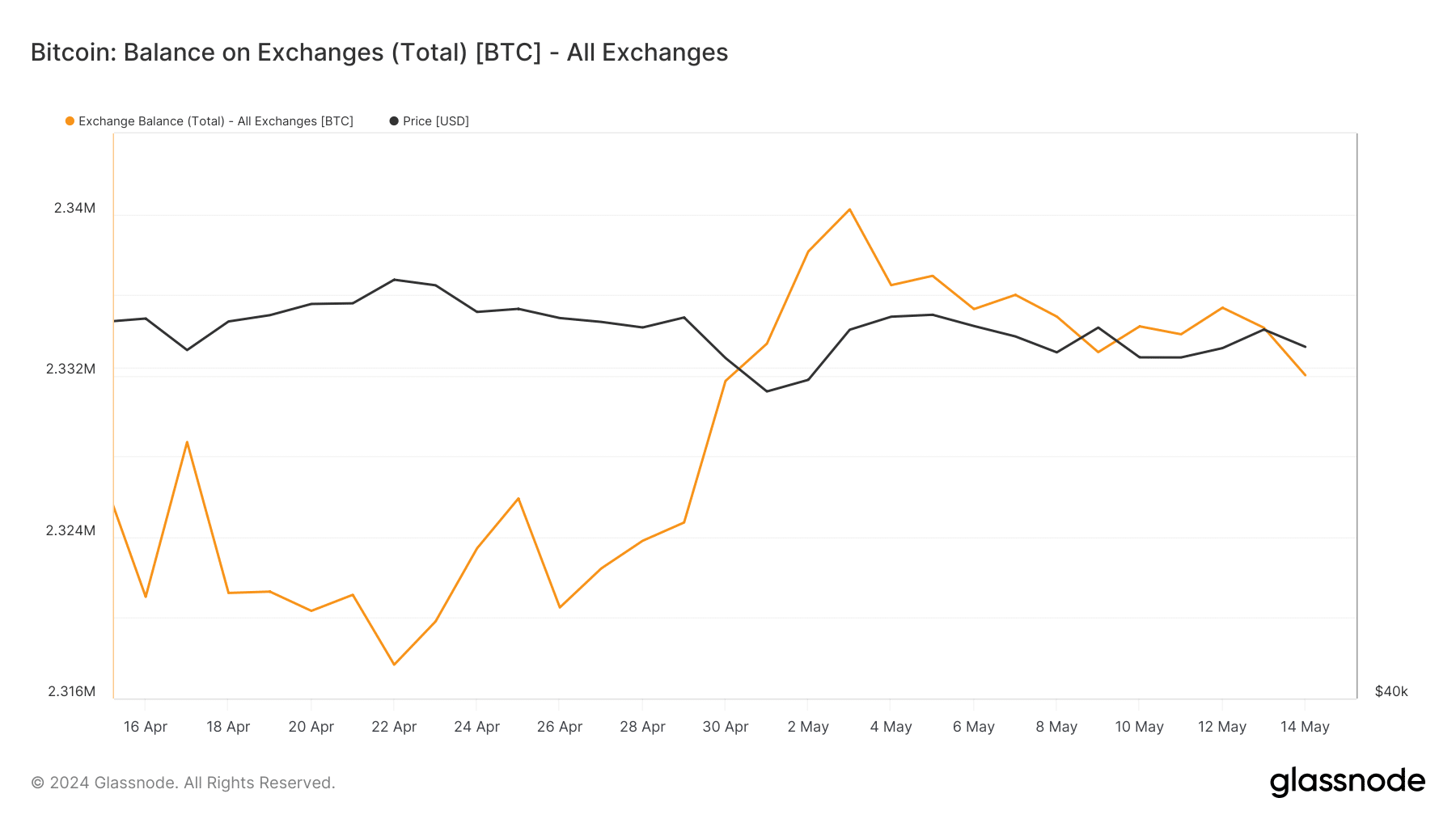

While the daily number of active new addresses trading BTC is decreasing, the number of coins sent to crypto exchanges is rapidly increasing.

At the time of writing, the exchange address held 2.33 million BTC, an increase of 1% in the last month.

Source: Glassnode

read bitcoin [BTC] Price prediction for 2024-2025

This rise in BTC exchange reserves suggests more declines for the coin.

If mainstream market participants continue to gain momentum while failing to attract new demand, BTC bulls may find it difficult to break through the $63,000 resistance in the near term.