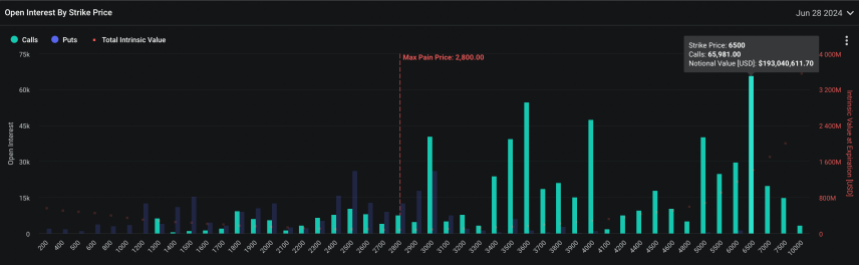

June Ethereum (ETH) options are showing notable interest in rising strike prices, with focus on levels above $3,600.

Deribit data reveals that traders are heavily betting on calls above this price, indicating bullish sentiment on Ethereum’s near-term trajectory. The most popular strike price for these optimistic bets is an ambitious $6,500.

Options market is bullish on Ethereum

Specifically, an option is a contract that gives a trader the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put) the underlying asset at a specified strike price until expiration.

Call options are typically purchased by traders who believe the price of an asset will rise, allowing them to buy at a lower rate and potentially sell at a higher market price. Conversely, put options are preferred by people who anticipate a fall in the price of an asset and aim to sell it at the current rate and buy it back at a lower value.

Currently, the Ethereum options market is heavily tilted toward calls, and total open interest, which represents the total number of contract options outstanding, tends to favor higher strike prices.

This concentration of calls, primarily above the $3,600 mark, suggests that a key market segment is positioned for Ethereum to rise to even higher levels by the end of June.

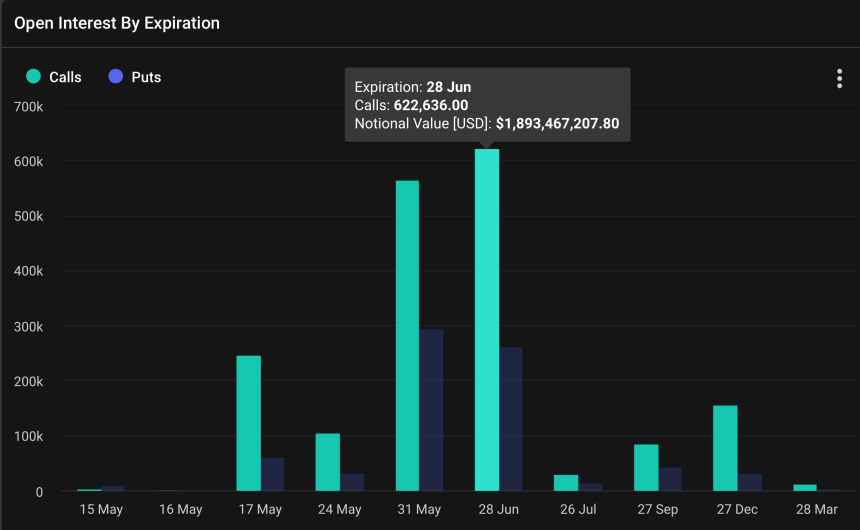

According to data from Deribit, approximately 622,636 Ethereum calling contracts are scheduled to expire by the end of June, with a notional value of more than $1.8 billion. Such a substantial position highlights the market's confidence in Ethereum's upside potential.

Furthermore, the data shows that the most substantial open interest is concentrated around the $6,500 strike price, with a notional amount of $193 million.

This concentration reflects traders' optimism and supports Ethereum's market price, especially if these options are exercised when the asset price approaches or exceeds the strike level.

Despite the optimism contained in these options, Ethereum is currently experiencing a slight decline. It is below $2,900, down 5.4% over the past week and 2.2% over the past 24 hours. This drop puts even more focus on upcoming market catalysts that could significantly shake up ETH's price.

Regulatory decisions and technical indicators: dual impact on the path of ETH

One of the key upcoming events is the U.S. Securities and Exchange Commission's (SEC) decision on several applications for Ethereum-based exchange traded funds (ETFs), which is expected by May 25th. I am.

This decision is crucial, as approval could spark a wave of institutional investment in Ethereum, sending the price skyrocketing. Conversely, a rejection could dampen bullish sentiment and lead to a further pullback.

From a technical analysis perspective, there are signs of a possible rebound. A “bullish crypto pattern” identified by analyst Titan of Crypto suggests that Ethereum may be at a tipping point. Ethereum is currently sitting at the 38.2% Fibonacci retracement level, a key support zone in many bull markets.

This level has historically served as a springboard for price increases, suggesting that Ethereum may be gearing up for a significant rally.

#altcoin #Ethereum Incoming bounce call.

The bullish cipher pattern worked perfectly and all goals were achieved 🎯.#ETH is currently at the 38.2% Fibonacci retrace level, also known as the “first stop.” This level is maintained in a bull market.

We expect a rebound from this level. 🚀 pic.twitter.com/o9e6VLEREz

— Crypto Titan (@Washigorira) May 12, 2024

Featured image from Unsplash, chart from TradingView