- Today's cryptocurrency market is in decline due to a major correction.

- Bitcoin is struggling near the $56,000 support level, with technical indicators pointing to a possible reversal.

If you check the crypto market today, all you see is red.It seems like the entire Bitcoin market has crashed. [BTC] and Ethereum [ETH] It took most of the hits and is well below the critical support level.

Bullish sentiment within the community appears to have almost completely dissipated. Once again, investors are panicking and perhaps on the verge of giving up. So what's going on? Why is the virtual currency market depressed now?

2024 is generally expected to be a very bullish year for the market. And it happened. But we are now dealing with a strong case for a fix.

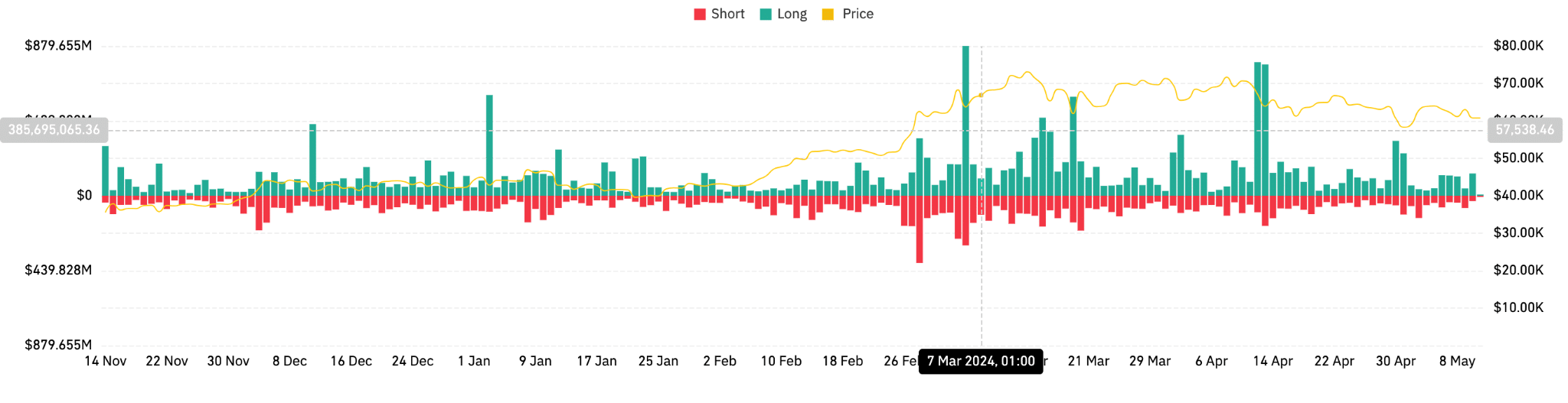

According to data from Coinglass, inflows for both tokens have exceeded outflows in the past 24 hours. Liquidation rates are also relatively low.

On May 10th, US banking sector giants JP Morgan and Wells Fargo made headlines when they revealed their holdings in a spot Bitcoin ETF.

However, this revelation has had little impact on overall market trends. Bitcoin, for one, appears to be stuck in an extended correction cycle, stubbornly testing investors' patience.

Source: Coin Glass

Why is the cryptocurrency market depressed?

The immediate support level for BTC for traders is currently around $56,000. A breakout is still imminent, as widely expected by the community.

TradingView data shows that this is where fear and optimism collide, with traders torn between hopes for a breakout and fear of further declines.

Bitcoin is retesting its former all-time resistance level, which is now a new support zone.

This activity represents a classic case of an RSI bullish divergence on the 4-hour chart, suggesting that the downtrend momentum is losing momentum and could soon reverse.

However, the currency is still moving through a dangerous downward wedge pattern, a technical indicator that suggests that while the end of the tunnel may be near, the path is still filled with fear and uncertainty.

The community consensus is leaning towards an eventual breakout, which could push Bitcoin’s value to new heights, potentially reaching $78,000 in an upcoming bullish surge.

Source: TradingView

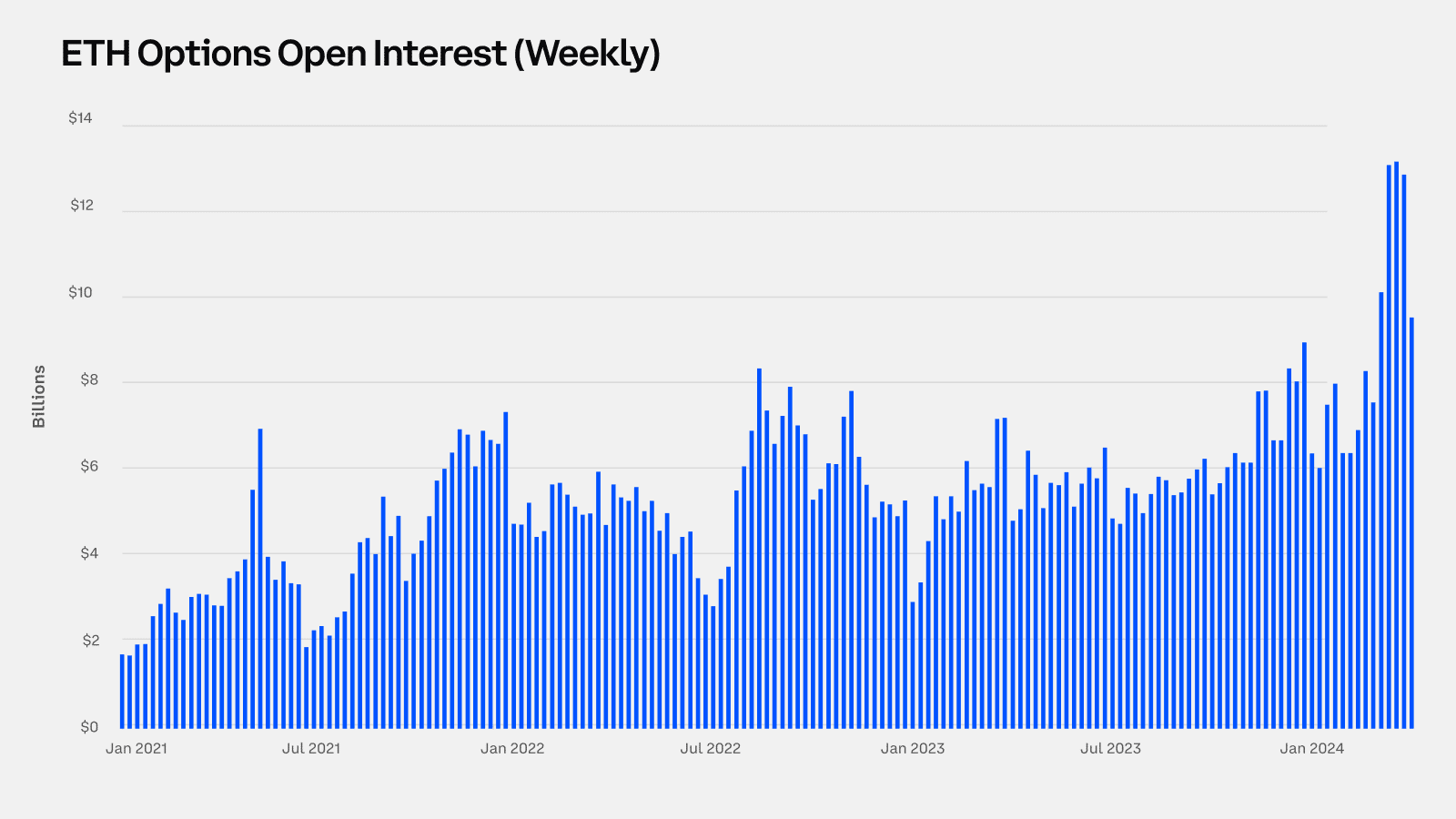

As for Ethereum, its current trajectory is slightly different than Bitcoin. According to the Ethereum derivatives market, the Ethereum derivatives market is showing signs of increasing activity and investor interest. glass node.

Open interest surged by 50%, indicating strong involvement in Ethereum’s financial products.

However, despite these positive indicators in derivatives, Ethereum's performance compared to Bitcoin this cycle has been much slower.

There is a cautious attitude among these investors as speculative interest, especially from short-term holder groups, lags.

On the other hand, long-term holders remain They sit on the sidelines and look for better opportunities to take profits in future bull markets.

Source: Glassnode

At the time of writing, Ethereum was valued at $2,897.

read bitcoin [BTC] Price prediction for 2024-2025

Despite weathering the current market downturn, the company's increased interest in derivatives suggests that the favorable conditions these holders have been waiting for may be around the corner.

Overall, the reason for the pullback is that the market is still consolidating and experts expect it to break out anyway. Investors are advised not to give up. 2024 remains the year of cryptocurrencies.