- Short positions increase following Grayscale's decision to withdraw its application for an Ethereum futures ETF.

- Market sentiment has become more bearish and further declines are possible.

Ethereum [ETH]It is the second-largest cryptocurrency by market capitalization, but in contrast to Bitcoin, it has shown a lack of significant upward momentum recently. [BTC] Recent surge.

Ethereum surpassed $4,000 in March, but unlike Bitcoin, which hit a new all-time high around the same time, it was unable to make a new all-time high.

Over the past two weeks, Ethereum has fallen nearly 10%, and this downward trend continued in the past 24 hours, with it down 2.2%.

This bearish sentiment is reflected in the actions of Ethereum traders, who have increased their short positions, especially following the significant progress of Grayscale Investments.

Grayscale's strategic withdrawal

Recent Grayscale Investments application was withdrawn The movement of Ethereum futures exchange traded funds (ETFs) had a significant impact on trader sentiment.

This decision, which came just three weeks before the U.S. Securities and Exchange Commission (SEC) was scheduled to issue its verdict, led to an increase in short positions in Ethereum.

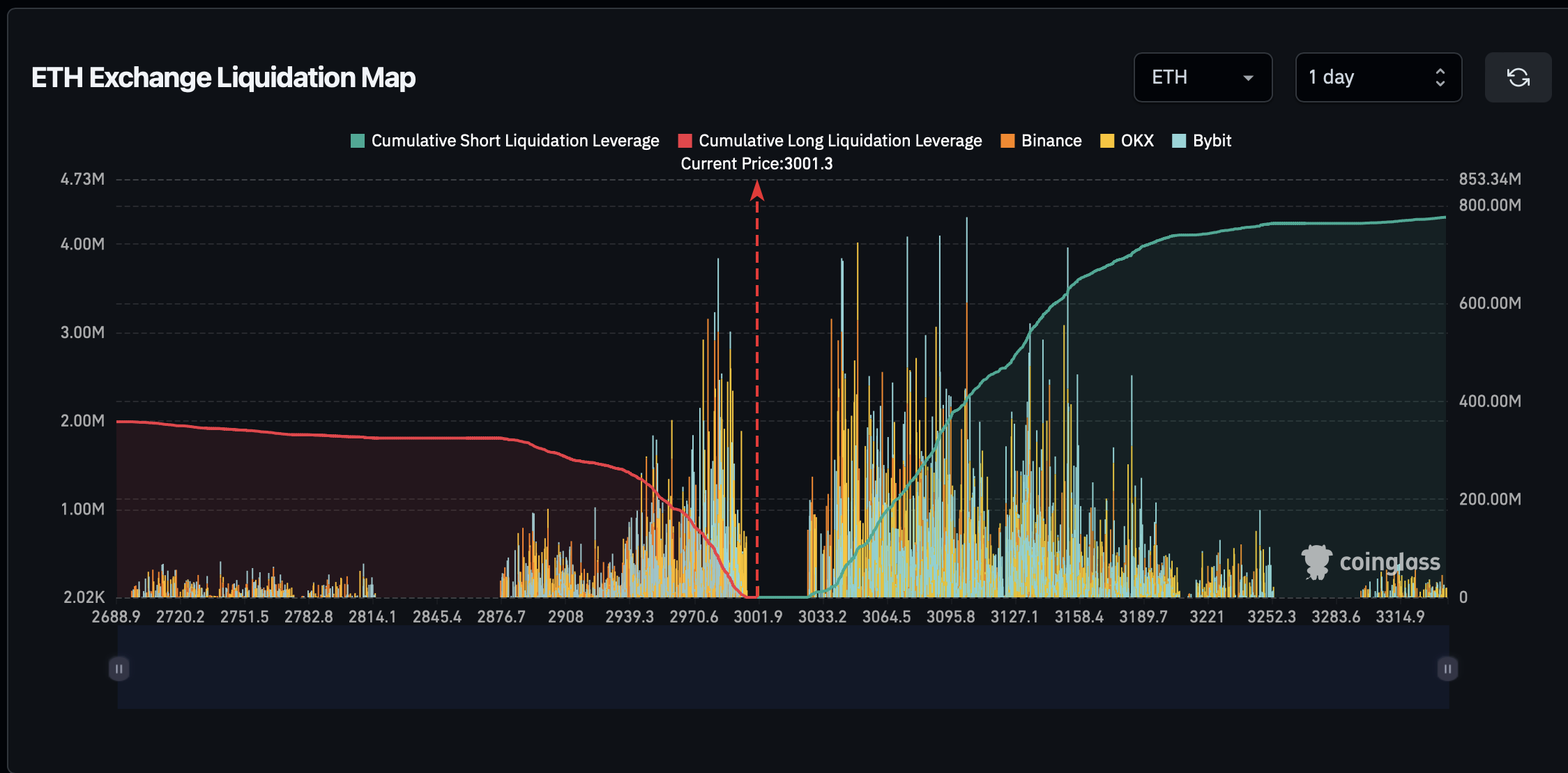

The trader is currently place a large bet If the price rises by just 4%, a $358 million short position could be liquidated, potentially leading to further declines.

Conversely, a 4% decline would only eliminate $237 million of long positions.

Source: Coin Glass

This withdrawal coincides with widespread concerns about Ethereum's regulatory status, specifically its classification as a security and the fate of the Spot Ethereum ETF.

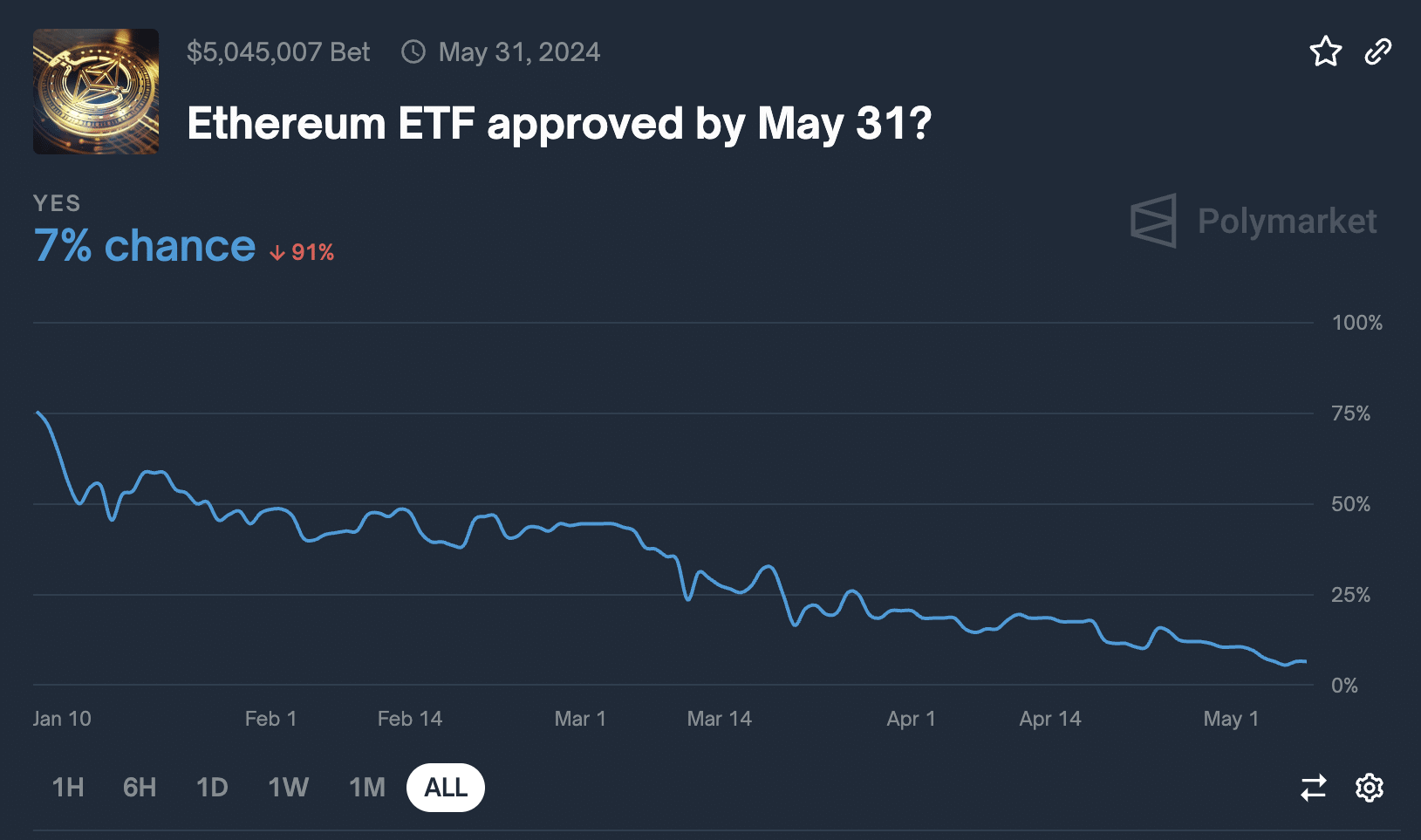

Analysts and market participants are increasingly skeptical about the approval of these ETFs as the May 23 decision date approaches.

according to Polymarketmore than 90% of participants believe that Spot Ethereum ETF will be rejected.

Source: Polymarket

How is Ethereum doing?

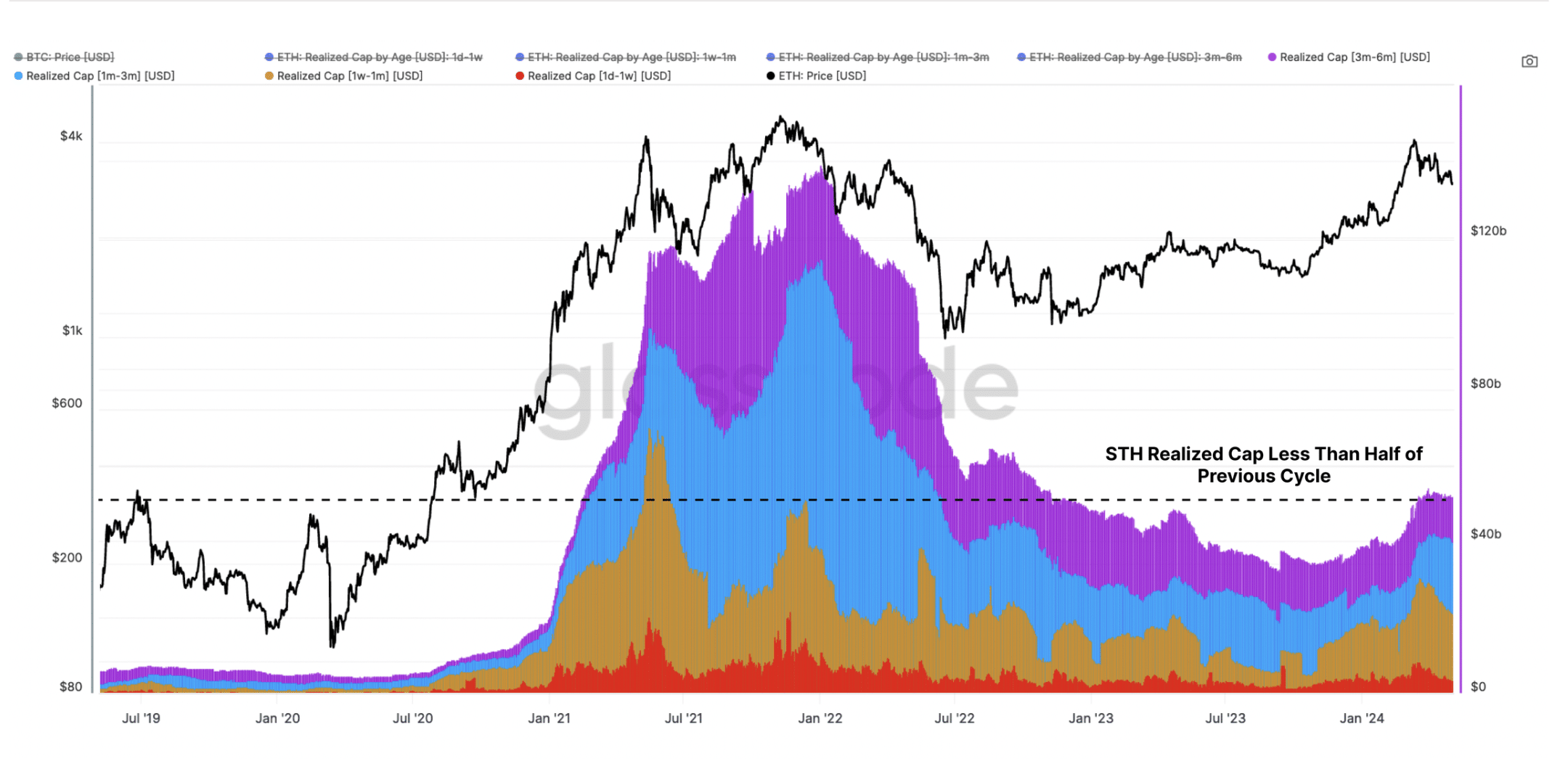

Besides the ETF concerns, Ethereum also faces issues with overall usage and a lack of speculative interest, especially from short-term holders.

James Check, a well-known cryptocurrency on-chain analyst, said: It pointed out Ethereum usage is so low that the writing mechanism cannot keep up with issuance to validators.

This sentiment resonated with glass nodehighlighted Ethereum's poor performance compared to Bitcoin due to lagging speculative interest from these short-term holders.

Source: Glassnode

read ethereum [ETH] Price prediction for 2024-2025

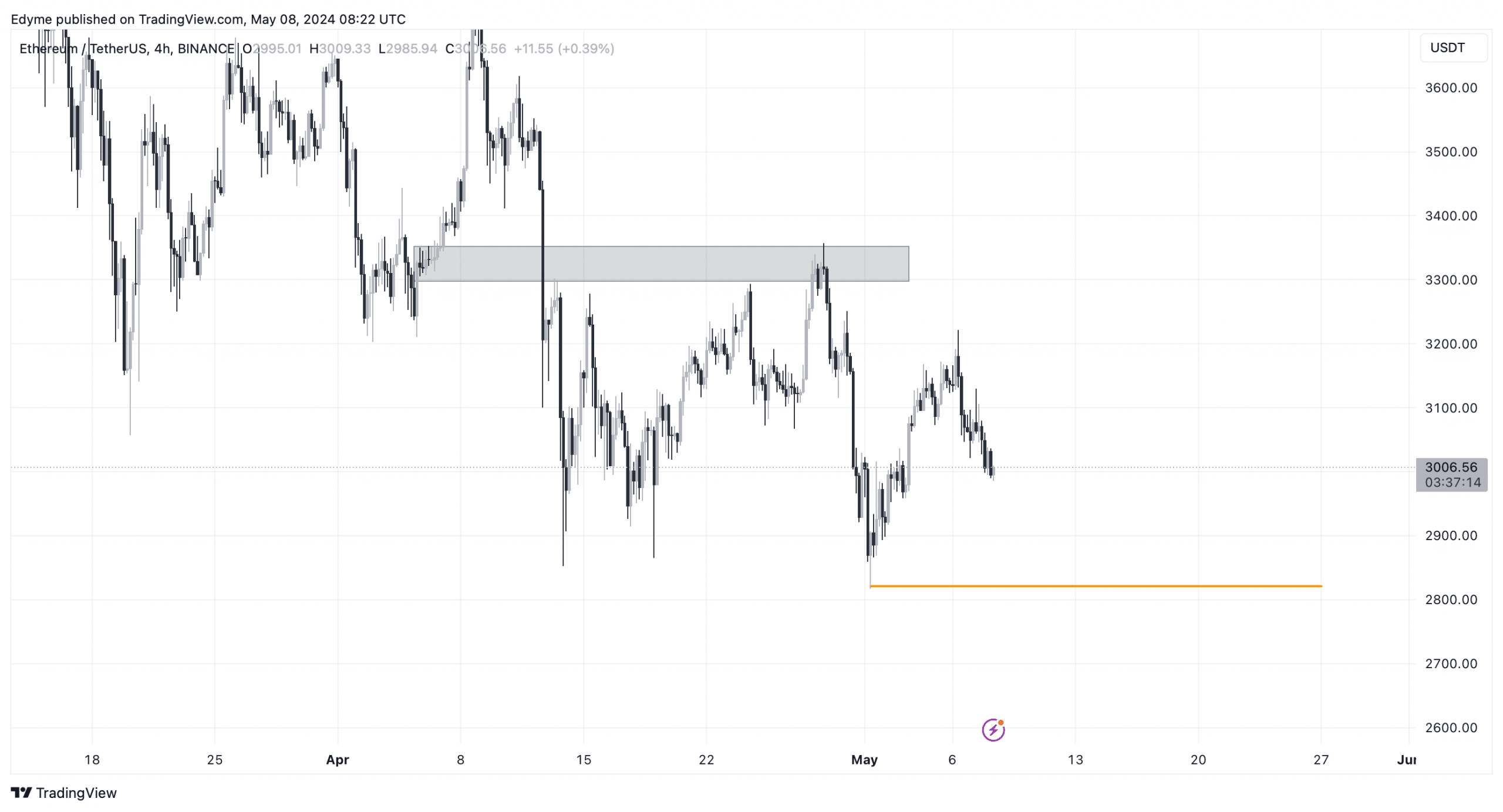

From a technical perspective, Ethereum price is expected to continue its downward trajectory until it reaches swing-low liquidity around $2,800.

This is because Ethereum price recently touched a breaker block and its next objective is to hit a major swing low on the 4-hour chart.

Source: TradingView