- Exchanges reduce the value of BTC and ETH.

- Despite the exchange's decline, holders continued to increase.

Bitcoin [BTC] and Ethereum [ETH] The two largest assets based on market capitalization are: But recent data shows that one of them is becoming rare.

Bitcoin and Ethereum exchanges fall

AMBCrypto's analysis of the exchange's Bitcoin and Ethereum balance metrics shows that the availability of these assets on the exchange is decreasing.

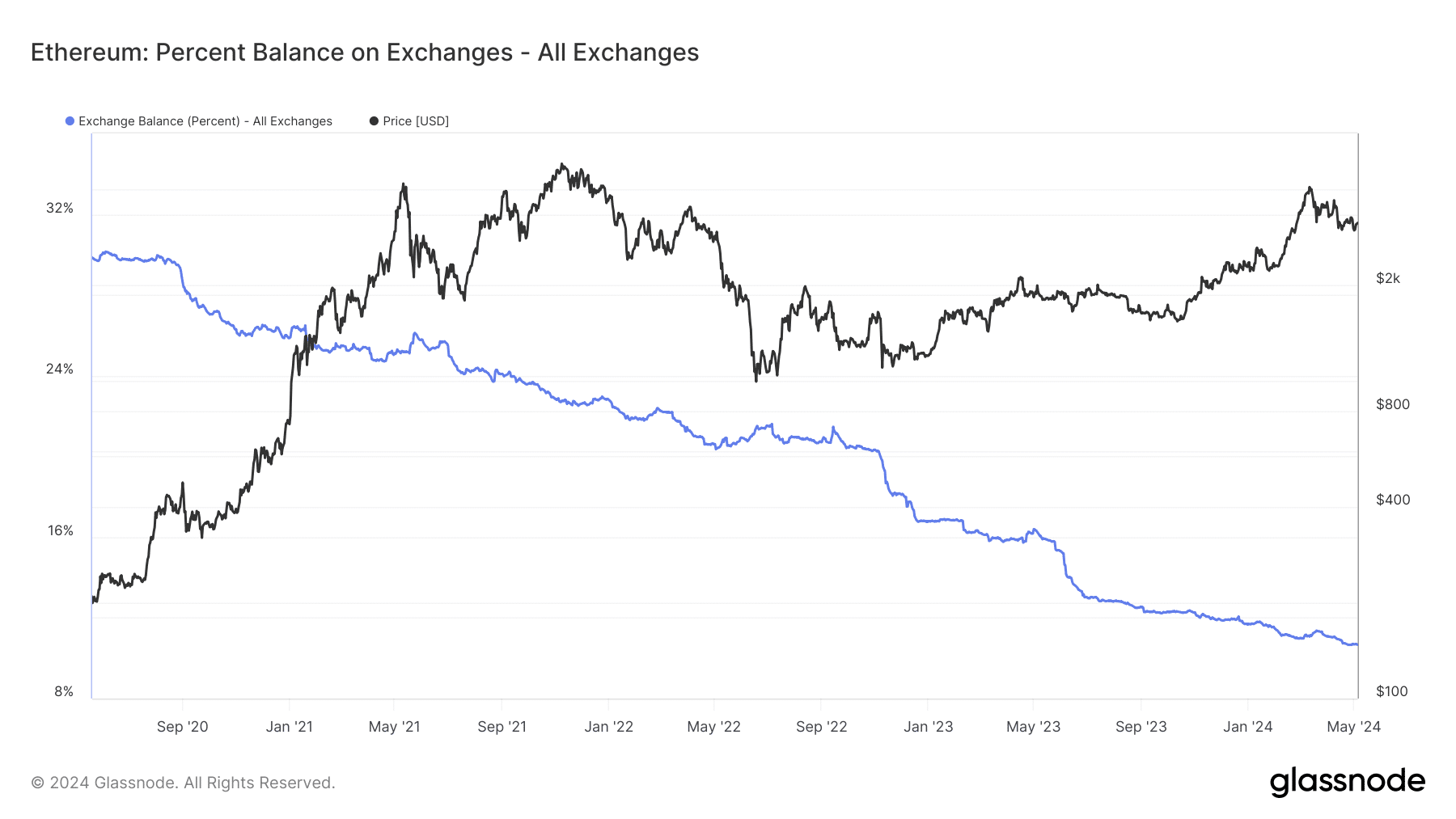

Interestingly, Ethereum balances on exchanges have experienced a more pronounced decline compared to Bitcoin.

According to Glassnode data from March 2023 to the present, ETH balances on the exchange have plummeted by nearly 6%.

It started at 16% in March 2023 and has fallen to 10.66% in the latest figures.

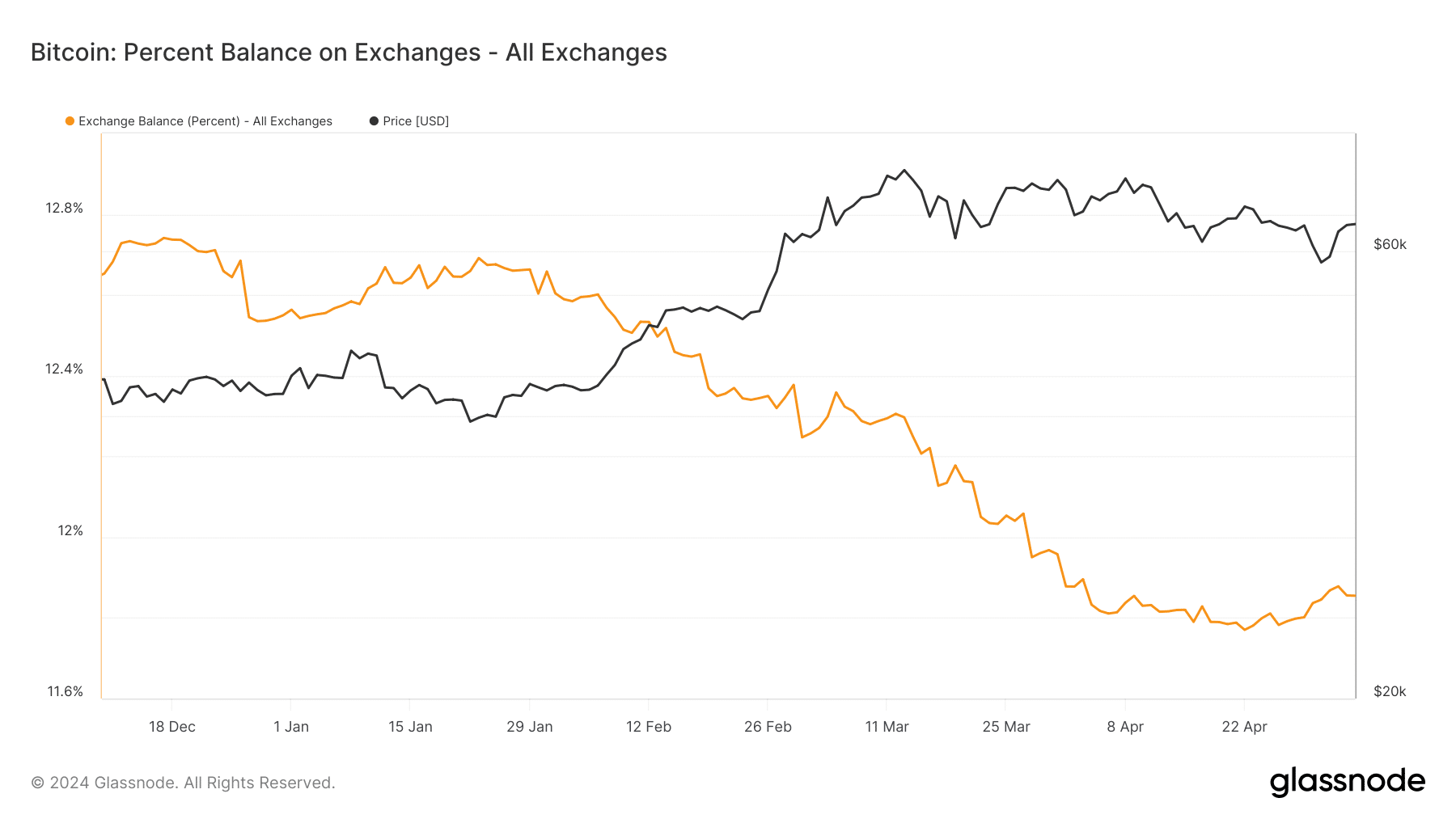

Conversely, BTC balances on exchanges showed a gradual decline of almost 2%, dropping from 13% in March 2023 to approximately 11.85% at the time of writing.

Source: Glassnode

The decline in Ethereum balances on exchanges suggests that the asset available for trading is becoming increasingly scarce.

A decrease in the balance on an exchange usually means that holders are withdrawing their assets from the trading platform.

In the case of Ethereum, it could also indicate that holders are withdrawing and staking their assets for potential profits, further reducing the supply available for trading.

Source: Glassnode

Will it affect the number of holders?

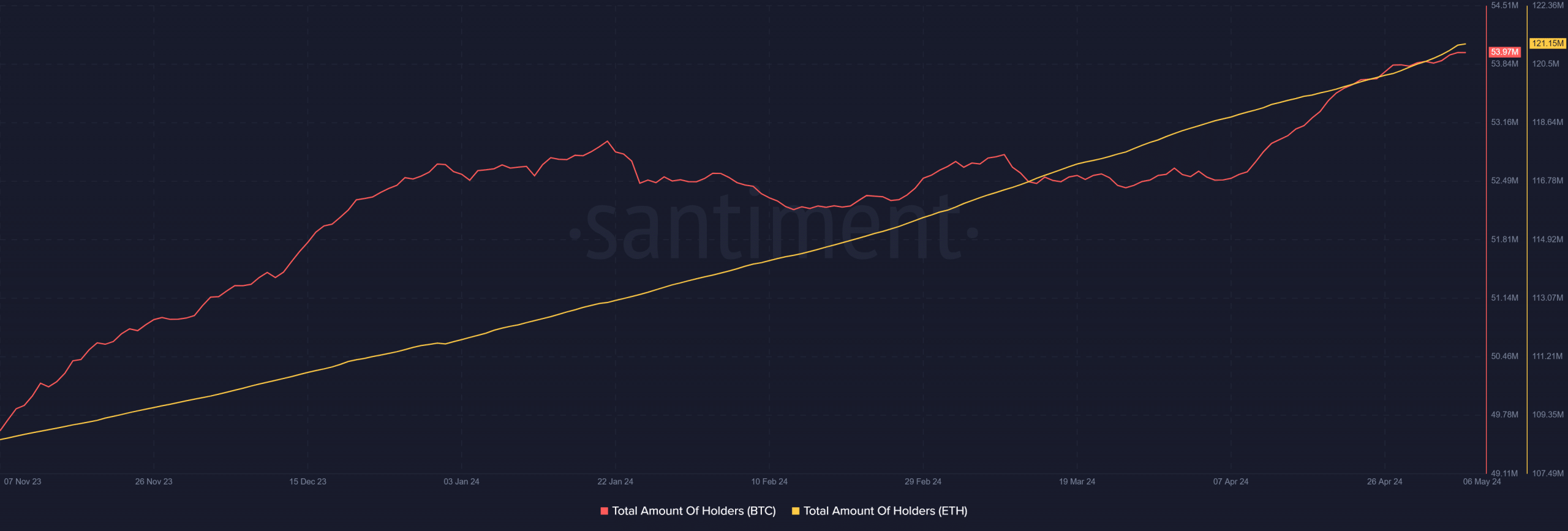

Santiment’s Bitcoin and Ethereum holders revealed consistent growth trends.

At the time of this evaluation, the number of BTC holders was approximately 54 million, while the number of Ethereum holders was over 121 million.

This data shows that both assets have steadily gained ownership over the past few months, with continued interest and adoption.

Source: Santiment

As observed in the previous analysis, the increase in the number of holders is also consistent with the decrease in the balances of these assets on exchanges.

This trend suggests that holders are actively withdrawing assets from exchanges, perhaps for long-term holding or other investment strategies.

Such actions are generally interpreted as a positive sign for the asset, as it reflects confidence in its long-term value and usefulness.

Bitcoin and Ethereum profits rise

Analysis of Bitcoin and Ethereum supply in profits showed a recent upward trend. As of this writing, the profit from the supply of ETH was approximately 117 million, while BTC recorded approximately 18 million.

read bitcoin [BTC] Price prediction for 2023-24

This upward trend is consistent with the recent price rebound observed in both the BTC and ETH markets.

As of this writing, ETH is trading around $3,200, up over 2%. Meanwhile, Bitcoin price was around $65,200, also up almost 2%.