Ethereum (ETH) is currently trying to break above $3,000, an important technical and psychological support.

This is likely only possible if ETH holders choose to exit sales and HODLs, which happens to be the case.

Ethereum investors move to HODL

Ethereum price is trading at $3,177, above the $3,000 support floor, and ETH holders are showing more bullishness than before. Signs of this resilience can be seen in changes in supply and behavior.

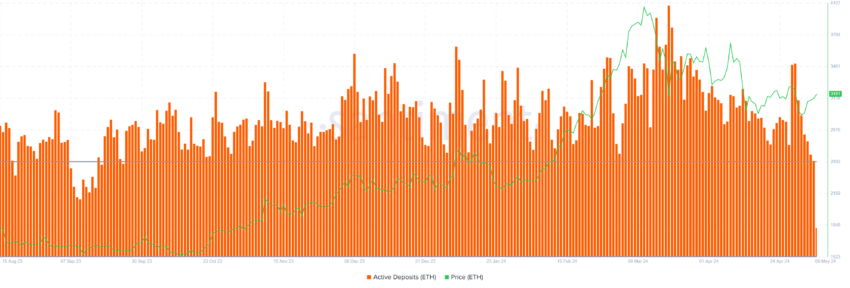

Deposits observed on-chain have recorded a 27% drawdown over the past week, which is a positive signal.

Active deposits highlight the unique addresses that are moving supply from your wallet to the exchange. The decline has reduced the underlying sell-off to an eight-month low, with the last such low recorded in September 2023.

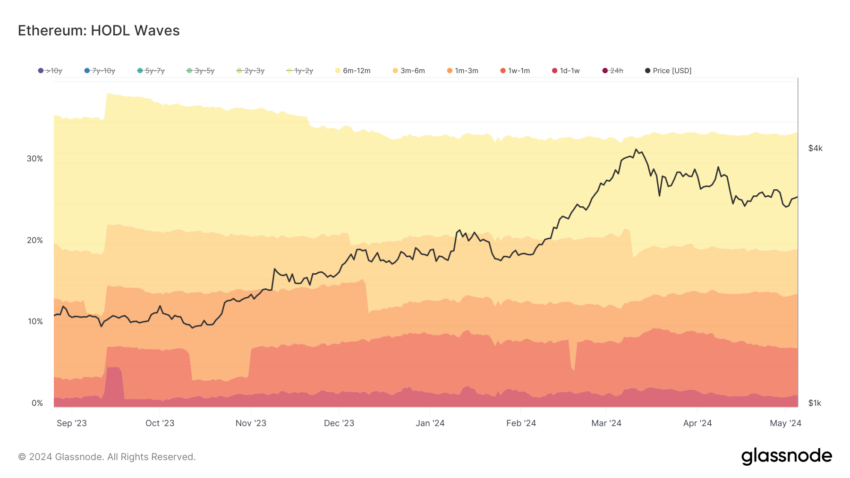

Furthermore, HODLing of ETH is also growing, with supply shifting from short-term holders to medium-term holders. The HODL wave shows that wallets holding ETH for 1 month to 1 year have seen a 2.3% increase in supply over the past month.

Furthermore, addresses that hold ETH for periods of one week to one month have witnessed outflows equivalent to 2.2% of the circulating ETH supply. This is evidence that ETH has moved from potential sellers to HODLers who tend to avoid immediate dumping.

This decline in the dominance of short-term holders proves that investor confidence has increased significantly.

Read more: Ethereum ETF explained: What is Ethereum ETF and how does it work?

ETH price prediction: $3,000 hold

Ethereum price remains above $3,000, a key support level that coincides with the 23.6% Fibonacci retracement. The 23.6% Fib level is known to be an important support level, the loss of which reduces the chances of recovery. Therefore, it is extremely important for ETH to maintain the level above $3,000, and with investor support, that is the expected outcome.

If this bullish momentum continues, Ethereum’s price could break through the Fib’s 38.2% level. Securing this support will allow ETH to attempt to break out of the resistance block between $3,582 and $3,829.

Read more: Ethereum (ETH) Price Prediction 2024 / 2025 / 2030

However, if the $3,000 support is lost, ETH will most likely witness a correction to $2,539. This decline would invalidate the bullish thesis and widen investors' losses.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although BeInCrypto strives for accurate and unbiased reporting, market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms of Use, Privacy Policy, and Disclaimer have been updated.