The past few days have been terrible for the crypto industry, with the decline taking more than $280 billion of liquidity from the market. Major altcoins have fallen further below 40% in recent days due to the plummeting price of Bitcoin.

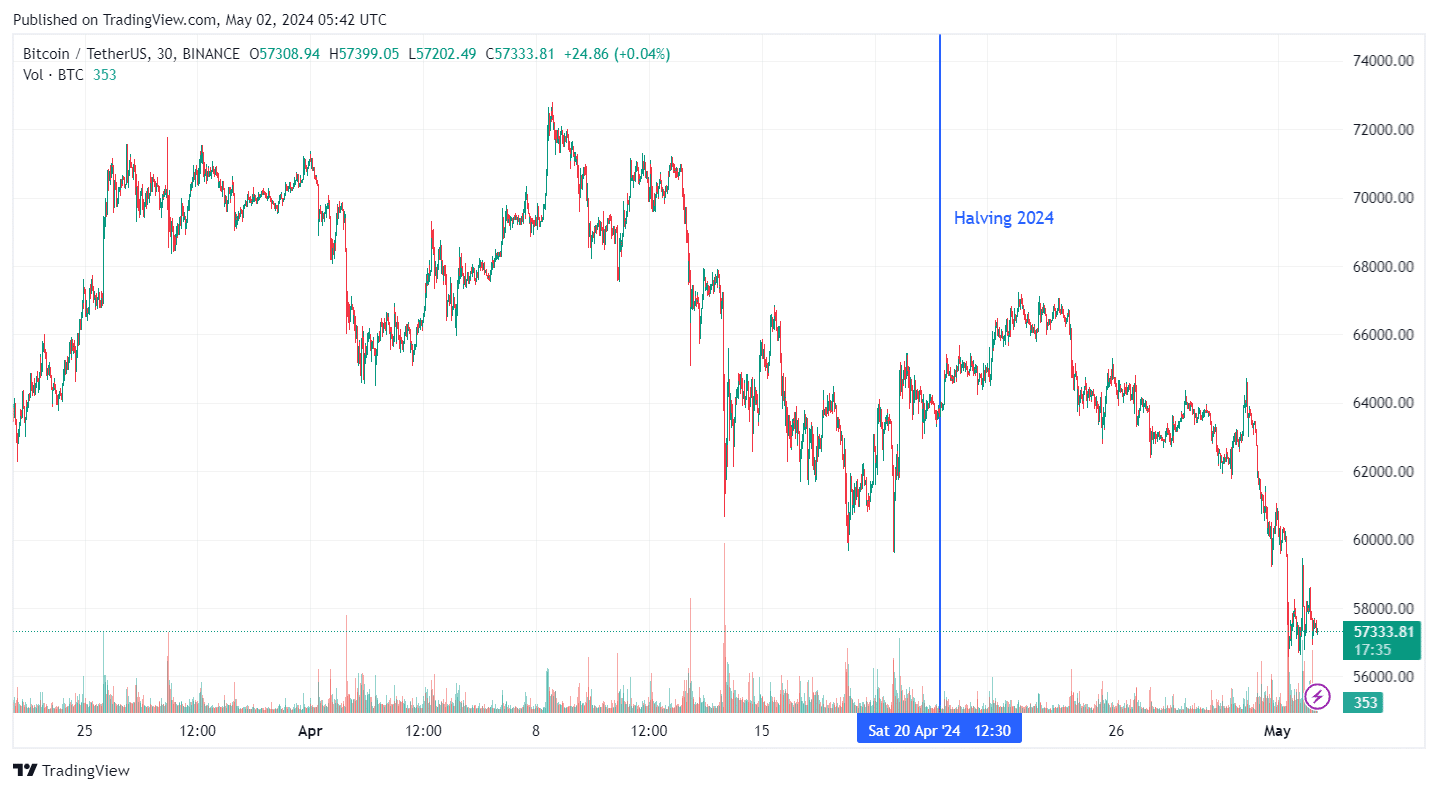

Analysis over the past few days has revealed that there has been significant volatility in Bitcoin prices due to several factors, including halving expectations, the potential impact of spot ETFs, and interest rate hikes by the US government. The closing ratio of both positive and negative sentiment kept Bitcoin fluctuating above $60,000 from March to April.

However, after the halving week, the market stance turned negative. Over the past few days, Bitcoin price has fallen from a high of $67,200 to $56,500, registering a 15% decline in that time. While this decline seems natural given the volatility, it is considered an upset in a continuing bull market.

Why Bitcoin will fall after halving

One of the reasons why Bitcoin prices are currently falling is the lack of big news. Expectations for “immediate ETF approval” have seen the price of Bitcoin skyrocket from $40,000 to $70,000. Other similar trends are also helping to boost Bitcoin or at least maintain it at a certain level. The recently hyped spot ETH and BTC ETF launch in Hong Kong also faded into insignificance as the first-day trading volume was just $11 million, well below his expected $120 million. Ta.

Currently, with no such upcoming event, Bitcoin seems to have lost its grip and is unable to sustain higher price levels. Another reason is that Bitcoin hit a new all-time high before the halving, which was different from the previous three halvings, where Bitcoin hit a new all-time high after the halving.

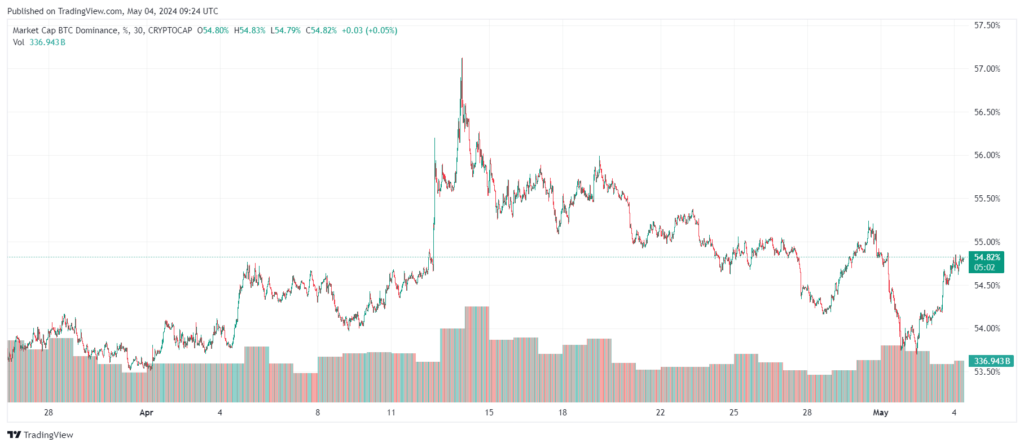

Following the decline, Bitcoin's dominance has also declined since the past few days, when it regained three-year highs in early April. It dropped from 57% to 54% during this period, and the ratio is expected to fall below 50% next month after the altcoin season ends.

This surprising move was unexpected, and market participants are now expecting a sideways move after hitting a new all-time high.

Also read: Economist predicts Bitcoin to reach $115,000 within months

Could Ethereum outperform Bitcoin in the coming months?

One common prediction among cryptocurrency analysts is that Ethereum has greater potential when it comes to a parabolic surge. While Bitcoin has already hit new highs for the cycle, Ethereum appears to be lacking the traction it needs to reach new highs.

According to market data from Coinmarketcap, the all-time high for ETH price was $4,891, and it reached nearly $4,066 in early March. Considering that ETH price usually hits all-time highs a few days after BTC price, this time it failed to even come close to the previous high.

Amid the recent market turmoil, ETH lost strong support and fell below $3000. However, the upcoming ETH price surge is expected to surpass the BTC price in the coming months. This claim is supported by several factors, including ETHBTC's bottom price, possible approval of the ETH ETF, and expectations for altcoin season. Let's briefly discuss each of these.

ETHBTC recovery

The ETHBTC pair is currently shrinking to a three-year low of 0.048, although it lacks strong support around 0.04 as seen on the chart. According to some analysts, this is the lowest level for ETH BTC and is now back to levels seen at the beginning of spot Bitcoin ETF inflows. A possible ETH BTC reversal could see the pair return to 0.08 before Bitcoin price reclaims the $70,000 price mark.

If ETH is able to rise further following the approval of spot ETFs, it will open up a new dimension of ETH price growth. There is a possibility that it will break new highs while significantly outperforming BTC.

Possible approval of ETH ETF

The excitement surrounding the Spot ETH ETF is still in the air. The SEC was previously scheduled to announce a decision on the ETH ETF, but this has now been postponed until May 24th. While most market participants expect a rejection, the bizarre outcome could be earth-shaking and send ETH price back to $4,000 or higher. The first ETH ETH has already been approved in Hong Kong before the US, but it received a colder response than expected.

Ethereum has greater growth potential, so if approved, ETH could bring massive inflows to the market. Although it is technically more advanced than Bitcoin, it has only 17% market power.

Deflationary ETH supply

Due to the much talked about merge upgrade, ETH has changed from an inflationary asset to a deflationary asset. According to data from Ultra Sound Money, over 432,000 of his ETH has been written since the upgrade. This mechanism allows achieving a positive issuance-to-issuance ratio, which ultimately allows the ETH market supply to decrease over time. This reduced supply and increased demand will benefit the ETH market in the long term.

The next few months will be critical in determining the fate of Bitcoin and initiating its post-halving price accumulation phase. Some leading analysts predict that Bitcoin's price movements will slow, while Ethereum and other major altcoins will reach record highs during the upcoming market recovery.