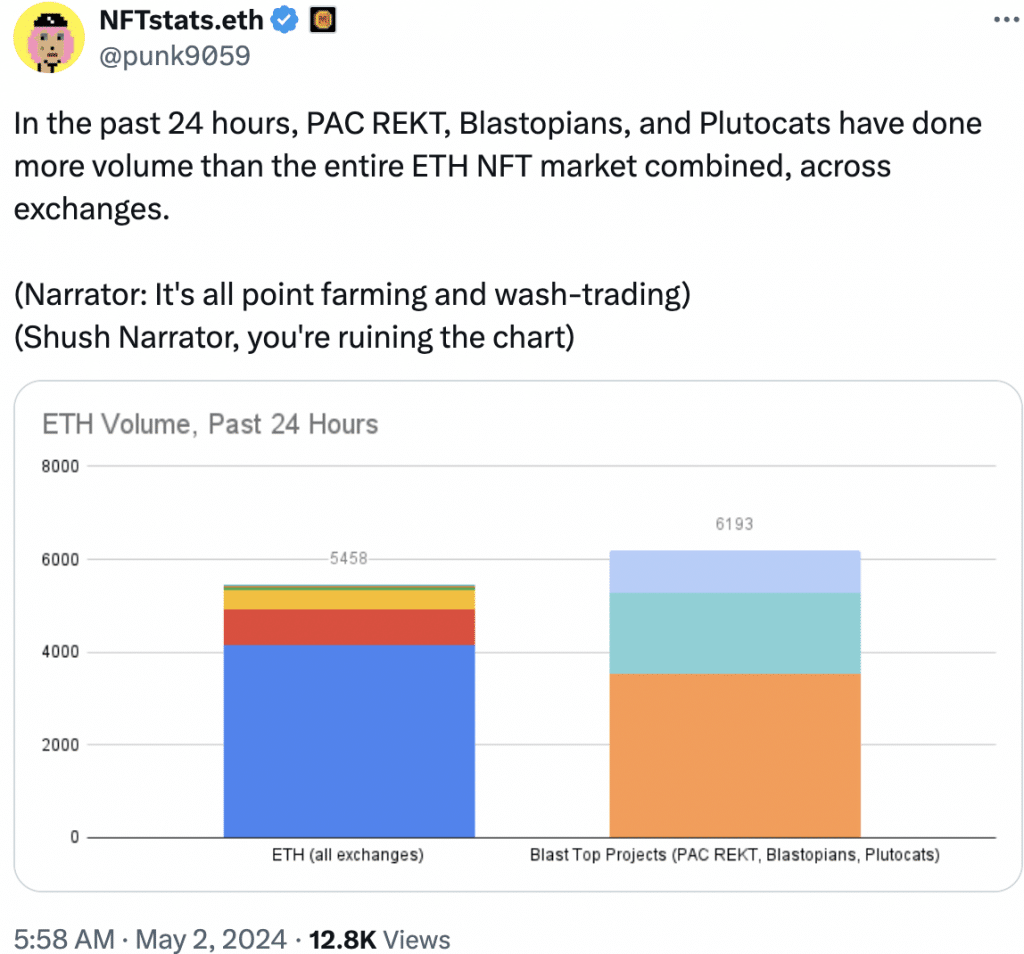

- Blast overtakes Ethereum in NFT volume

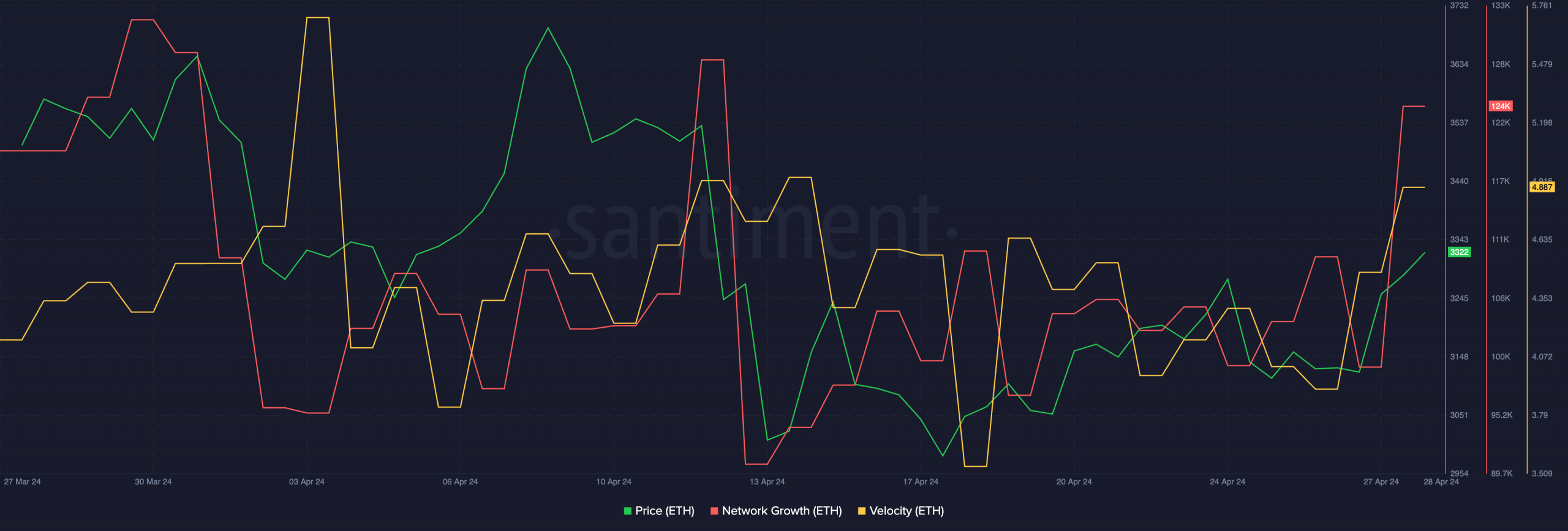

- Although the price of ETH has fallen, the growth and speed of the network has increased significantly on the charts

Ethereum [ETH] It is mainly dominant in most sectors of the entire crypto space. But in some ways, the tide appears to have turned in Blast Network's favor.

Full Blast NFT

Recent data suggests that in the past 24 hours, Blast NFT collections such as PAC REKT, Blastopians, and Plutocrats collectively generated more volume than the entire Ethereum NFT market across all exchanges .

Source:X

Now, even if Blast surpasses Ethereum in terms of NFT trading volume, a significant portion of this trading volume could be attributed to wash trading. For context, NFT wash trading inflates trading volumes by buying and selling between controlled wallets, creating false popularity and misleading investors. It weakens the NFT market by distorting prices and reducing real liquidity.

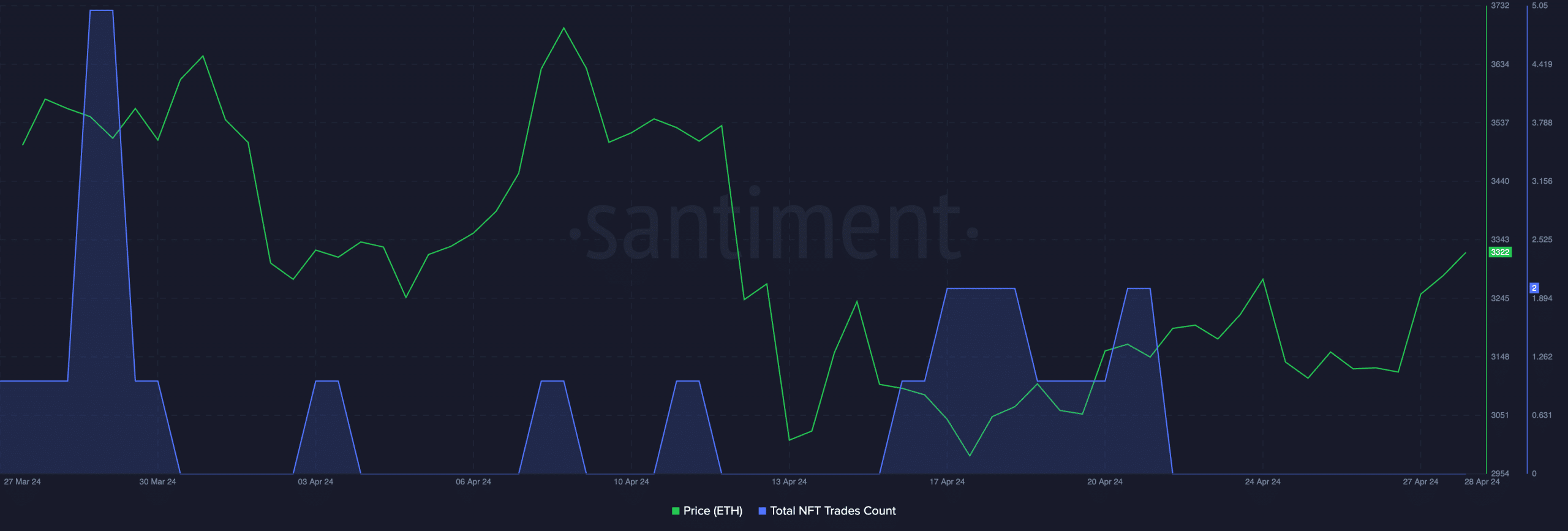

While a large portion of Blast's NFT trading volume may be due to wash trades, the decline in interest in Ethereum NFTs raises concerns about the state of the network. In fact, AMBCrypto's analysis of Santiment data revealed a significant decline in the number of NFTs being traded.

Source: Santiment

Looking deeper

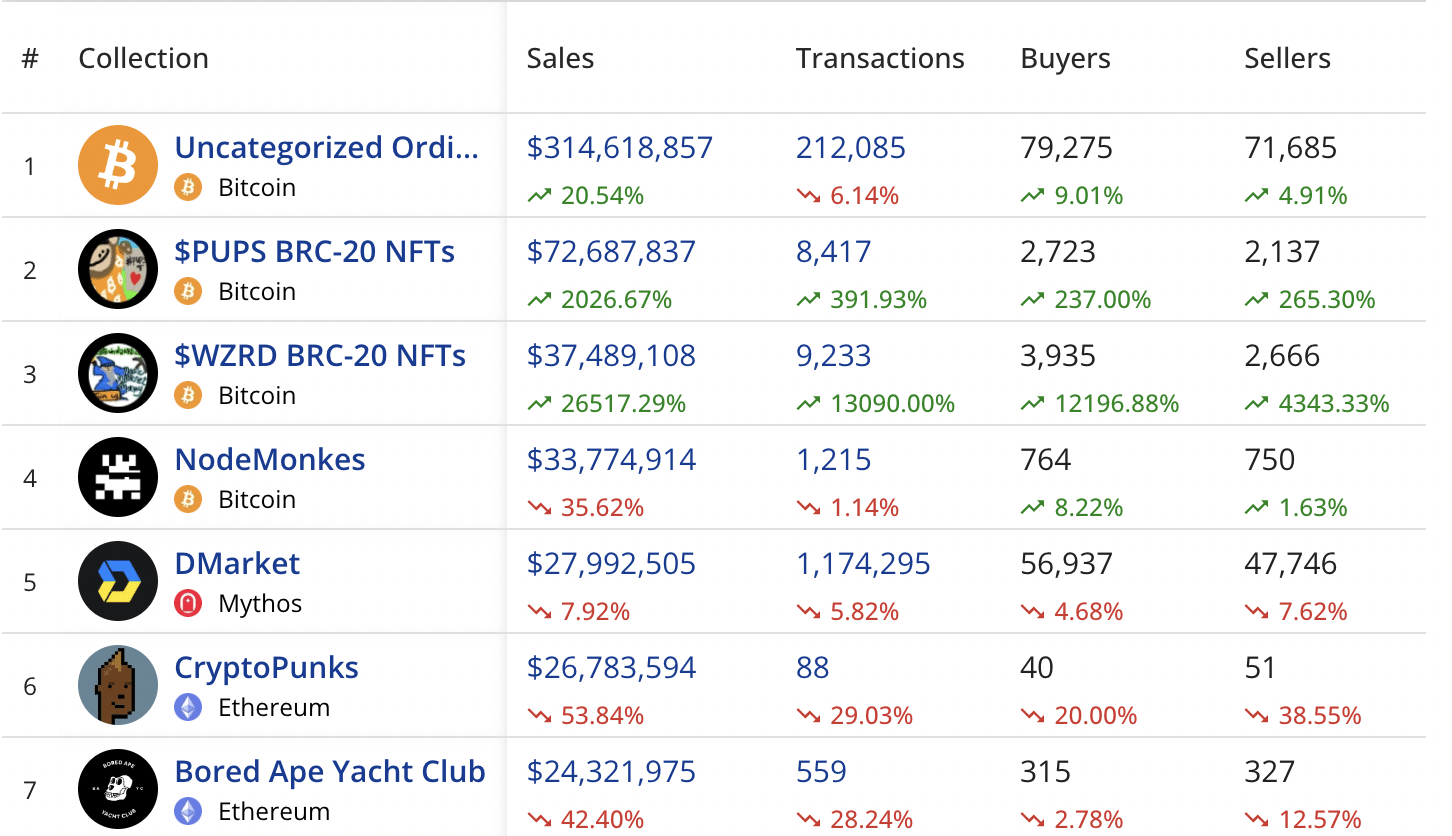

NFT collections on other networks such as Bitcoin and Mythos outperformed Ethereum NFTs. Popular Ethereum NFT collections such as BAYC and Crypto Punks failed to crack the top five most sold NFTs last month, according to CryptoSlam data. The number of Crypto Punk buyers decreased by an astonishing 20%, while the number of BAYC buyers decreased by 2.78%.

If this trend continues, Ethereum could soon lose its top spot in the NFT sector.

Source: CryptoSlam

Bleeding of ETH holders

As far as the price of ETH is concerned, at the time of writing, it was above $3,000 following Bitcoin's recovery. Moreover, the growth of the ETH network continued to increase as well.

Increased network growth indicates that new addresses are showing interest in ETH. Speeds have also increased, suggesting a surge in transaction activity on the Ethereum network.

Increased interest and increased velocity from new addresses could mark ETH as green and push the altcoin to its latest pre-market correction levels.

Source: Santiment

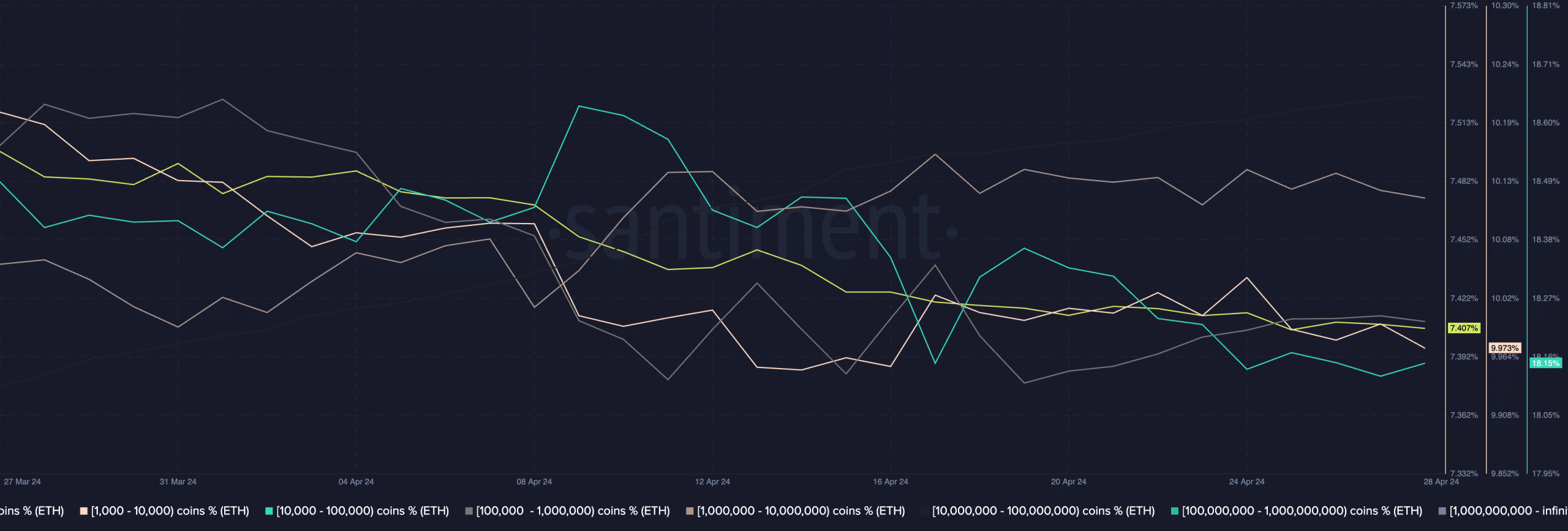

However, the size of addresses expressing interest in ETH will also play an important role in Ethereum's future price movements.

For example, according to Santiment data, the number of addresses holding between 100 and 10,000 ETH was decreasing at the time of writing. Large purchases by large addresses could play a major role in the future price trajectory of ETH.

Is your portfolio green? Check out our ETH Profit Calculator

Source: Santiment